Question: Can someone help me? I really need the answer ASAP. Thank you in advance. Suppose that yield rates on zero coupon bonds are currently 2.2%

Can someone help me? I really need the answer ASAP. Thank you in advance.

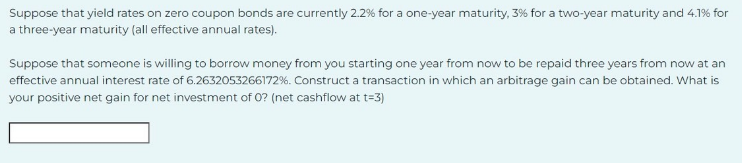

Suppose that yield rates on zero coupon bonds are currently 2.2% for a one-year maturity, 3% for a two-year maturity and 4.1% for a three-year maturity (all effective annual rates). Suppose that someone is willing to borrow money from you starting one year from now to be repaid three years from now at an effective annual interest rate of 6.2632053266172%. Construct a transaction in which an arbitrage gain can be obtained. What is your positive net gain for net investment of O? (net cashflow at t=3) Suppose that yield rates on zero coupon bonds are currently 2.2% for a one-year maturity, 3% for a two-year maturity and 4.1% for a three-year maturity (all effective annual rates). Suppose that someone is willing to borrow money from you starting one year from now to be repaid three years from now at an effective annual interest rate of 6.2632053266172%. Construct a transaction in which an arbitrage gain can be obtained. What is your positive net gain for net investment of O? (net cashflow at t=3)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts