Question: Can someone guide me on how to sort every transaction, into which account, the best method to determine all of these? Here are all the

Can someone guide me on how to sort every transaction, into which account, the best method to determine all of these?

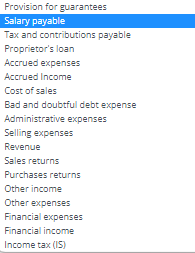

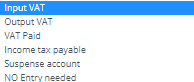

Here are all the possible answers for the debit and credit sides.

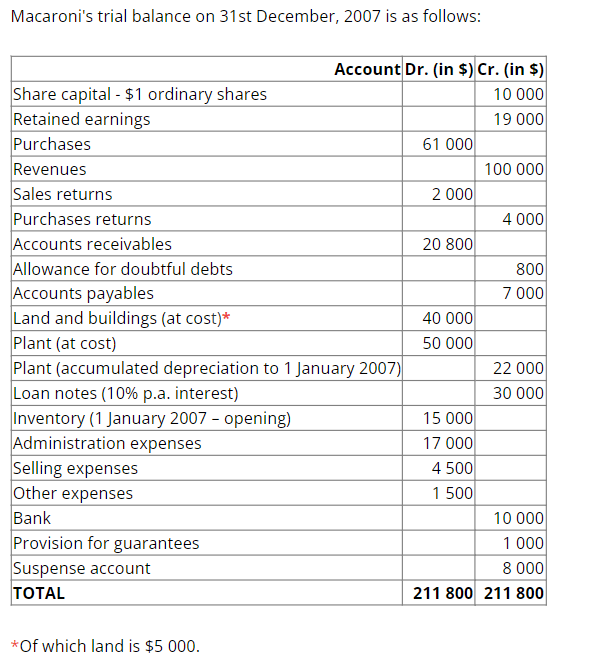

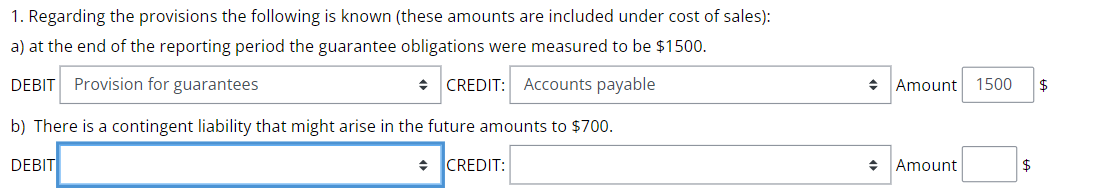

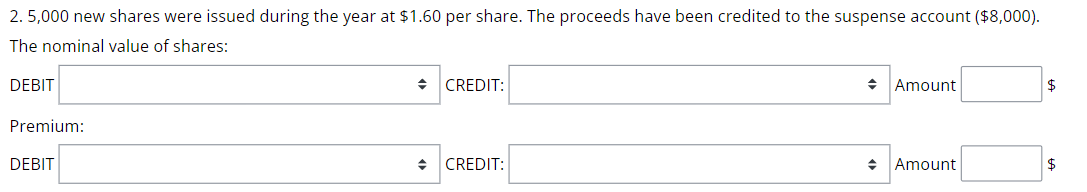

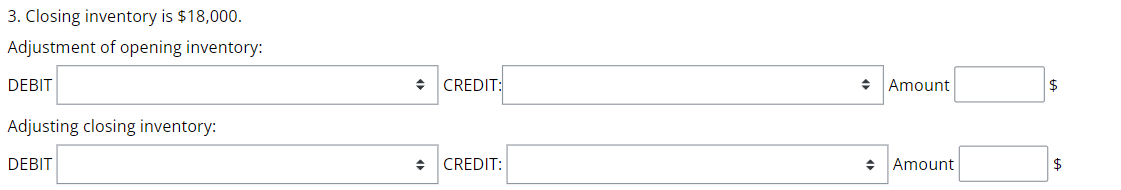

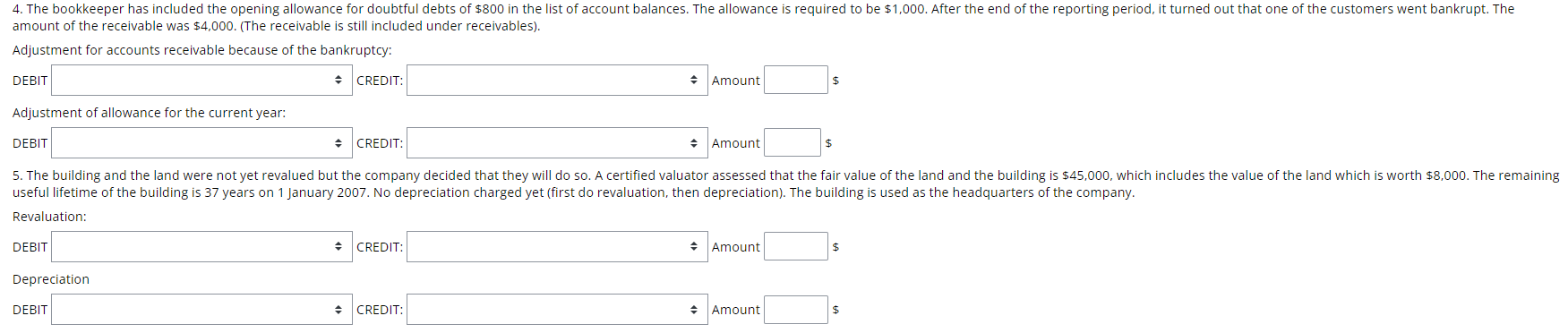

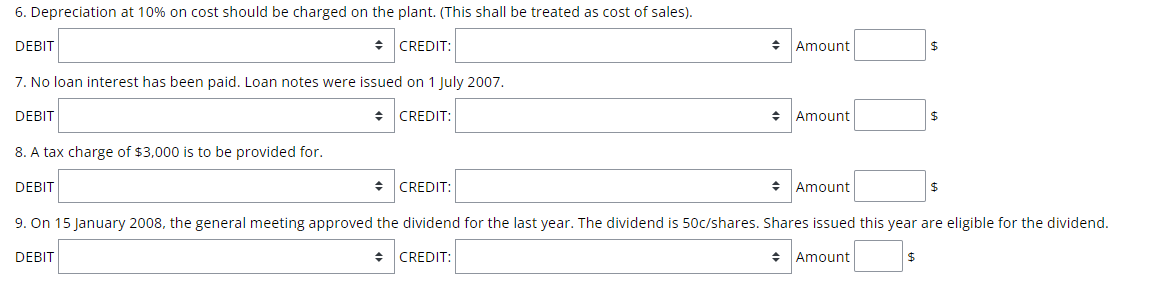

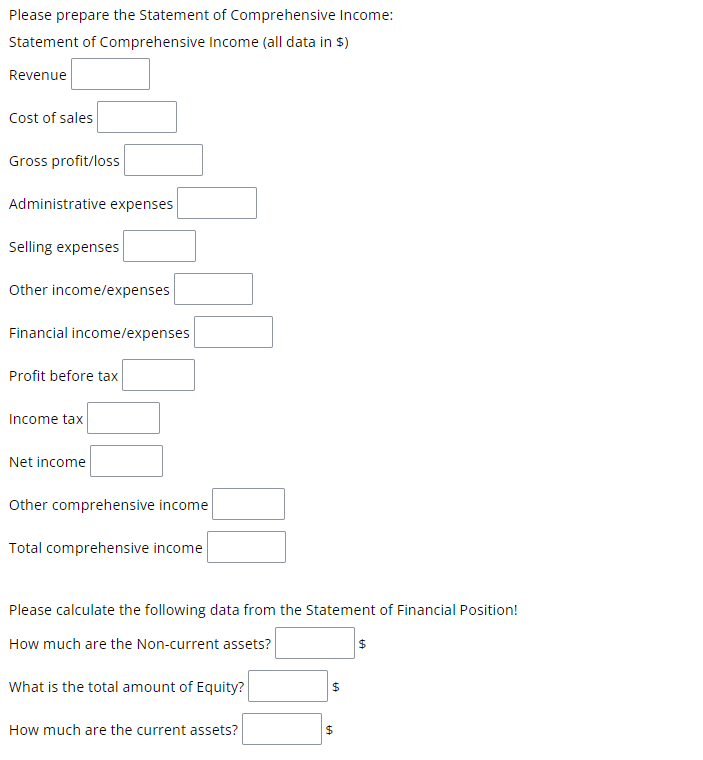

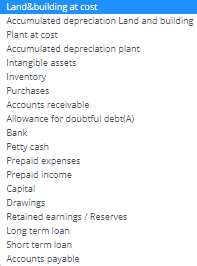

Macaroni's trial balance on 31st December, 2007 is as follows: *Of which land is $5000. 1. Regarding the provisions the following is known (these amounts are included under cost of sales): a) at the end of the reporting period the guarantee obligations were measured to be $1500. DEBIT CREDIT: Amount $ b) There is a contingent liability that might arise in the future amounts to $700. DEBIT CREDIT: Amount $ 2. 5,000 new shares were issued during the year at $1.60 per share. The proceeds have been credited to the suspense account ($8,000). The nominal value of shares: DEBIT CREDIT: Amount $ Premium: DEBIT CREDIT: Amount $ 3. Closing inventory is $18,000. Adjustment of opening inventory: DEBIT CREDIT: Amount $ Adjusting closing inventory: DEBIT CREDIT: Amount $ amount of the receivable was $4,000. (The receivable is still included under receivables). Adjustment for accounts receivable because of the bankruptcy: ZREDIT: Amount Adjustment of allowance for the current year: DEBIT [ CREDIT: Amount $ Revaluation: CREDIT: Amount $ CREDIT: Amount $ 7. No loan interest has been paid. Loan notes were issued on 1 July 2007. DEBIT CREDIT: Amount $ 8. A tax charge of $3,000 is to be provided for. DEBIT CREDIT: Amount $ 9. On 15 January 2008, the general meeting approved the dividend for the last year. The dividend is 50c/shares. Shares issued this year are eligible DEBIT CREDIT: ] Amount $ Please prepare the Statement of Comprehensive Income: Statement of Comprehensive Income (all data in \$) Revenue Cost of sales Gross profit/loss Administrative expenses Selling expenses Other income/expenses Financial income/expenses Profit before tax Income tax Net income Other comprehensive income Total comprehensive income Please calculate the following data from the Statement of Financial Position! How much are the Non-current assets? $ What is the total amount of Equity? $ How much are the current assets? $ Land\&building at cost Accumulated depreciation Land and building Plant at cost Accumulated depreciation plant Intangible assets Inventory Purchases Accounts receivable Allowance for doubtful debt(A) Bank Petty cash Prepaid expenses Prepaid income Capital Drawings Retained earnings / Reserves Long term loan Short term loan Accounts payable Provision for guarantees Salary payable Tax and contributions payable Proprietor's loan Accrued expenses Accrued Income Cost of sales Bad and doubtful debt expense Administrative expenses Selling expenses Revenue Sales returns Purchases returns Other income Other expenses Financial expenses Financial income Income tax (I5) Input VAT Output VAT VAT Paid Income tax payable Suspense account NO Entry needed Macaroni's trial balance on 31st December, 2007 is as follows: *Of which land is $5000. 1. Regarding the provisions the following is known (these amounts are included under cost of sales): a) at the end of the reporting period the guarantee obligations were measured to be $1500. DEBIT CREDIT: Amount $ b) There is a contingent liability that might arise in the future amounts to $700. DEBIT CREDIT: Amount $ 2. 5,000 new shares were issued during the year at $1.60 per share. The proceeds have been credited to the suspense account ($8,000). The nominal value of shares: DEBIT CREDIT: Amount $ Premium: DEBIT CREDIT: Amount $ 3. Closing inventory is $18,000. Adjustment of opening inventory: DEBIT CREDIT: Amount $ Adjusting closing inventory: DEBIT CREDIT: Amount $ amount of the receivable was $4,000. (The receivable is still included under receivables). Adjustment for accounts receivable because of the bankruptcy: ZREDIT: Amount Adjustment of allowance for the current year: DEBIT [ CREDIT: Amount $ Revaluation: CREDIT: Amount $ CREDIT: Amount $ 7. No loan interest has been paid. Loan notes were issued on 1 July 2007. DEBIT CREDIT: Amount $ 8. A tax charge of $3,000 is to be provided for. DEBIT CREDIT: Amount $ 9. On 15 January 2008, the general meeting approved the dividend for the last year. The dividend is 50c/shares. Shares issued this year are eligible DEBIT CREDIT: ] Amount $ Please prepare the Statement of Comprehensive Income: Statement of Comprehensive Income (all data in \$) Revenue Cost of sales Gross profit/loss Administrative expenses Selling expenses Other income/expenses Financial income/expenses Profit before tax Income tax Net income Other comprehensive income Total comprehensive income Please calculate the following data from the Statement of Financial Position! How much are the Non-current assets? $ What is the total amount of Equity? $ How much are the current assets? $ Land\&building at cost Accumulated depreciation Land and building Plant at cost Accumulated depreciation plant Intangible assets Inventory Purchases Accounts receivable Allowance for doubtful debt(A) Bank Petty cash Prepaid expenses Prepaid income Capital Drawings Retained earnings / Reserves Long term loan Short term loan Accounts payable Provision for guarantees Salary payable Tax and contributions payable Proprietor's loan Accrued expenses Accrued Income Cost of sales Bad and doubtful debt expense Administrative expenses Selling expenses Revenue Sales returns Purchases returns Other income Other expenses Financial expenses Financial income Income tax (I5) Input VAT Output VAT VAT Paid Income tax payable Suspense account NO Entry needed

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts