Question: can someone help me with 5-8 5 You are evaluating shares in Arrow Electronics (ARW), which are currently trading at a price of $75.25. Last

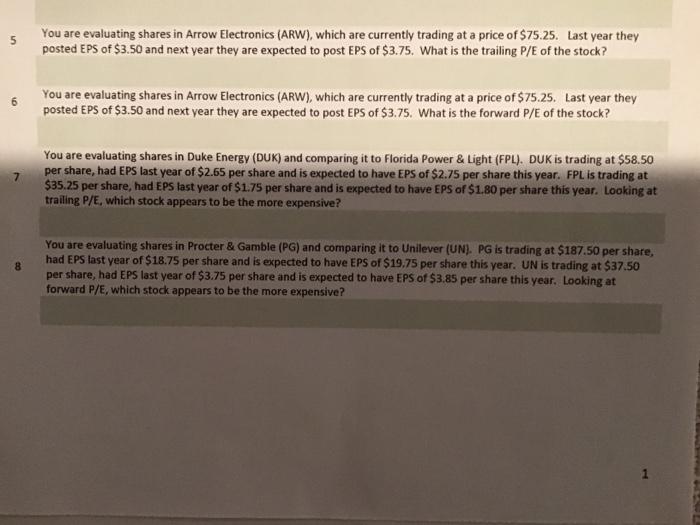

5 You are evaluating shares in Arrow Electronics (ARW), which are currently trading at a price of $75.25. Last year they posted EPS of $3.50 and next year they are expected to post EPS of $3.75. What is the trailing P/E of the stock? 6 You are evaluating shares in Arrow Electronics (ARW), which are currently trading at a price of $75.25. Last year they posted EPS of $3.50 and next year they are expected to post EPS of $3.75. What is the forward P/E of the stock? You are evaluating shares in Duke Energy (DUK) and comparing it to Florida Power & Light (FPL). DUK is trading at $58.50 per share, had EPS last year of $2.65 per share and is expected to have EPS of $2.75 per share this year. FPL is trading at $35.25 per share, had EPS last year of $1.75 per share and is expected to have EPS of $1.80 per share this year. Looking at trailing P/E, which stock appears to be the more expensive? You are evaluating shares in Procter & Gamble (PG) and comparing it to Unilever (UN). PG is trading at $187.50 per share, had EPS last year of $18.75 per share and is expected to have EPS of $19.75 per share this year. UN is trading at $37.50 per share, had EPS last year of $3.75 per share and is expected to have EPS of $3.85 per share this year. Looking at forward P/E, which stock appears to be the more expensive

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts