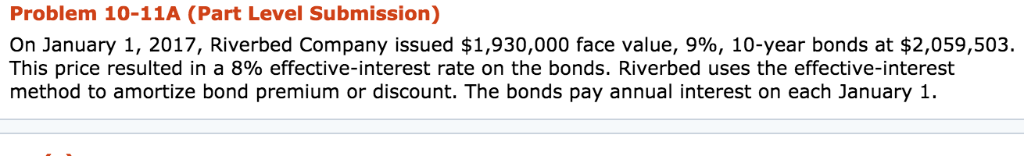

Question: CAN SOMEONE HELP ME THIS QUESTION? Problem 10-11A (Part Level Submission) On January 1, 2017, Riverbed Company issued $1,930,000 face value, 990, 10-year bonds at

CAN SOMEONE HELP ME THIS QUESTION?

CAN SOMEONE HELP ME THIS QUESTION?

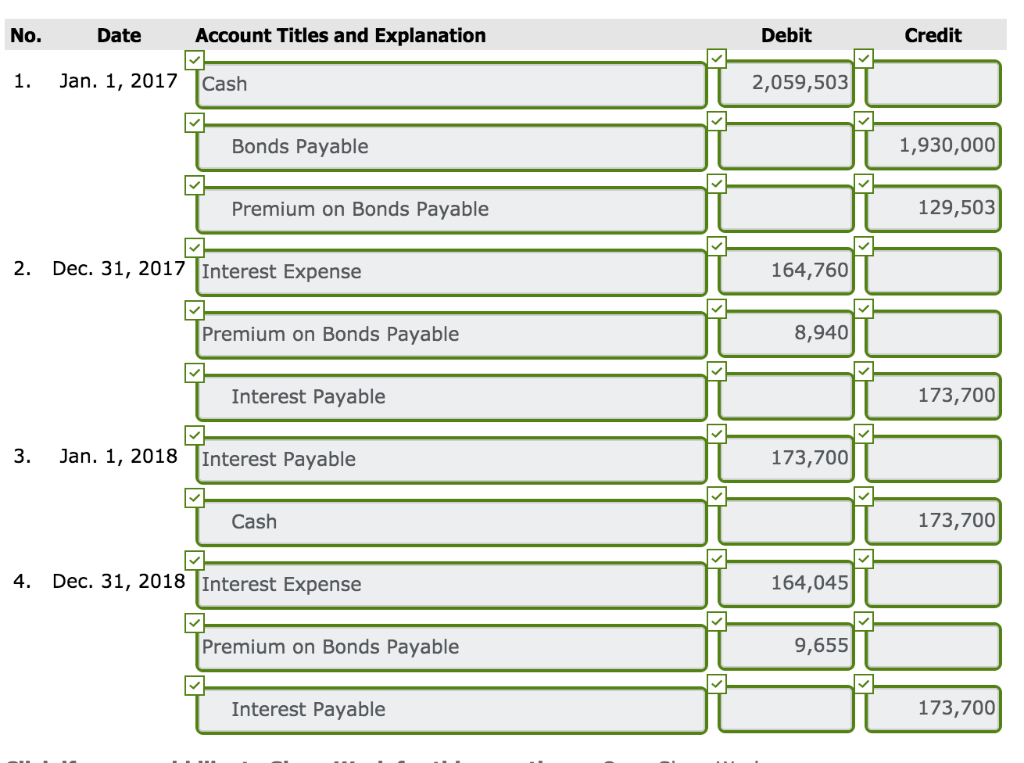

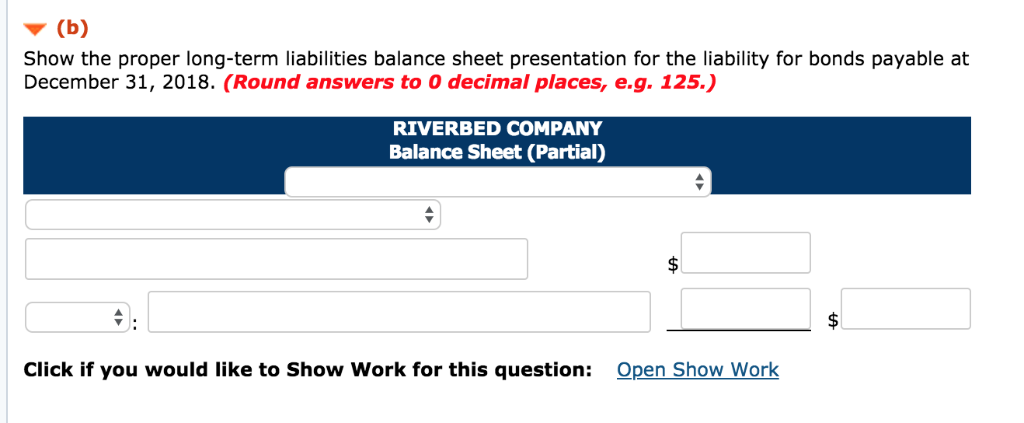

Problem 10-11A (Part Level Submission) On January 1, 2017, Riverbed Company issued $1,930,000 face value, 990, 10-year bonds at $2,059,503. This price resulted in a 8% effective-interest rate on the bonds. Riverbed uses the effective-interest method to amortize bond premium or discount. The bonds pay annual interest on each January 1. No. Date Account Titles and Explanation Debit Credit 1. Jan. 1, 2017 Cash 2,059,503 Bonds Payable 1,930,000 Premium on Bonds Payable 129,503 2. Dec. 31, 2017 Interest Expense 164,760 Premium on Bonds Payable 8,940 Interest Payable 173,700 3. Jan. 1, 2018 Interest Payable 173,700 Cash 173,700 4. Dec. 31, 2018 Interest Expense 164,045 Premium on Bonds Payable 9,655 Interest Payable 173,700 Show the proper long-term liabilities balance sheet presentation for the liability for bonds payable at December 31, 2018. (Round answers to O decimal places, e.g. 125.) RIVERBED COMPANY Balance Sheet (Partial) Click if you would like to Show Work for this question: Open Show Work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts