Question: Can someone help me solve this problem and pls show work if possible 2. Consider the following assumption about annual returns to two stock mutual

Can someone help me solve this problem and pls show work if possible

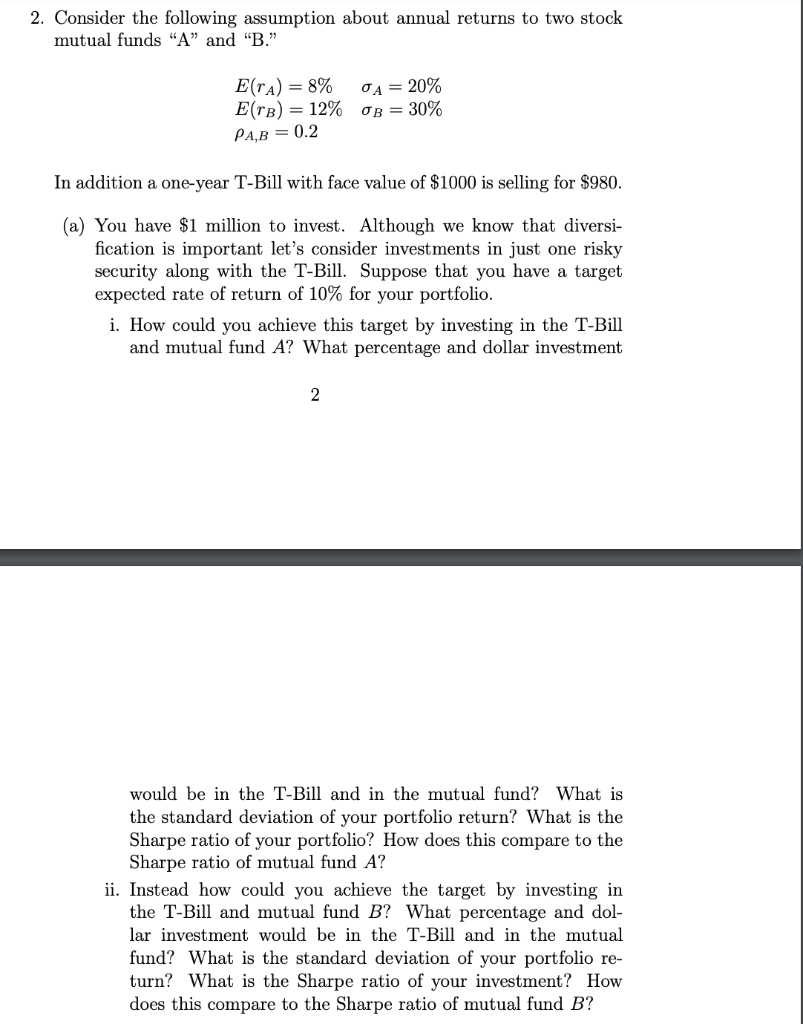

2. Consider the following assumption about annual returns to two stock mutual funds "A" and "B." E(TA) = 8% A = 20% E(TB) = 12% OB = 30% PAB = 0.2 In addition a one-year T-Bill with face value of $1000 is selling for $980. (a) You have $1 million to invest. Although we know that diversi- fication is important let's consider investments in just one risky security along with the T-Bill. Suppose that you have a target expected rate of return of 10% for your portfolio. i. How could you achieve this target by investing in the T-Bill and mutual fund A? What percentage and dollar investment 2 would be in the T-Bill and in the mutual fund? What is the standard deviation of your portfolio return? What is the Sharpe ratio of your portfolio? How does this compare to the Sharpe ratio of mutual fund A? ii. Instead how could you achieve the target by investing in the T-Bill and mutual fund B? What percentage and dol- lar investment would be in the T-Bill and in the mutual fund? What is the standard deviation of your portfolio re- turn? What is the Sharpe ratio of your investment? How does this compare to the Sharpe ratio of mutual fund B

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts