Question: Can someone help me figure this out please. Required information Use the following to answer the next three questions: The Wall, Co, is considering the

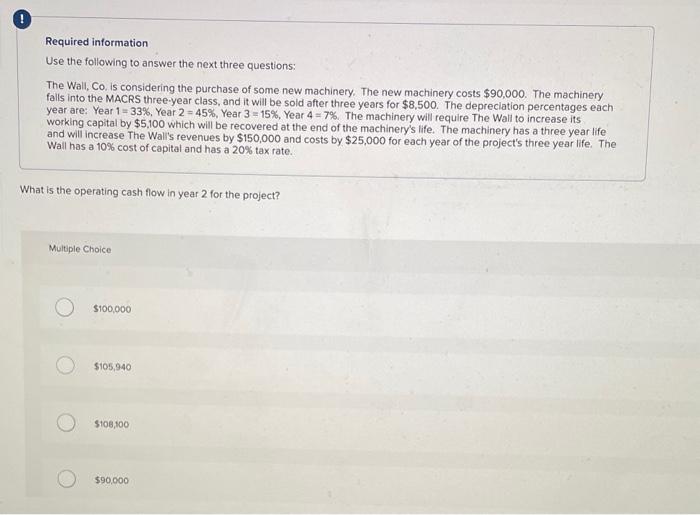

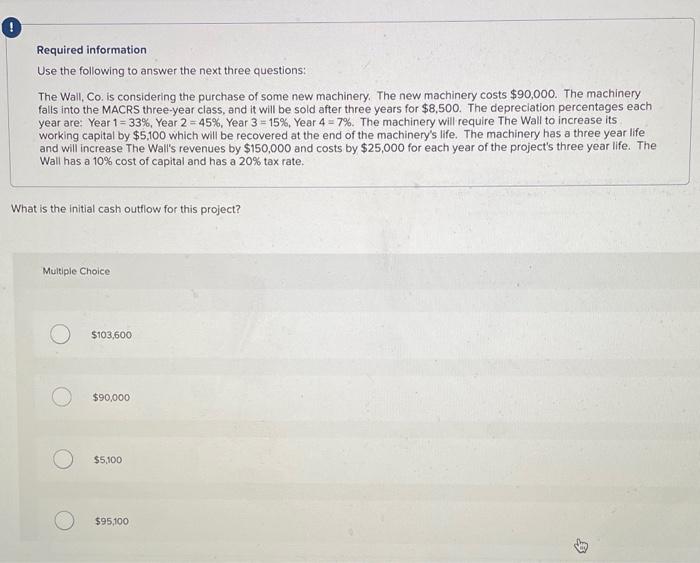

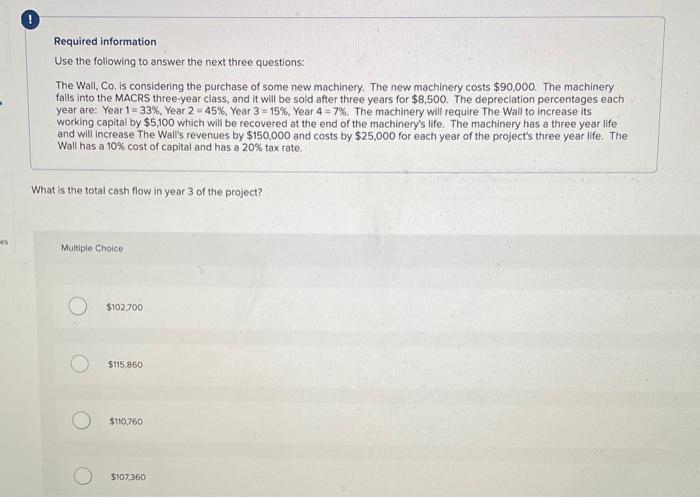

Required information Use the following to answer the next three questions: The Wall, Co, is considering the purchase of some new machinery. The new machinery costs $90,000. The machinery falls into the MACRS three-year class, and it will be sold after three years for $8,500. The depreciation percentages each year are: Year 1=33%, Year 2=45%, Year 3=15%, Year 4=7%. The machinery will require The Wall to increase its working capital by $5,100 which will be recovered at the end of the machinery's life. The machinery has a three year life and will increase The Wall's revenues by $150,000 and costs by $25,000 for each year of the project's three year life. The Wall has a 10% cost of capital and has a 20% tax rate. What is the operating cash flow in year 2 for the project? Multiple Choice $100,000 $105,940 5108,500 $90.000 Required information Use the following to answer the next three questions: The Wall, Co. is considering the purchase of some new machinery. The new machinery costs $90,000. The machinery falls into the MACRS three-year class, and it will be sold after three years for $8,500. The depreciation percentages each year are: Year 1=33%, Year 2=45%, Year 3=15%, Year 4=7%. The machinery will require The Wall to increase its working capital by $5,100 which will be recovered at the end of the machinery's life. The machinery has a three year life and will increase The Wall's revenues by $150,000 and costs by $25,000 for each year of the project's three year life. The Wall has a 10% cost of capital and has a 20% tax rate. What is the initial cash outflow for this project? Multiple Choice 5103,600 $90,000 $5,100 $95,100 Required information Use the following to answer the next three questions: The Wail, Co, is considering the purchase of some new machinery. The new machinery costs $90,000. The machinery falls into the MACRS three-year class, and it will be sold after three years for $8,500. The depreciation percentages each year are: Year 1=33%, Year 2=45%, Year 3=15%, Year 4=7%. The machinery will require The Wall to increase its working capital by $5,100 which will be recovered at the end of the machinery's life. The machinery has a three year life and will increase The Wali's revenues by $150,000 and costs by $25,000 for each year of the project's three year life. The Wall has a 10% cost of capital and has a 20% tax rate. What is the total cash flow in year 3 of the project? Mutiple Choice $102,700 $115,860 $110.760 $107,360

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts