Question: can someone help me with 6-10 Section Two: Intermediate 7 points each) You own $1 mil Par Amount of the UST 3X 30yr bond. What

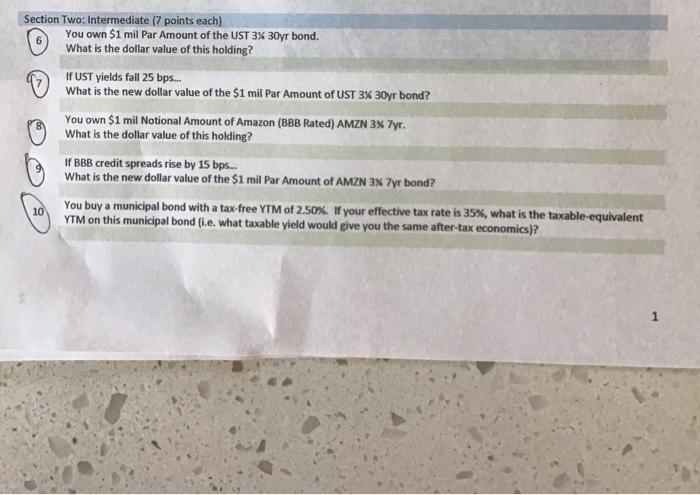

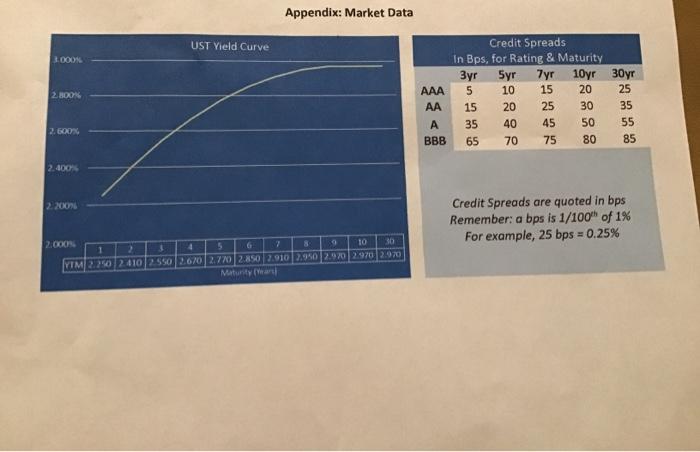

Section Two: Intermediate 7 points each) You own $1 mil Par Amount of the UST 3X 30yr bond. What is the dollar value of this holding? If UST yields fall 25 bps... What is the new dollar value of the $1 mil Par Amount of UST 3% 30yr bond? You own $1 mil Notional Amount of Amazon (BBB Rated) AMZN 3X 7yr. What is the dollar value of this holding? If BBB credit spreads rise by 15 bps. What is the new dollar value of the $1 mil Par Amount of AMZN 3X 7yr bond? You buy a municipal bond with a tax-free YTM of 2.50%. If your effective tax rate is 35%, what is the taxable-equivalent YTM on this municipal bond (ie what taxable yield would give you the same after-tax economics)? 10 Appendix: Market Data UST Yield Curve 3.OOON 2. BONN AAA AA A BBB Credit Spreads In Bps, for Rating & Maturity 3yr Syr 7yr 10yr 30yr 5 10 15 20 25 15 20 25 30 35 35 40 45 50 55 65 70 75 80 85 2. GOD 2.400% 2.2007 Credit Spreads are quoted in bps Remember: a bps is 1/100 of 1% For example, 25 bps = 0.25% 2.000 2 5 4 5 6 7 19 10 SO YIM 2.250 2 410 2550 2.670 2710 2.850 2.910 2.950 2970 2.970 2.970 Matutyan Section Two: Intermediate 7 points each) You own $1 mil Par Amount of the UST 3X 30yr bond. What is the dollar value of this holding? If UST yields fall 25 bps... What is the new dollar value of the $1 mil Par Amount of UST 3% 30yr bond? You own $1 mil Notional Amount of Amazon (BBB Rated) AMZN 3X 7yr. What is the dollar value of this holding? If BBB credit spreads rise by 15 bps. What is the new dollar value of the $1 mil Par Amount of AMZN 3X 7yr bond? You buy a municipal bond with a tax-free YTM of 2.50%. If your effective tax rate is 35%, what is the taxable-equivalent YTM on this municipal bond (ie what taxable yield would give you the same after-tax economics)? 10 Appendix: Market Data UST Yield Curve 3.OOON 2. BONN AAA AA A BBB Credit Spreads In Bps, for Rating & Maturity 3yr Syr 7yr 10yr 30yr 5 10 15 20 25 15 20 25 30 35 35 40 45 50 55 65 70 75 80 85 2. GOD 2.400% 2.2007 Credit Spreads are quoted in bps Remember: a bps is 1/100 of 1% For example, 25 bps = 0.25% 2.000 2 5 4 5 6 7 19 10 SO YIM 2.250 2 410 2550 2.670 2710 2.850 2.910 2.950 2970 2.970 2.970 Matutyan

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts