Question: can someone explain why in step 3 the 2/3 is assigned to the 1 and why the 0 is multiplied by the 1/3. why isnt

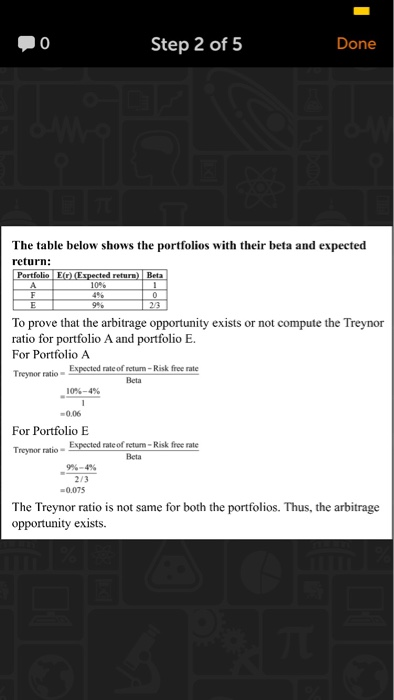

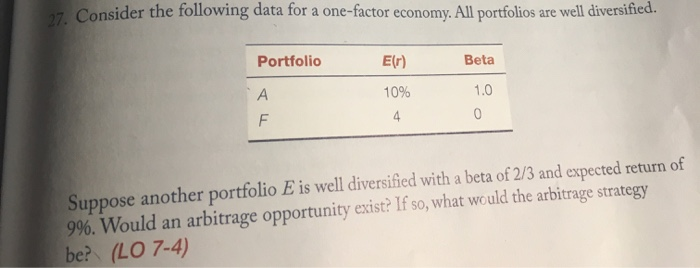

0 Step 1 of 5 Done Treynor ratio measures the return earned in excess of return that could have been earned on a riskless investment per unit of market risk. The Treynor ratio can be calculated by subtracting risk free rate by expected return and dividing it by beta as follows: Treynor ratio- Expected rate of return-Risk free rate Beta The arbitrage could be possible if an investor is capable to make a risk less portfolio at zero cost, which could guarantee positive return 0 Step 2 of 5 Done The table below shows the portfolios with their beta and expected return Portfolio E(r) (Expected return) Beta 10% 4% 96 A 10 23 E To prove that the arbitrage opportunity exists or not compute the Treynor ratio for portfolio A and portfolio E For Portfolio A Treynor ratio- Expected rate of returm- Risk free rate Beta 10%-4 % 0.06 For Portfolio E Expected rate of return-Risk free rate Beta Trevnor ratio 9%-4 % 2/3 0.075 The Treynor ratio is not same for both the portfolios. Thus, the arbitrage opportunity exists. 0 Step 3 of 5 Done Now, create a portfolio G by combining portfolio A and portfolio F. The proportion will be 2/3 in Portfolio A and 1/3 in Portfolio F. The formula to compute beta of portfolio is given below. B,-Bw+B Where, The beta is B. The Weight is W. First step: Compute the beta of this new portfolio G as follows: P-PW+Bw (x2/3)+(0x1/3) 2/3 Thus, the beta of Portfolio G will be 2/3. 0 Step 4 of 5 Done The expected return of the portfolio is the weighted average of the portfolio. The formula to compute the weighted average of the portfolio is given below E-)-). Where The expected return of portfolio is E) The expected return of individual sccurity is E(). The weight of individual security is Second step: Compute the expected return of portfolio G as follows: E,)-). -2/3x10 % + 1 / 3x4 8% Thus, the expected retun of portfolio G will be 8%. It implies that the arbitrage opportunity exists 97 Consider the following data for a one-factor economy. All portfolios are well diversified. Portfolio EN Beta 10% 1.0 F Suppose another portfolio E is well diversified with a beta of 2/3 and expected return of 9%. Would an arbitrage opportunity exist? If so, what would the arbitrage strategy be? (LO 7-4)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts