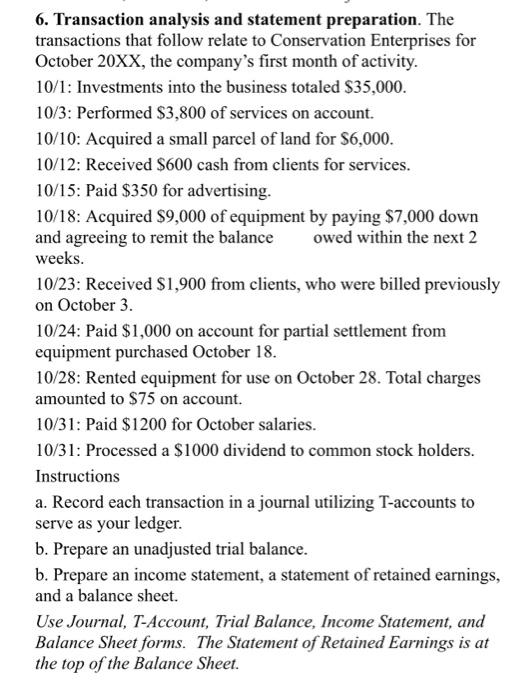

Question: Can someone help me on this problem? 6. Transaction analysis and statement preparation. The transactions that follow relate to Conservation Enterprises for October 20XX, the

6. Transaction analysis and statement preparation. The transactions that follow relate to Conservation Enterprises for October 20XX, the company's first month of activity. 10/1: Investments into the business totaled $35,000. 10/3: Performed $3,800 of services on account. 10/10: Acquired a small parcel of land for $6,000. 10/12: Received $600 cash from clients for services. 10/15: Paid $350 for advertising. 10/18: Acquired $9,000 of equipment by paying $7,000 down and agreeing to remit the balance owed within the next 2 weeks. 10/23: Received $1,900 from clients, who were billed previously on October 3. 10/24: Paid $1,000 on account for partial settlement from equipment purchased October 18. 10/28: Rented equipment for use on October 28. Total charges amounted to $75 on account. 10/31: Paid $1200 for October salaries. 10/31: Processed a $1000 dividend to common stock holders. Instructions a. Record each transaction in a journal utilizing T-accounts to serve as your ledger. b. Prepare an unadjusted trial balance. b. Prepare an income statement, a statement of retained earnings, and a balance sheet. Use Journal, T-Account, Trial Balance, Income Statement, and Balance Sheet forms. The Statement of Retained Earnings is at the top of the Balance Sheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts