Question: Can someone explain why selection (b.) best tracks assett AA? Page > of 6 Section 2. Quiz Questions 2. Use the information below regarding the

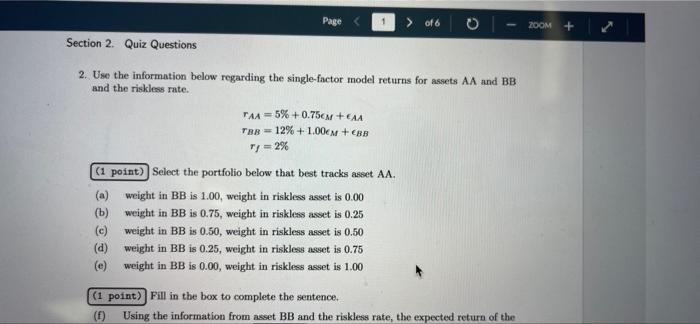

Page > of 6 Section 2. Quiz Questions 2. Use the information below regarding the single-factor model returns for assets AA and BB and the riskless rate. TAA5%+0.75CM +EAA TBB 12% +1.00CM + EBB 71=2% (1 point)] Select the portfolio below that best tracks asset AA. (a) weight in BB is 1.00, weight in riskless asset is 0.00 weight in BB is 0.75, weight in riskless asset is 0.25 (b) (c) weight in BB is 0.50, weight in riskless asset is 0.50 (d) weight in BB is 0.25, weight in riskless asset is 0.75 (e) weight in BB is 0.00, weight in riskless asset is 1.00 (1 point) Fill in the box to complete the sentence. (f) Using the information from asset BB and the riskless rate, the expected return of the ZOOM +

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts