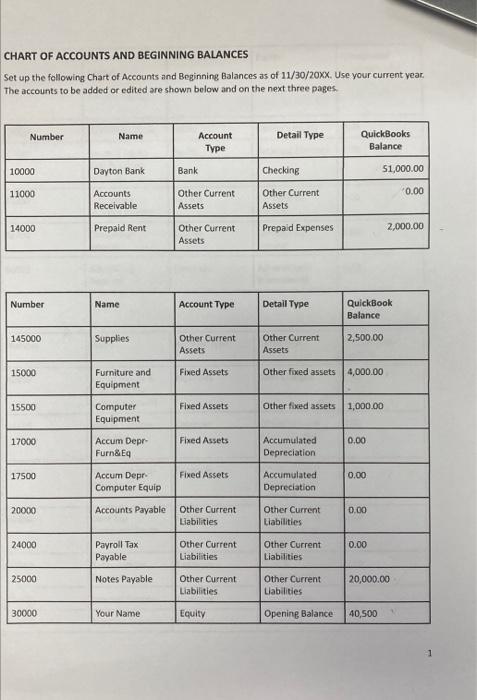

Question: can someone guide me here. this is a project CHART OF ACCOUNTS AND BEGINNING BALANCES Set up the following Chart of Accounts and Beginning Balances

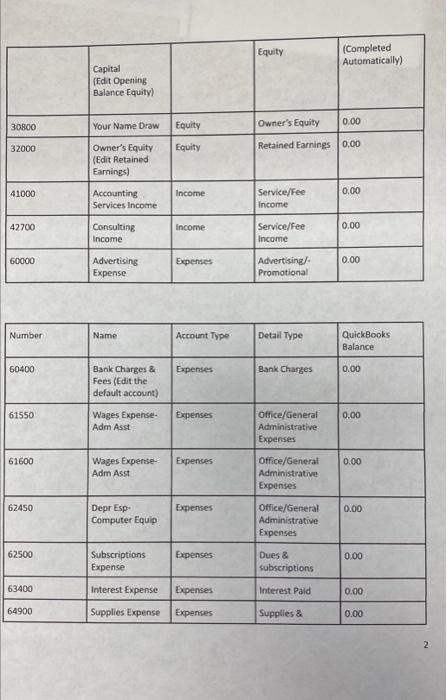

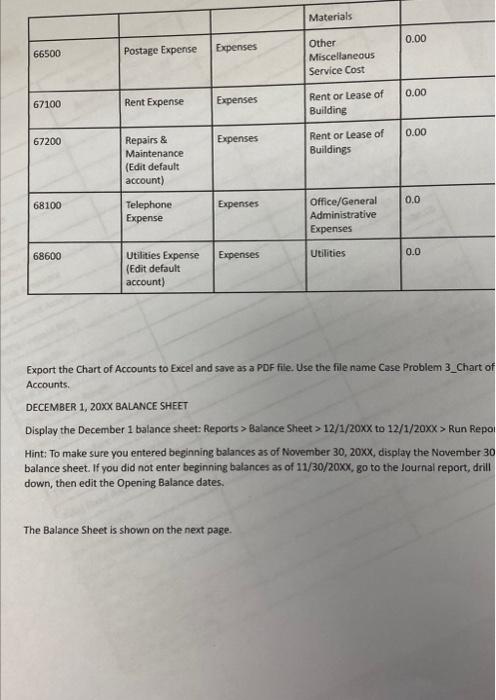

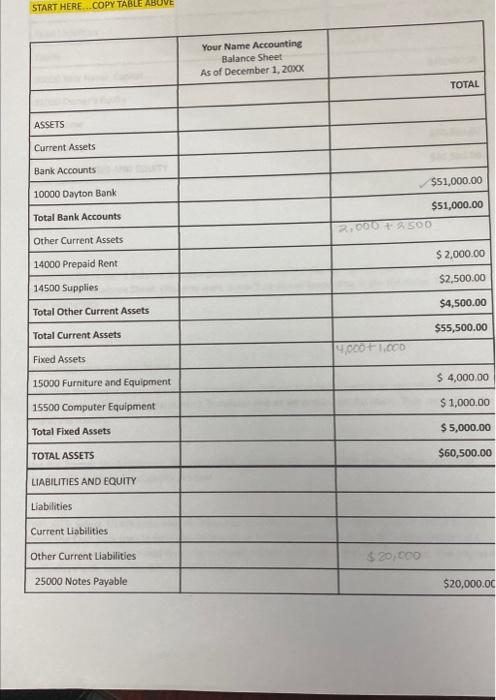

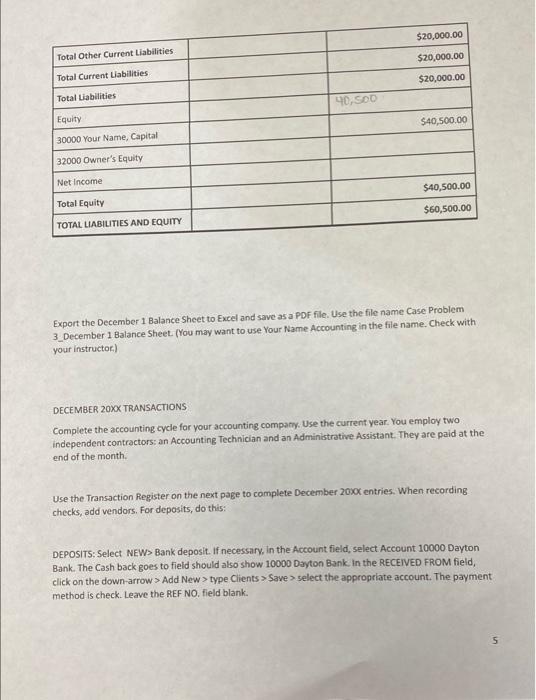

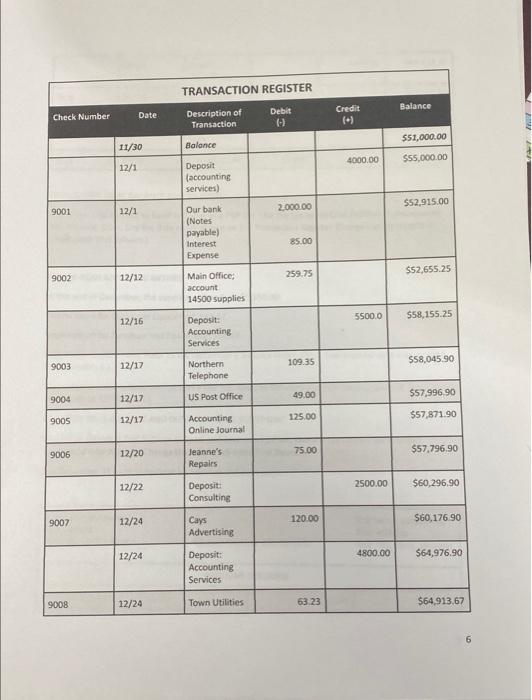

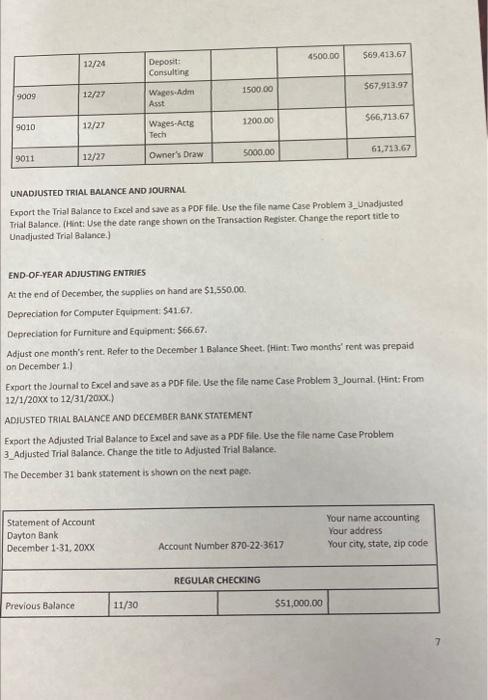

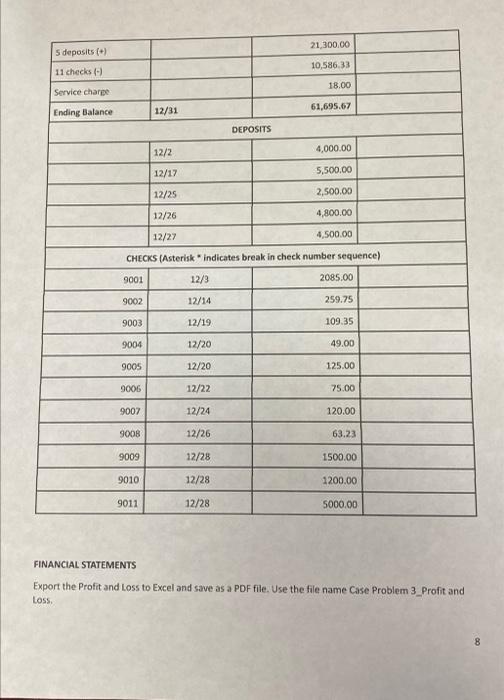

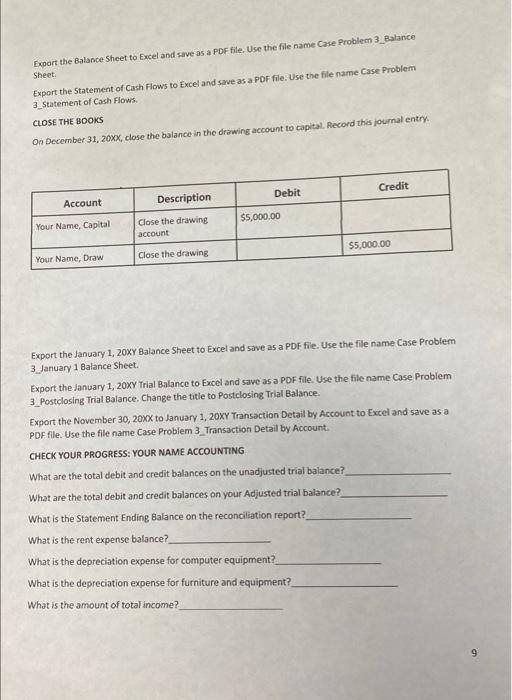

CHART OF ACCOUNTS AND BEGINNING BALANCES Set up the following Chart of Accounts and Beginning Balances as of 11/30/20xX. Use your current year. The accounts to be added or edited are shown below and on the next three pages. \begin{tabular}{|l|l|l|l|l|} \hline & & & Equity & (Completed \\ \hline & Capital (Edit Opening Balance Equity) & & & \\ \hline 30800 & Your Name Draw & Equity & Owner's Equity & 0.00 \\ \hline 32000 & Owner's Equity (Edit Retained Earnings) & Equity & Retained Earnings & 0.00 \\ \hline 41000 & Accounting Services Income & Income & Service/fee Income & 0.00 \\ \hline 42700 & Consulting Income & Income & Service/Fee & 0.00 \\ \hline Income & 0.00 \\ \hline 60000 & Advertising Expense & Expenses Promotional & \\ \hline \end{tabular} 2 Export the Chart of Accounts to Excel and save as a PDF file. Use the file name Case Problem 3_Chart of Accounts. DECEMBER 1,20 BALANCE SHEET Display the December 1 balance sheet: Reports > Balance Sheet >12/1/20X to 12/1/20xX > Run Repol Hint: To make sure you entered beginning balances as of November 30,20xx, display the November 30 balance sheet. If you did not enter beginning balances as of 11/30/200, go to the lournal report, drill down, then edit the Opening Balance dates. The Balance Sheet is shown on the next page. START HERE .. COPY TABLE ABUVE Export the December 1 Balance Sheet to Excel and save as a PDF file. Use the file name Case Problem 3_December 1 Balance Sheet. (You may want to use Your Name Accounting in the file name. Check with your instructoc) DECEMBER 20XX TRANSACTIONS Complete the accounting cycle for your accounting compary. Use the current year. You employ two independent contractors: an Accounting Technician and an Administrative Assistant. They are paid at the end of the month. Use the Transaction Register on the next page to complete December 2000 entries. When recording checks, add vendors. For deposits, do this: DEPOSITS: Select NEW> Bank deposit. If necessarv. In the Account field, select Account 10000 Dayton Bank. The Cash back goes to fieid should also show 10000 Dayton Bank. In the RECEIVED FROM field, click on the down-arrow > Add New > type Clients > Save > select the appropriate account. The payment method is check. Leave the REF NO. field blank. 6 UNADJUSTED TRIAL BALANCE AND JOURNAL Export the Trial Balance to Excel and save as a PDF file. Use the file name Case Protlem 3 Un Unadjusted Trial Balance. (Hint: Use the date range shown on the Transaction Register. Change the report title to Unadjusted Trial Balance.) END-OF-YEAR ADJUSTING ENTRIES At the end of December, the supplies on hand are $1,550.00. Depreciation for Computer Equipment: \$41.67. Depreciation for Furniture and Equipment: $66.67. Adjust one month's rent. Refer to the December 1 Balance Sheet. (Hint: Two months' rent was prepaid on December 1.l Export the Journal to Excel and save as a PDF flle. Use the file name Case Problem 3 Journal. (Hint: Erom 12/1/20 to 12/31/20x.) ADIUSTED TRIAL BALANCE AND DECEMBER BRNK STATEMENT Export the Adjusted Trial Balance to Excel and save as a PDF file. Use the flie name Case Problem 3_Adjusted Trial Balance. Change the title to Adjusted Trial Balance. The December 31 bank statement is shown on the nert page. FINANCIAL STATEMENTS Export the Profit and Loss to Excel and save as a PDF file. Use the file name Case Problem 3_Profit and Loss. Export the Balance Sheet to Excel and save as a PDF file. Use the file name Case Problem 3_Palance Sheet. Export the Statement of Cash Flows to Excel and save as a PDF file. Use the file name Case Problem 3_Statement of Cash Flows. CLOSE THE BOOKS On December 31, 20XX, close the balance in the drawing account to capital. Record this journal entry. Export the January 1, 20xY Balance Sheet to Excel and save as a PDF file. Use the file name Case Problem 3_January 1 Balance Sheet. Export the January 1, 20XY Trial Balance to Excel and save as a PDF file. Use the file name Case Problem 3_Postclosing Trial Balance. Change the titie to Postclosing Trial Balance. Export the November 30, 20xX to January 1, 20XY Transaction Detail by Account to Excel and save as a PDF file. Use the file name Case Problem 3_Transaction Detail by Account. CHECK YOUR PROGRESS: YOUR NAME ACCOUNTING What are the total debit and credit balances on the unadjusted trial balance? What are the total debit and credit balances on your Adjusted trial balance? What is the Statement Ending Balance on the reconciliation report? What is the rent expense balance? What is the depreciation expense for computer equipment? What is the depreciation expense for furniture and equipment? What is the amount of total income? How much net income (or net loss) is reported on December 31 ? What is the account balance in the Notes Payable account? What is the total assets balance on December 31? Is there an increase or decrease in Cash for the month of December? What is the balance in the Owher's Equity account? CHART OF ACCOUNTS AND BEGINNING BALANCES Set up the following Chart of Accounts and Beginning Balances as of 11/30/20xX. Use your current year. The accounts to be added or edited are shown below and on the next three pages. \begin{tabular}{|l|l|l|l|l|} \hline & & & Equity & (Completed \\ \hline & Capital (Edit Opening Balance Equity) & & & \\ \hline 30800 & Your Name Draw & Equity & Owner's Equity & 0.00 \\ \hline 32000 & Owner's Equity (Edit Retained Earnings) & Equity & Retained Earnings & 0.00 \\ \hline 41000 & Accounting Services Income & Income & Service/fee Income & 0.00 \\ \hline 42700 & Consulting Income & Income & Service/Fee & 0.00 \\ \hline Income & 0.00 \\ \hline 60000 & Advertising Expense & Expenses Promotional & \\ \hline \end{tabular} 2 Export the Chart of Accounts to Excel and save as a PDF file. Use the file name Case Problem 3_Chart of Accounts. DECEMBER 1,20 BALANCE SHEET Display the December 1 balance sheet: Reports > Balance Sheet >12/1/20X to 12/1/20xX > Run Repol Hint: To make sure you entered beginning balances as of November 30,20xx, display the November 30 balance sheet. If you did not enter beginning balances as of 11/30/200, go to the lournal report, drill down, then edit the Opening Balance dates. The Balance Sheet is shown on the next page. START HERE .. COPY TABLE ABUVE Export the December 1 Balance Sheet to Excel and save as a PDF file. Use the file name Case Problem 3_December 1 Balance Sheet. (You may want to use Your Name Accounting in the file name. Check with your instructoc) DECEMBER 20XX TRANSACTIONS Complete the accounting cycle for your accounting compary. Use the current year. You employ two independent contractors: an Accounting Technician and an Administrative Assistant. They are paid at the end of the month. Use the Transaction Register on the next page to complete December 2000 entries. When recording checks, add vendors. For deposits, do this: DEPOSITS: Select NEW> Bank deposit. If necessarv. In the Account field, select Account 10000 Dayton Bank. The Cash back goes to fieid should also show 10000 Dayton Bank. In the RECEIVED FROM field, click on the down-arrow > Add New > type Clients > Save > select the appropriate account. The payment method is check. Leave the REF NO. field blank. 6 UNADJUSTED TRIAL BALANCE AND JOURNAL Export the Trial Balance to Excel and save as a PDF file. Use the file name Case Protlem 3 Un Unadjusted Trial Balance. (Hint: Use the date range shown on the Transaction Register. Change the report title to Unadjusted Trial Balance.) END-OF-YEAR ADJUSTING ENTRIES At the end of December, the supplies on hand are $1,550.00. Depreciation for Computer Equipment: \$41.67. Depreciation for Furniture and Equipment: $66.67. Adjust one month's rent. Refer to the December 1 Balance Sheet. (Hint: Two months' rent was prepaid on December 1.l Export the Journal to Excel and save as a PDF flle. Use the file name Case Problem 3 Journal. (Hint: Erom 12/1/20 to 12/31/20x.) ADIUSTED TRIAL BALANCE AND DECEMBER BRNK STATEMENT Export the Adjusted Trial Balance to Excel and save as a PDF file. Use the flie name Case Problem 3_Adjusted Trial Balance. Change the title to Adjusted Trial Balance. The December 31 bank statement is shown on the nert page. FINANCIAL STATEMENTS Export the Profit and Loss to Excel and save as a PDF file. Use the file name Case Problem 3_Profit and Loss. Export the Balance Sheet to Excel and save as a PDF file. Use the file name Case Problem 3_Palance Sheet. Export the Statement of Cash Flows to Excel and save as a PDF file. Use the file name Case Problem 3_Statement of Cash Flows. CLOSE THE BOOKS On December 31, 20XX, close the balance in the drawing account to capital. Record this journal entry. Export the January 1, 20xY Balance Sheet to Excel and save as a PDF file. Use the file name Case Problem 3_January 1 Balance Sheet. Export the January 1, 20XY Trial Balance to Excel and save as a PDF file. Use the file name Case Problem 3_Postclosing Trial Balance. Change the titie to Postclosing Trial Balance. Export the November 30, 20xX to January 1, 20XY Transaction Detail by Account to Excel and save as a PDF file. Use the file name Case Problem 3_Transaction Detail by Account. CHECK YOUR PROGRESS: YOUR NAME ACCOUNTING What are the total debit and credit balances on the unadjusted trial balance? What are the total debit and credit balances on your Adjusted trial balance? What is the Statement Ending Balance on the reconciliation report? What is the rent expense balance? What is the depreciation expense for computer equipment? What is the depreciation expense for furniture and equipment? What is the amount of total income? How much net income (or net loss) is reported on December 31 ? What is the account balance in the Notes Payable account? What is the total assets balance on December 31? Is there an increase or decrease in Cash for the month of December? What is the balance in the Owher's Equity account

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts