Question: Can someone help me to do task 5 like this following format: the answer is mine but i'm not sure, please help me to do

Can someone help me to do task 5 like this following format:

the answer is mine but i'm not sure, please help me to do like this format

the answer is mine but i'm not sure, please help me to do like this format

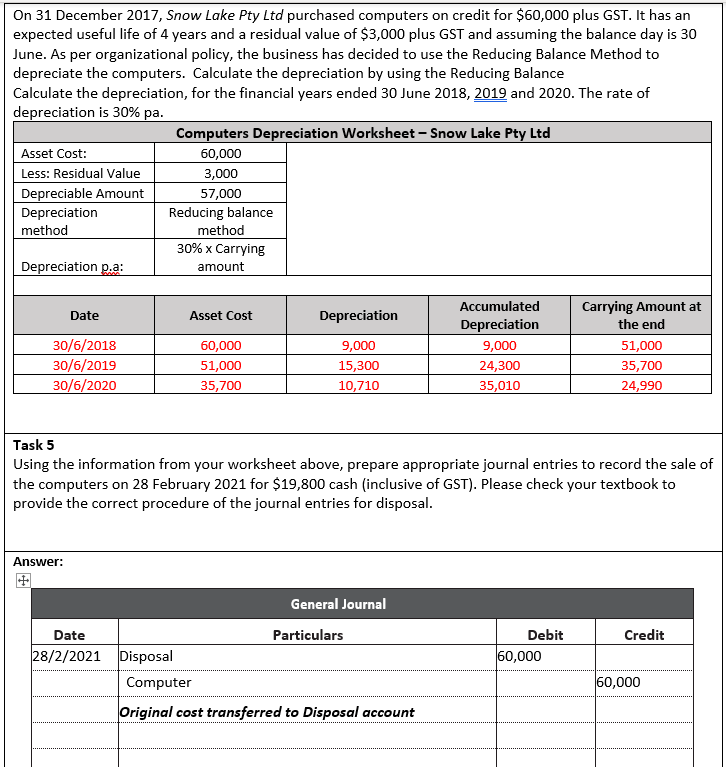

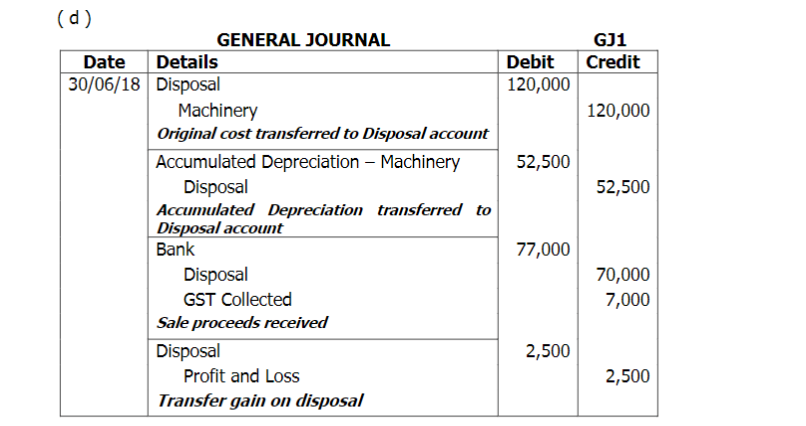

On 31 December 2017, Snow Lake Pty Ltd purchased computers on credit for $60,000 plus GST. It has an expected useful life of 4 years and a residual value of $3,000 plus GST and assuming the balance day is 30 June. As per organizational policy, the business has decided to use the Reducing Balance Method to depreciate the computers. Calculate the depreciation by using the Reducing Balance Calculate the depreciation, for the financial years ended 30 June 2018, 2019 and 2020 . The rate of depreciation is 30% pa. Task 5 Using the information from your worksheet above, prepare appropriate journal entries to record the sale o the computers on 28 February 2021 for $19,800 cash (inclusive of GST). Please check your textbook to provide the correct procedure of the journal entries for disposal. Answer: (d)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts