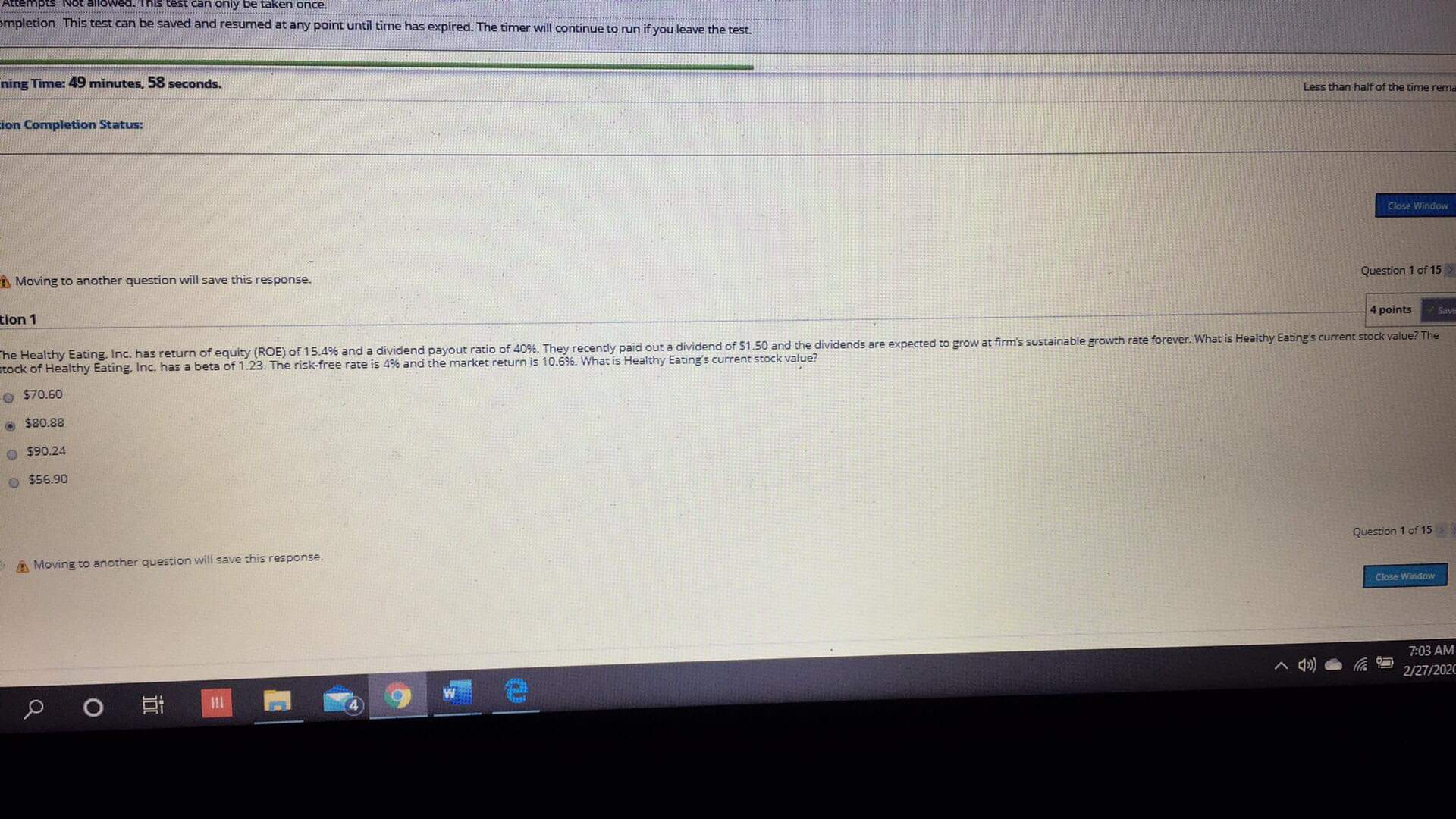

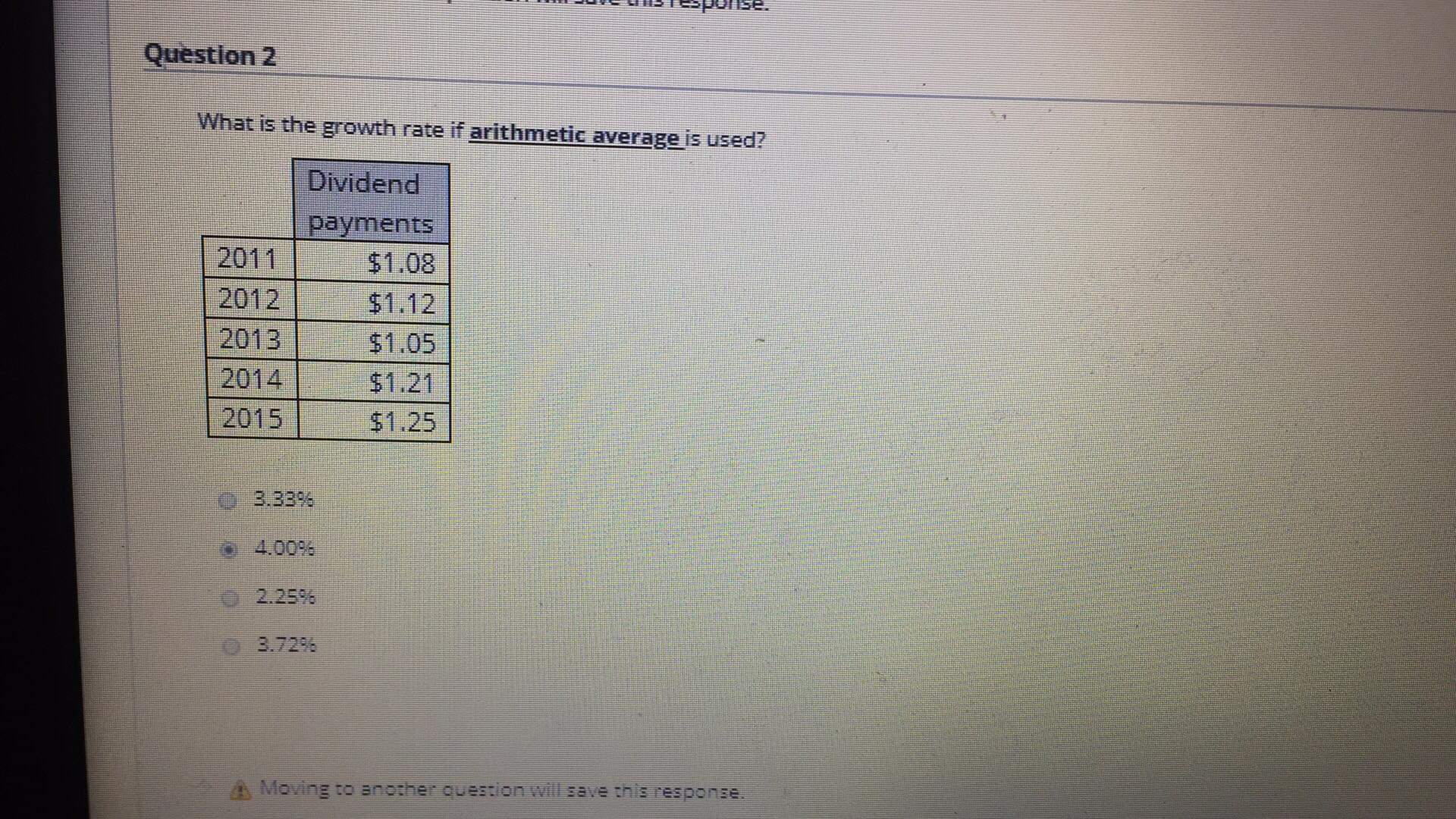

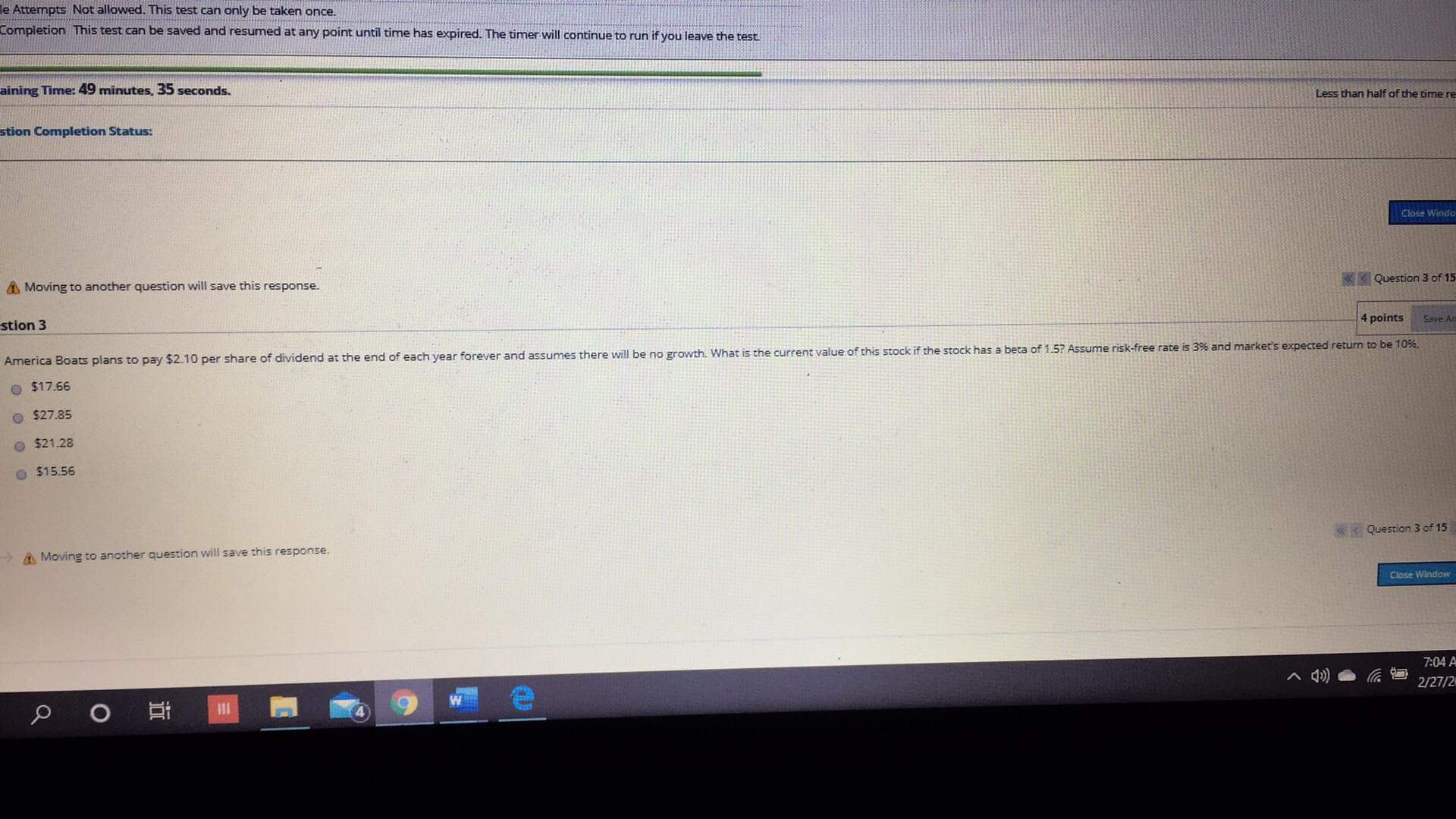

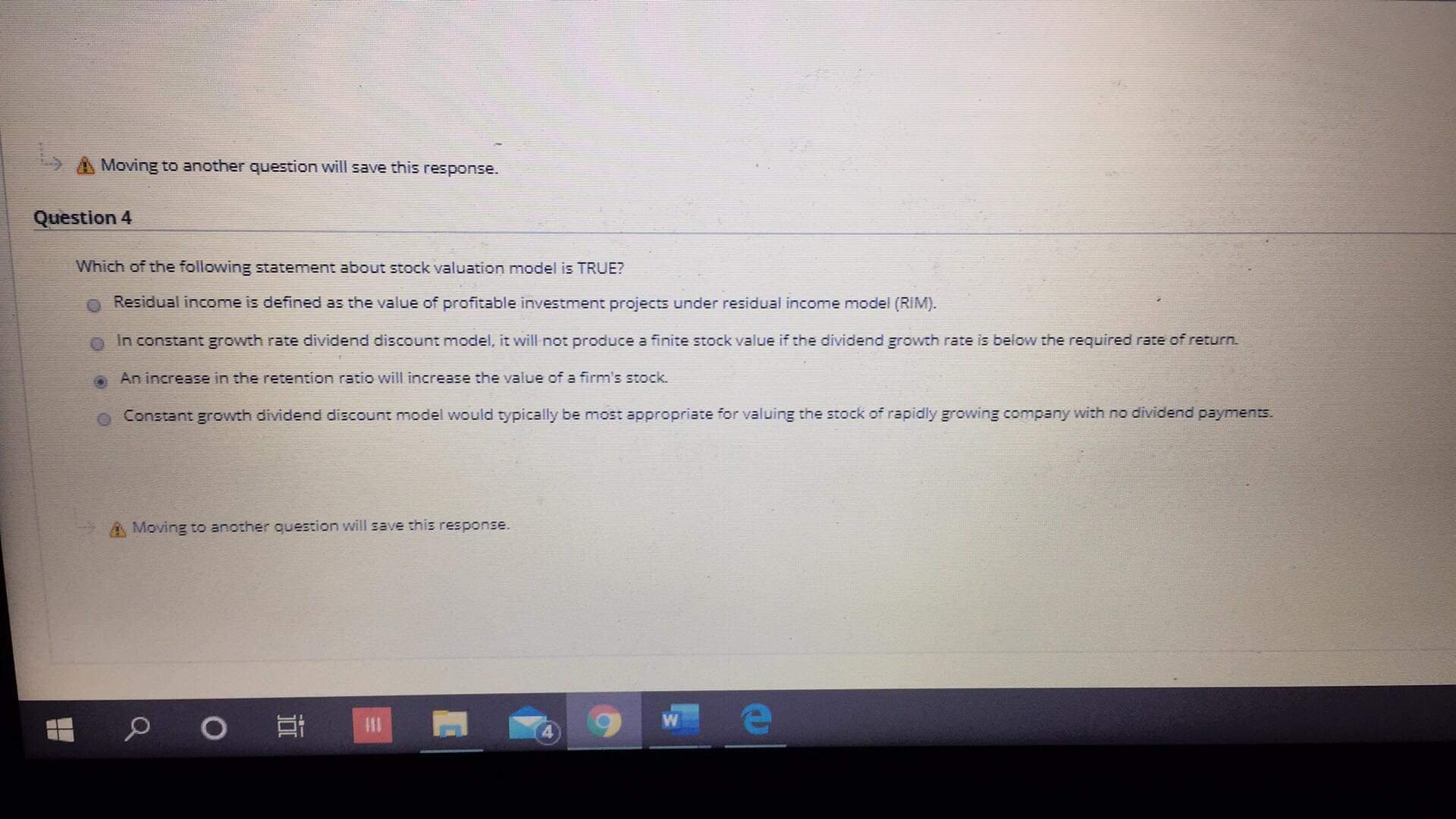

Question: Can someone help me please en once. Ampletion This test can be saved and resumed at any point until time has expired. The timer will

Can someone help me please

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock