Question: Can someone help me on how to do horizontal analysis of balance sheet for the year 2020 and 2021 with a conclusion? Assets Cash and

Can someone help me on how to do horizontal analysis of balance sheet for the year 2020 and 2021 with a conclusion?

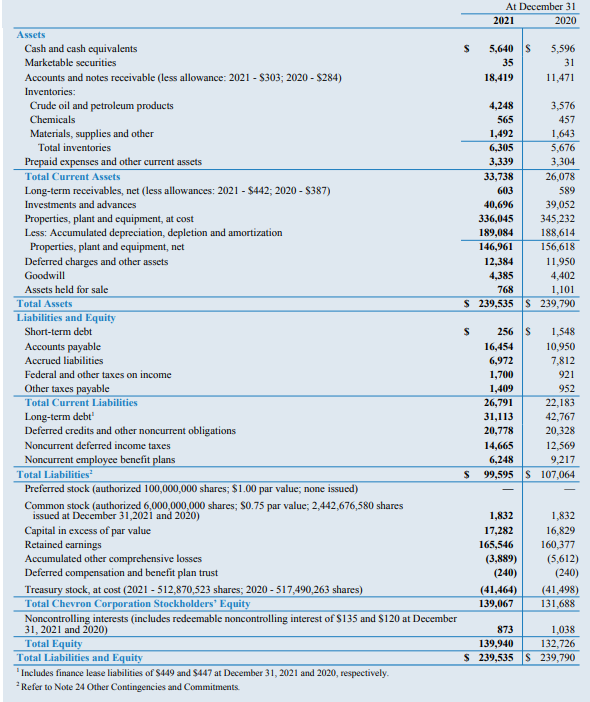

Assets Cash and cash equivalents Marketable securities Accounts and notes receivable (less allowance: 2021-$303; 2020 - $284) Inventories: Crude oil and petroleum products Chemicals Materials, supplies and other Total inventories Prepaid expenses and other current assets Total Current Assets Long-term receivables, net (less allowances: 2021 - $442; 2020 - $387) Investments and advances Properties, plant and equipment, at cost Less: Accumulated depreciation, depletion and amortization Properties, plant and equipment, net Deferred charges and other assets Goodwill Assets held for sale Total Assets Liabilities and Equity Short-term debt Accounts payable Accrued liabilities Federal and other taxes on income Other taxes payable Total Current Liabilities Long-term debt Deferred credits and other noncurrent obligations Noncurrent deferred income taxes Noncurrent employee benefit plans Total Liabilities Preferred stock (authorized 100,000,000 shares; $1.00 par value; none issued) Common stock (authorized 6,000,000,000 shares; $0.75 par value; 2,442,676,580 shares issued at December 31,2021 and 2020) Capital in excess of par value Retained earnings Accumulated other comprehensive losses Deferred compensation and benefit plan trust Treasury stock, at cost (2021-512,870,523 shares; 2020-517,490,263 shares) Total Chevron Corporation Stockholders' Equity Noncontrolling interests (includes redeemable noncontrolling interest of $135 and $120 at December 31, 2021 and 2020) Total Equity Total Liabilities and Equity 'Includes finance lease liabilities of $449 and $447 at December 31, 2021 and 2020, respectively. *Refer to Note 24 Other Contingencies and Commitments. At December 31 2021 2020 5,640 S 5,596 35 31 18,419 11,471 4,248 3,576 565 457 1,492 1,643 6,305 5,676 3,339 3,304 33,738 26,078 603 589 40,696 39,052 336,045 345,232 189,084 188,614 146,961 156,618 12,384 11,950 4,385 4,402 768 1,101 $ 239,535 S 239,790 $ 256 S 1,548 16,454 10,950 6,972 7,812 1,700 921 1,409 952 26,791 22,183 31,113 42,767 20,778 20,328 14,665 12,569 6,248 9,217 99,595 $ 107,064 1,832 1,832 17,282 16,829 165,546 160,377 (3,889) (5,612) (240) (240) (41,464) (41,498) 139,067 131,688 873 1,038 139,940 132,726 $ 239,535 S 239,790 $ $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts