Question: Can someone give some insight on completing this Python question of an Income Tax Calculator? Write a function, calc_tax() that takes as argument a dictionary

Can someone give some insight on completing this Python question of an Income Tax Calculator?

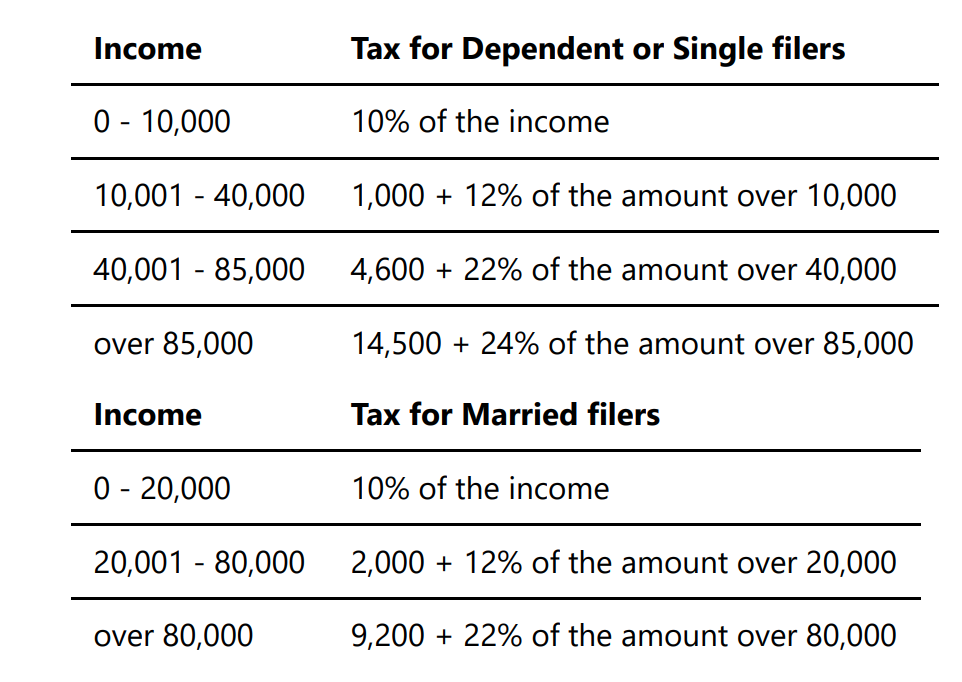

Write a function, calc_tax() that takes as argument a dictionary containing tax form information and calculate tax based on taxable income and status. The return value should be of type float with zero precision (e.g. 1500.0) Below is the tax calculation formula based on status:

Write a function, calc_tax_due() that takes as argument a dictionary containing tax form information and calculates taxes due. Taxes due is obtained by subtracting the withheld tax from the calculated tax. The return value should be of type float with zero precision (e.g. 1500.0)

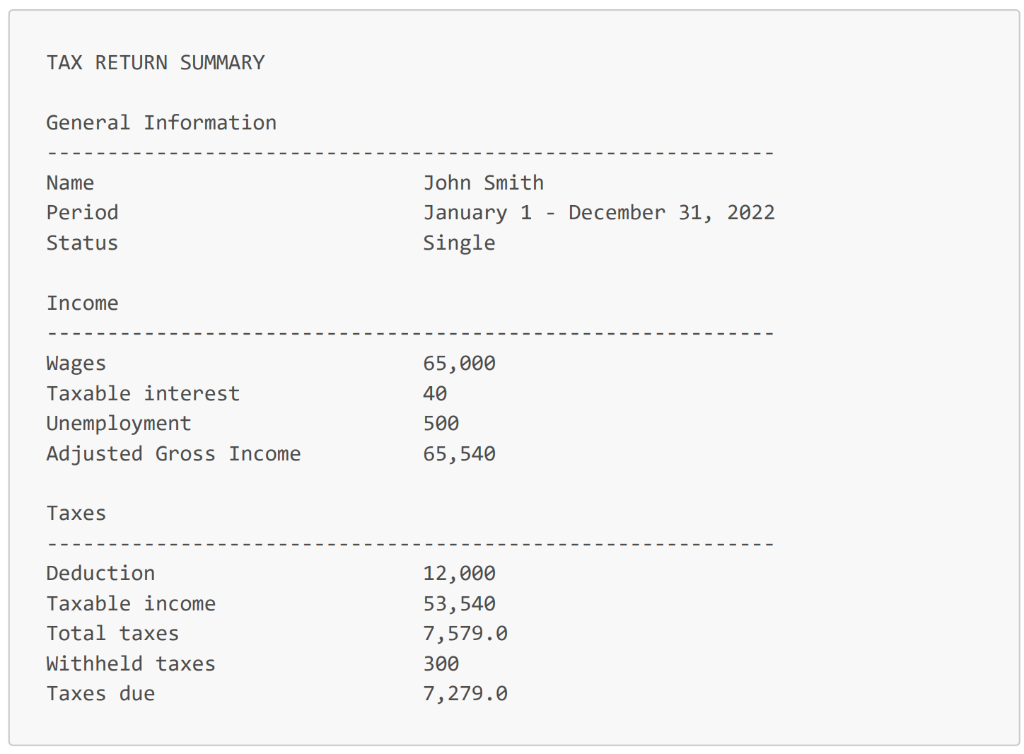

Write a function, print_tax_summary() that takes as argument a dictionary containing tax form information and displays a formatted summary of the tax return. You should use string formatting to display the data in columns as described below. Also, string formatting should be used to display numerical values with comma separator (e.g. 12,000). The summary should show the following:

A main header, e.g. Tax return summary

An empty line below the main header

Three sub-headers: General info, Income info, and Taxes

Each sub-header marks a section where information is displayed in two columns as follows:

-General info:

-Name

-Tax Period

-Status

-Income info:

-Wages

-Interest

-Unemployment

-Adjusted Gross Income

-Taxes

-Deduction

-Taxable Income

-Total taxes

-Withheld taxes

-Taxes due

Example output is given below:

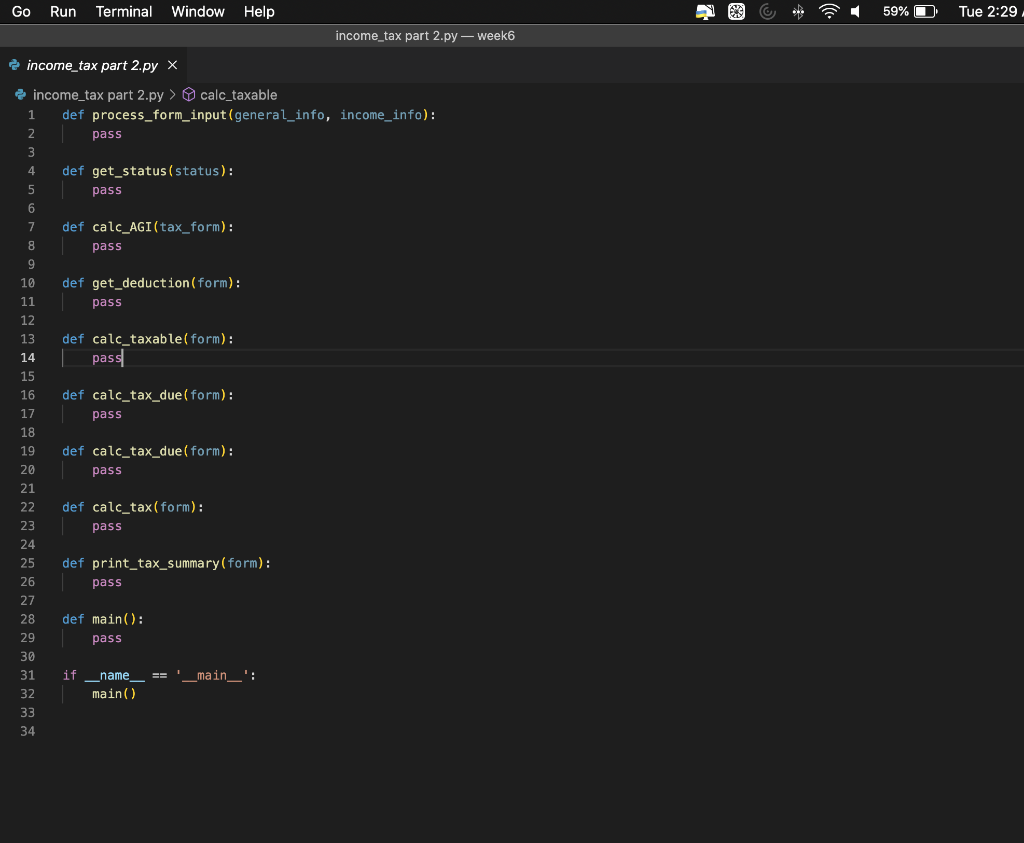

Code structure:

Can someone help me with this? Thank you

\begin{tabular}{ll} Income & Tax for Dependent or Single filers \\ \hline 010,000 & 10% of the income \\ \hline 10,00140,000 & 1,000+12% of the amount over 10,000 \\ \hline 40,00185,000 & 4,600+22% of the amount over 40,000 \\ \hline over 85,000 & 14,500+24% of the amount over 85,000 \\ Income & Tax for Married filers \\ \hline 020,000 & 10% of the income \\ \hline 20,00180,000 & 2,000+12% of the amount over 20,000 \\ \hline over 80,000 & 9,200+22% of the amount over 80,000 \end{tabular} TAX RETURN SUMMARY General Information NamePeriodStatusJohnSmithJanuary1-December31,2022Single Income WagesTaxableinterestUnemploymentAdjustedGrossIncome65,0004050065,540 Taxes DeductionTaxableincomeTotaltaxesWithheldtaxesTaxesdue12,00053,5407,579.03007,279.0 So Run Terminal Window Help income_tax part 2.py week6 \[ \text { income_tax part 2.py } \times \] income_tax part 2.py > calc_taxable

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts