Question: can someone help me with journal entry 7, 8 and 9 Tony and Suzie have purchased land for a new camp. Now they need money

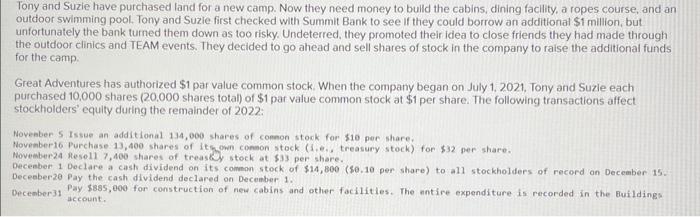

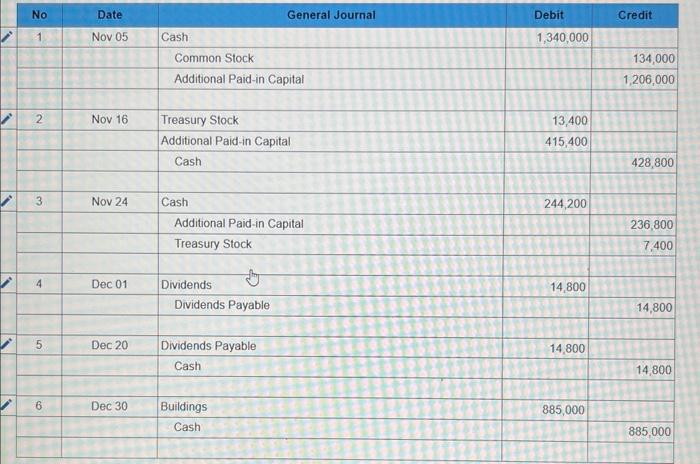

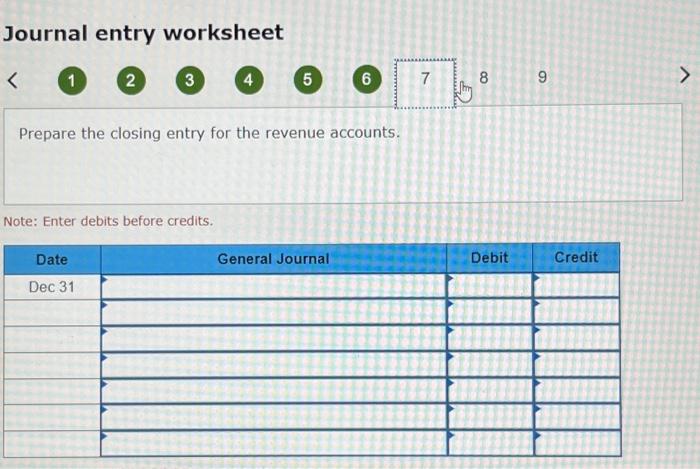

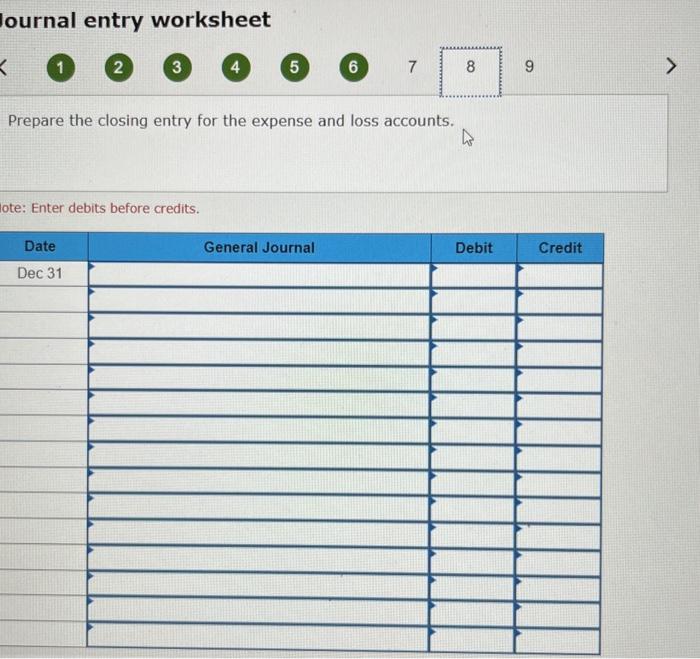

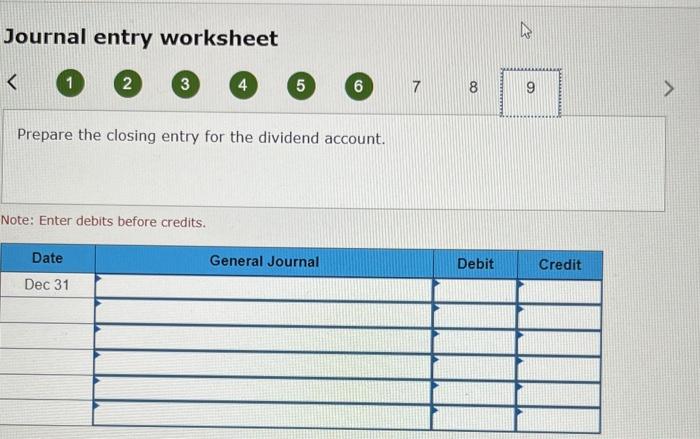

Tony and Suzie have purchased land for a new camp. Now they need money to bulld the cabins, dining facility, a ropes course, and an outdoor swimming pool. Tony and Suzle first checked with Summit Bank to see If they could borrow an additionat $1 million, but unfortunately the bank tumed them down as too risky. Undeterred, they promoted their idea to close friends they had made through the outdoor clinics and TEAM events. They decided to go ahead and sell shares of stock in the company to raise the additional funds for the camp. Great Adventures has authorized \$1 par value common stock. When the company began on July 1, 2021, Tony and Suzle each purchased 10,000 shares (20,000 shares total) of $1 par value common stock at $1 per share. The following transactions affect stockholders' equity during the remainder of 2022 : Noveabee 5 Issue an additional 134,000 shares of comon stock for \$1e pee share. Novemberi6 Purchase 13,400 shares of ithown connon stock (1.e.. treasury stock) for $32 per share. Movember24 thesel1 7,400 shares of treasky stock at $33 per share. Deceaber 1 Declare a cash dividend on its common stock of $14,800 (\$0.10 per share) to al1 stockholders of record on December 15. Deceober20 fay the cash dividend declared on Decenber 1. December31 Pay $885,000 for construction of neu cabins and other facilities. The nntire expenditure is recorded in the Buildings Journal entry worksheet 1 2 3 Prepare the closing entry for the revenue accounts. Note: Enter debits before credits. lournal entry worksheet 1 4 5 7 Prepare the closing entry for the expense and loss accounts. Enter debits before credits. Journal entry worksheet 1 Prepare the closing entry for the dividend account. Note: Enter debits before credits

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts