Question: Can someone help asap? Please review Case 5.5 New Tech at pages 164-166 of the text book and (a) calculate the value of New Tech,

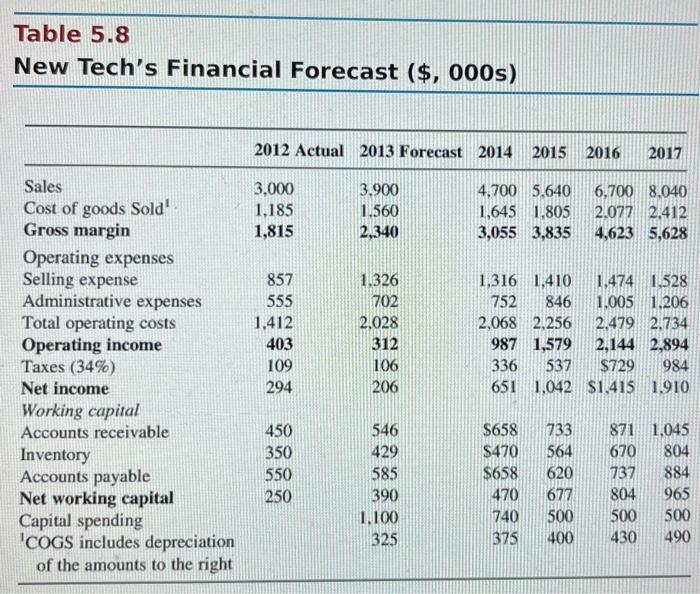

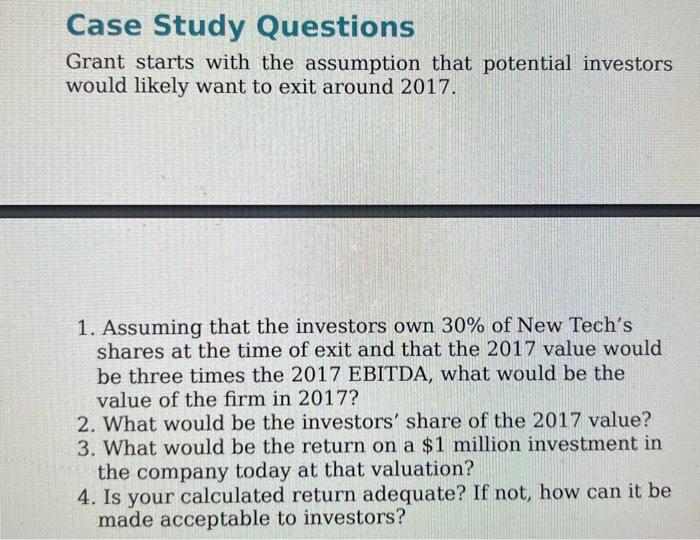

Please review Case 5.5 "New Tech" at pages 164-166 of the text book and (a) calculate the value of New Tech, using the data in Table 5.8 and the assumptions described in the Case, and (b) answer questions 14 on page 166. Table 5.8 New Tech's Financial Forecast ( $,000 s) Case Study Questions Grant starts with the assumption that potential investors would likely want to exit around 2017. 1. Assuming that the investors own 30% of New Tech's shares at the time of exit and that the 2017 value would be three times the 2017 EBITDA, what would be the value of the firm in 2017? 2. What would be the investors' share of the 2017 value? 3. What would be the return on a $1 million investment in the company today at that valuation? 4. Is your calculated return adequate? If not, how can it be made acceptable to investors

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts