Question: Can someone help me out on this one? No excel please and please show me the work you did A 40-year maturity bond has a

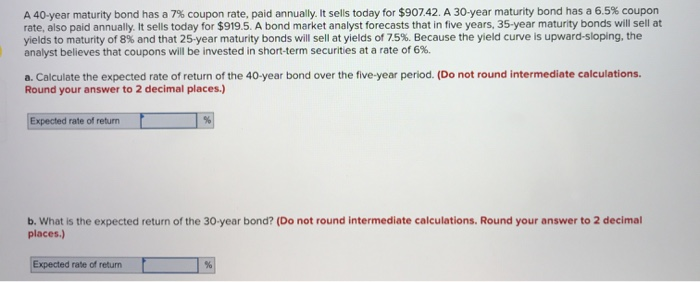

A 40-year maturity bond has a 7% coupon rate, paid annually. It sells today for $907.42. A 30-year maturity bond has a 6.5% coupon rate, also paid annually. It sells today for $919.5. A bond market analyst forecasts that in five years, 35-year maturity bonds will sell at yields to maturity of 8% and that 25 year maturity bonds will sell at yields of 7.5%. Because the yield curve is upward-sloping, the analyst believes that coupons will be invested in short-term securities at a rate of 6%. a. Calculate the expected rate of return of the 40-year bond over the five-year period. (Do not round intermediate calculations. Round your answer to 2 decimal places.) Expected rate of return % b. What is the expected return of the 30-year bond? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Expected rate of retum % A 40-year maturity bond has a 7% coupon rate, paid annually. It sells today for $907.42. A 30-year maturity bond has a 6.5% coupon rate, also paid annually. It sells today for $919.5. A bond market analyst forecasts that in five years, 35-year maturity bonds will sell at yields to maturity of 8% and that 25 year maturity bonds will sell at yields of 7.5%. Because the yield curve is upward-sloping, the analyst believes that coupons will be invested in short-term securities at a rate of 6%. a. Calculate the expected rate of return of the 40-year bond over the five-year period. (Do not round intermediate calculations. Round your answer to 2 decimal places.) Expected rate of return % b. What is the expected return of the 30-year bond? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Expected rate of retum %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts