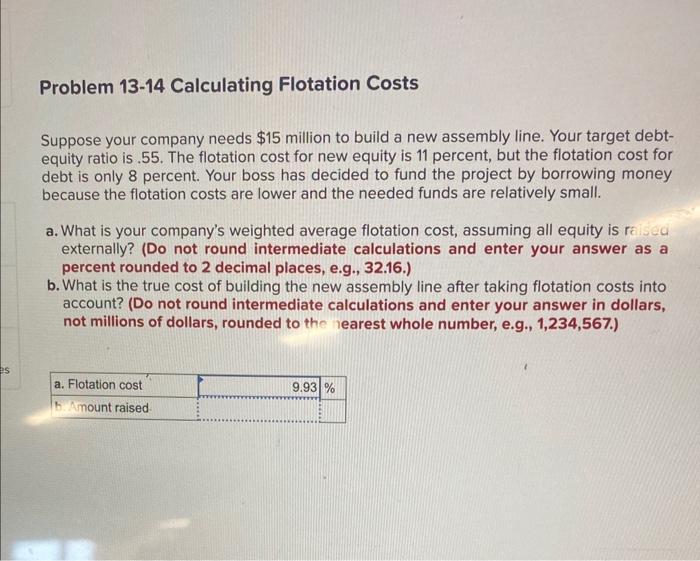

Question: can someone help me find Amount raised? Problem 13-14 Calculating Flotation Costs Suppose your company needs $15 million to build a new assembly line. Your

Problem 13-14 Calculating Flotation Costs Suppose your company needs $15 million to build a new assembly line. Your target debtequity ratio is .55. The flotation cost for new equity is 11 percent, but the flotation cost for debt is only 8 percent. Your boss has decided to fund the project by borrowing money because the flotation costs are lower and the needed funds are relatively small. a. What is your company's weighted average flotation cost, assuming all equity is reised externally? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) b. What is the true cost of building the new assembly line after taking flotation costs into account? (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to the learest whole number, e.g., 1,234,567.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts