Question: Can someone help me answer this question (MUST BE ANSWERED BY FORMUAL) the three pictures follow on question!! Complete the following analysis. Do not hard

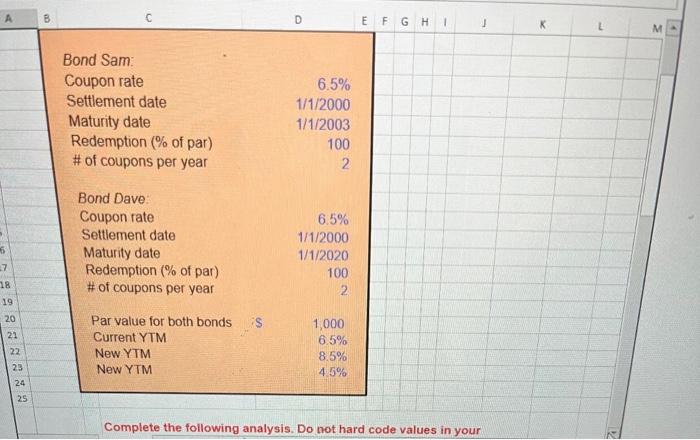

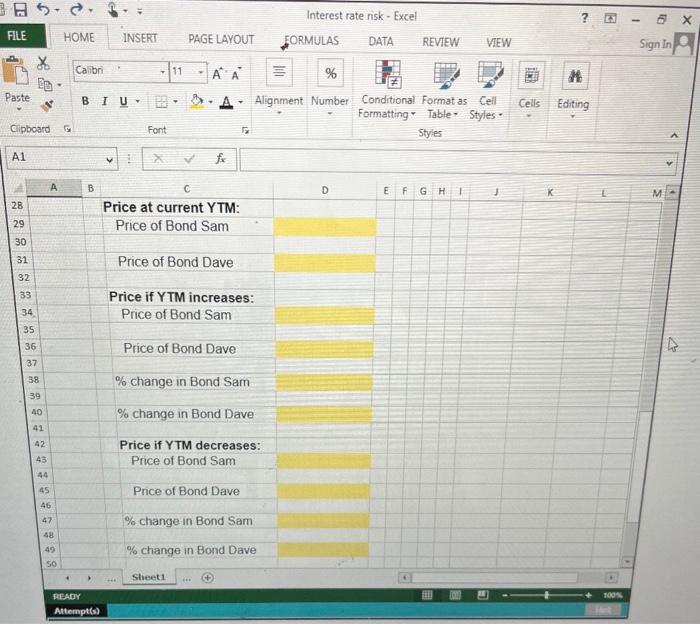

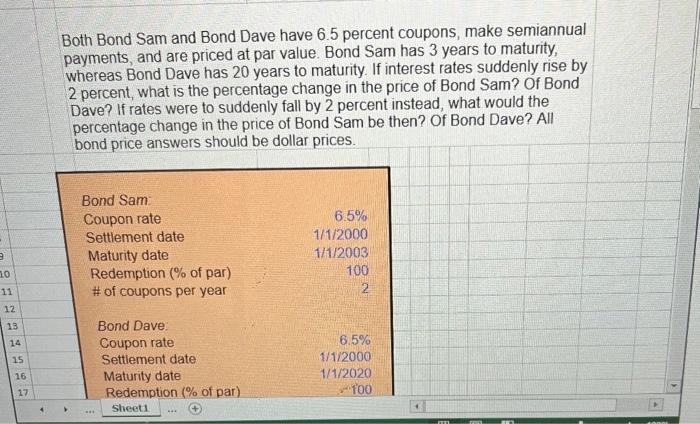

Complete the following analysis. Do not hard code values in your FILE DATA REVEW VEW B I U=[+B).A. Alignment Number Conditional Formatas Cell Cells Editing Formatting Table* Styles * Cipboard 5 Font x A1 Price if YTM increases: Price of Bond Sam Price of Bond Dave % change in Bond Sam % change in Bond Dave Price if YTM decreases: Price of Bond Sam Price of Bond Dave % change in Bond Sam \% change in Bond Dave Both Bond Sam and Bond Dave have 6.5 percent coupons, make semiannual payments, and are priced at par value. Bond Sam has 3 years to maturity, whereas Bond Dave has 20 years to maturity. If interest rates suddenly rise by 2 percent, what is the percentage change in the price of Bond Sam? Of Bond Dave? If rates were to suddenly fall by 2 percent instead, what would the percentage change in the price of Bond Sam be then? Of Bond Dave? All bond price answers should be dollar prices

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts