Question: can someone help? ive been going through this problem a couple of times now and im continually getting them wrong i need help with a

can someone help? ive been going through this problem a couple of times now and im continually getting them wrong i need help with a through d

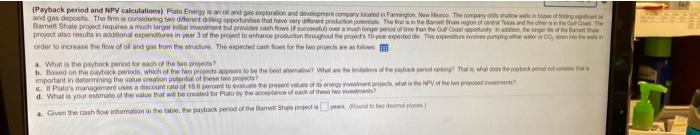

Plato Energy is an oil and gas exploration and development company located in Farmington, New Mexico. The company drills shallow wells in hopes of finding significant oil and gas deposits. The firm is considering two different drilling opportunities that have very different production potentials. The first is in the Barnett Shale region of central Texas and the other is in the Gulf Coast. The Barnett Shale project requires a much larger initial investment but provides cash flows (if successful) over a much longer period of time than the Gulf Coast opportunity. In addition, the longer life of the Barnett Shale project also results in additional expenditures in year 3 of the project to enhance production throughout the project's 10-year expected life. This expenditure involves pumping either water or CO2 down into the wells in order to increase the flow of oil and gas from the structure. The expected cash flows for the two projects are as follows:

a.What is the payback period for each of the two projects?

b.Based on the payback periods, which of the two projects appears to be the best alternative? What are the limitations of the payback period ranking? That is, what does the payback period not consider that is important in determining the value creation potential of these two projects?

c.If Plato's management uses a discount rate of 18.6 percent to evaluate the present values of its energy investment projects, what is the NPV of the two proposed investments?

d.What is your estimate of the value that will be created for Plato by the acceptance of each of these two investments?

| Year | Barnett Shale | Gulf Coast | |||

|---|---|---|---|---|---|

| 0 | $(4,500,000) | $(1,400,000) | |||

| 1 | 1,800,000 | 850,000 | |||

| 2 | 1,800,000 | 850,000 | |||

| 3 | (900,000) | 375,000 | |||

| 4 | 1,800,000 | 140,000 | |||

| 5 | 1,600,000 | ||||

| 6 | 1,600,000 | ||||

| 7 | 1,600,000 | ||||

| 8 | 800,000 | ||||

| 9 | 650,000 | ||||

| 10 | 90,000 | ||||

(Payback period and NPV calculation) Palo Energy mand gas exploration and devenit condamngton. Now they wonder and gas cool. The firm is considering to tong oportunities that have very for prodh The Herrer Twenthe Barnett Shale project requires a much largohet trods show I caught Our Cost contradient were project also ou non expert in your of the project to one point out the proceed The new bo to nema he tow of oil and gas from the outure. The expected can fom for the protestom a. What is the payback period for each of the w h. Based on the band, which of the was to be the best Word important in defining the value in profesor Pato's management account rate of 186 percent og present of the Power d. What is your state of the value that were for at byde ochowa 2. Given the cash flow information in the table the payback period of the Browwe

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts