Question: can someone help explain what is missing? thanks Use the following information for Ingersoll, Inc. Assume the tax rate is 22 percent. Sales Depreciation Cost

can someone help explain what is missing? thanks

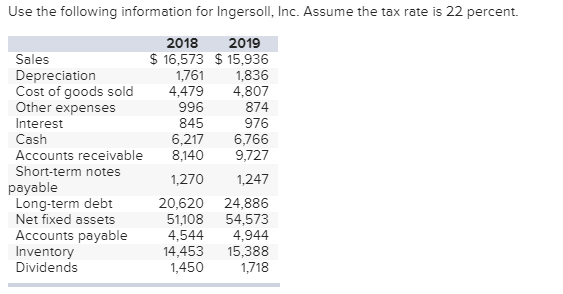

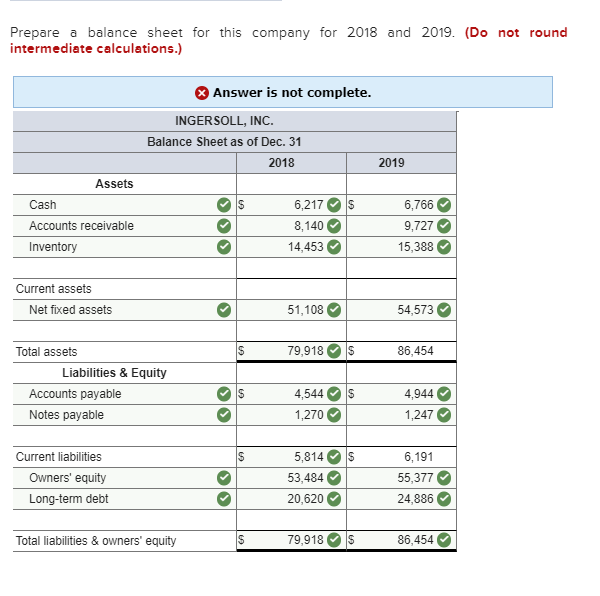

Use the following information for Ingersoll, Inc. Assume the tax rate is 22 percent. Sales Depreciation Cost of goods sold Other expenses Interest Cash Accounts receivable Short-term notes payable Long-term debt Net fixed assets Accounts payable Inventory Dividends 2018 2019 $ 16,573 $ 15,936 1,761 1,836 4,479 4,807 996 874 845 976 6,217 6,766 8,140 9,727 1,270 1,247 20,620 24,886 51,108 54,573 4,544 4,944 14,453 15,388 1,450 1,718 Prepare a balance sheet for this company for 2018 and 2019. (Do not round intermediate calculations.) Answer is not complete. INGERSOLL, INC. Balance Sheet as of Dec. 31 2018 2019 Assets Cash Accounts receivable Inventory S6,217S6,766 8,140 9,727 14,453 15,388 Current assets Net fixed assets 51,108 54,573 79,918 $ 86,454 Total assets Liabilities & Equity Accounts payable Notes payable 4,5449 1,270 4,944 1,247 $ Current liabilities Owners' equity Long-term debt 5,814 53,484 20,620 6,191 55,377 24,886 Total liabilities & owners' equity $ 79,918 $ 86,454

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts