Question: can someone help me with ex 11.6 A001 Support b. If the preferred stock is not cumulative, how much of the $500,000 would be paid

can someone help me with ex 11.6

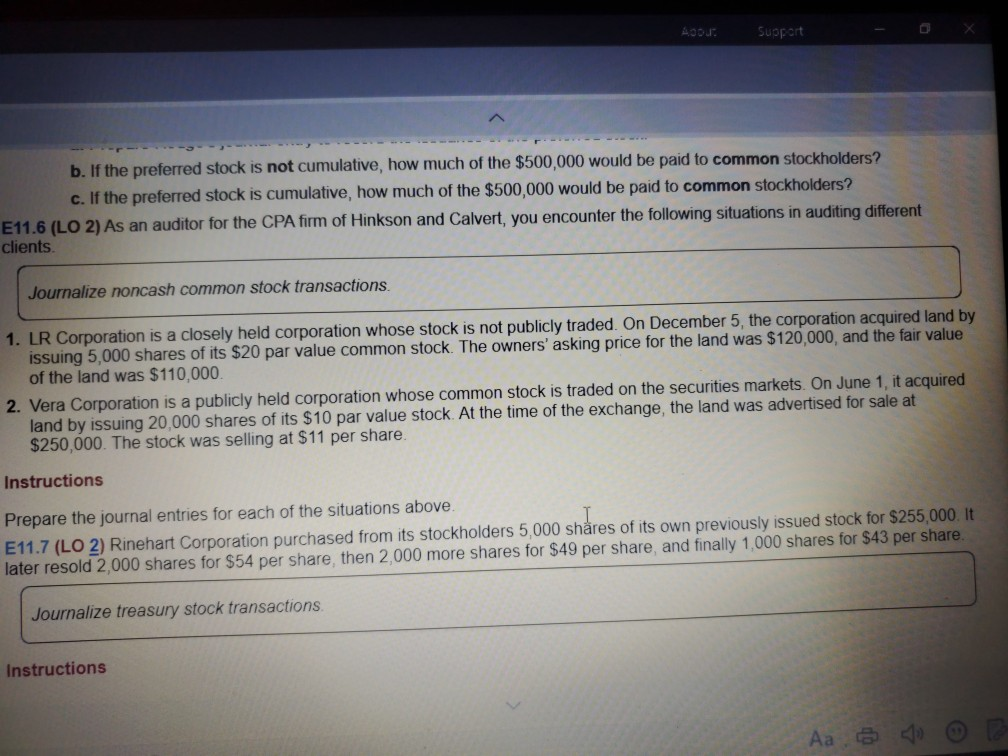

A001 Support b. If the preferred stock is not cumulative, how much of the $500,000 would be paid to common stockholders? c. If the preferred stock is cumulative, how much of the $500,000 would be paid to common stockholders? E11.6 (LO 2) As an auditor for the CPA firm of Hinkson and Calvert, you encounter the following situations in auditing different clients Journalize noncash common stock transactions. 1. LR Corporation is a closely held corporation whose stock is not publicly traded. On December 5, the corporation acquired land by issuing 5,000 shares of its $20 par value common stock. The owners' asking price for the land was $120,000, and the fair value of the land was $110,000. 2. Vera Corporation is a publicly held corporation whose common stock is traded on the securities markets. On June 1, it acquired land by issuing 20,000 shares of its $10 par value stock. At the time of the exchange, the land was advertised for sale at $250,000. The stock was selling at $11 per share. Instructions Prepare the journal entries for each of the situations above E11.7 (LO 2) Rinehart Corporation purchased from its stockholders 5,000 shares of its own previously issued stock for $255,000. It later resold 2,000 shares for $54 per share then 2.000 more shares for $49 per share, and finally 1,000 shares for $43 per share. Journalize treasury stock transactions Instructions AaB

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts