Question: Can someone help me with my code? I need the code to be in C Program. Take home pay Write a double => double function

Can someone help me with my code? I need the code to be in C Program.

Can someone help me with my code? I need the code to be in C Program.

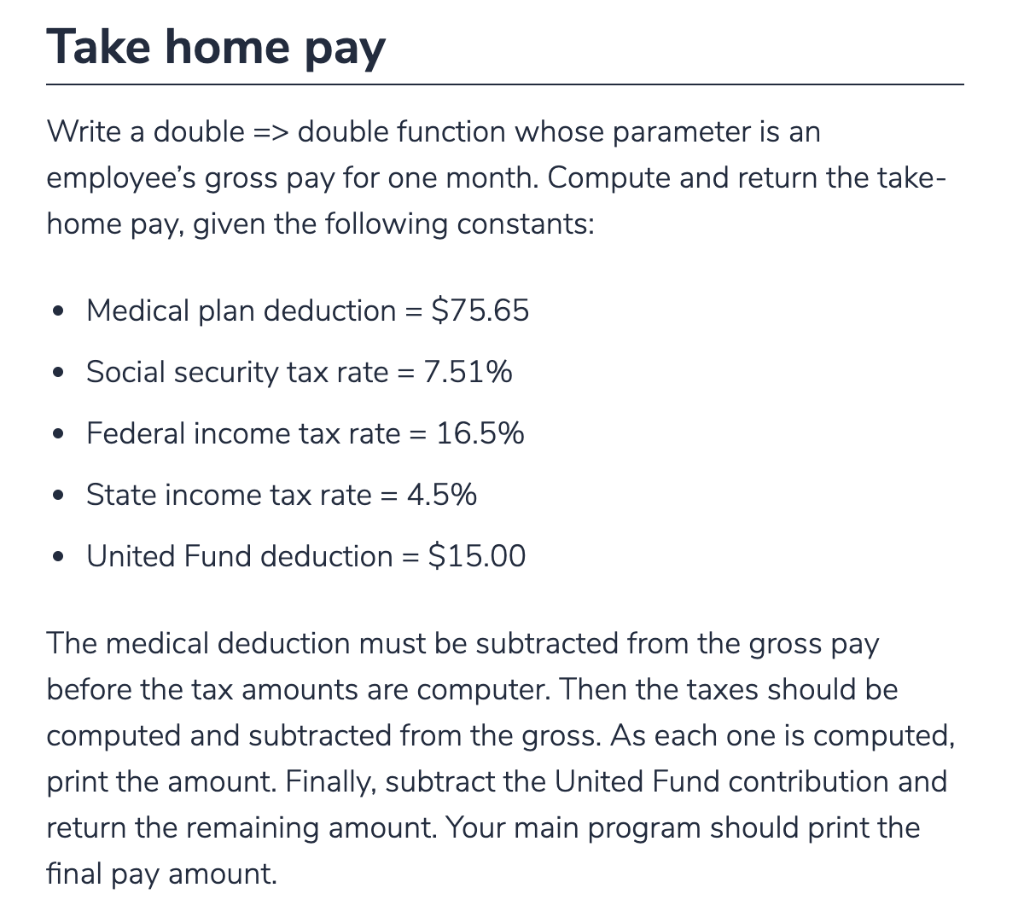

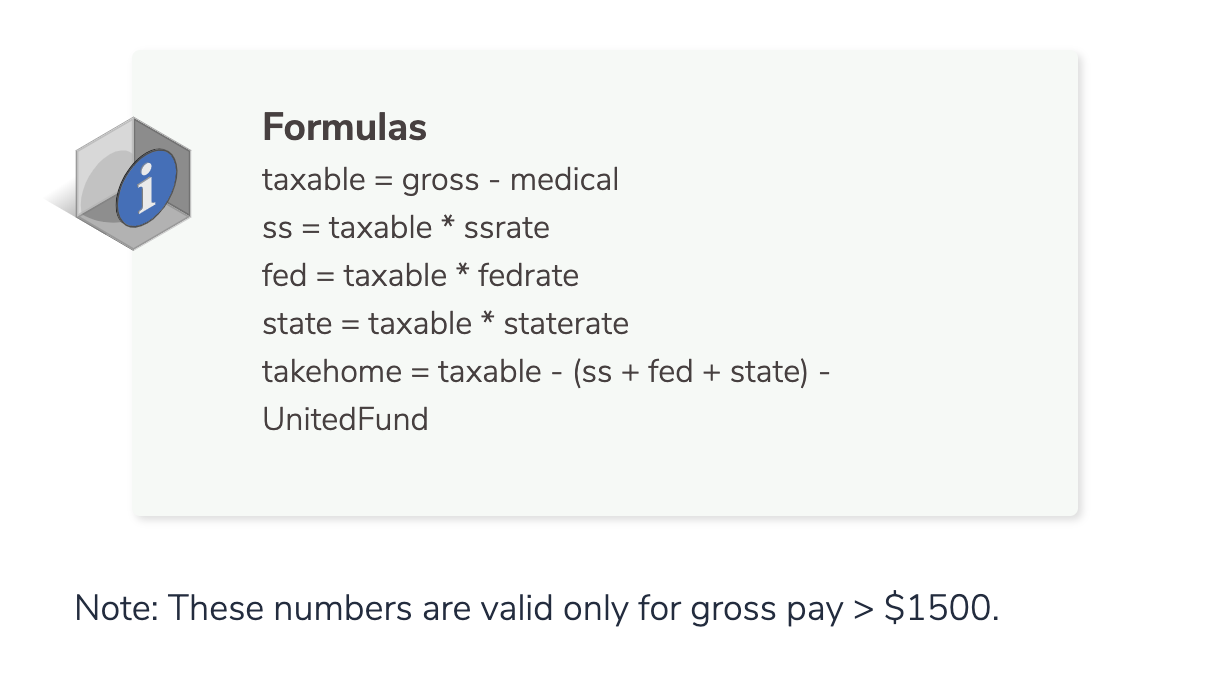

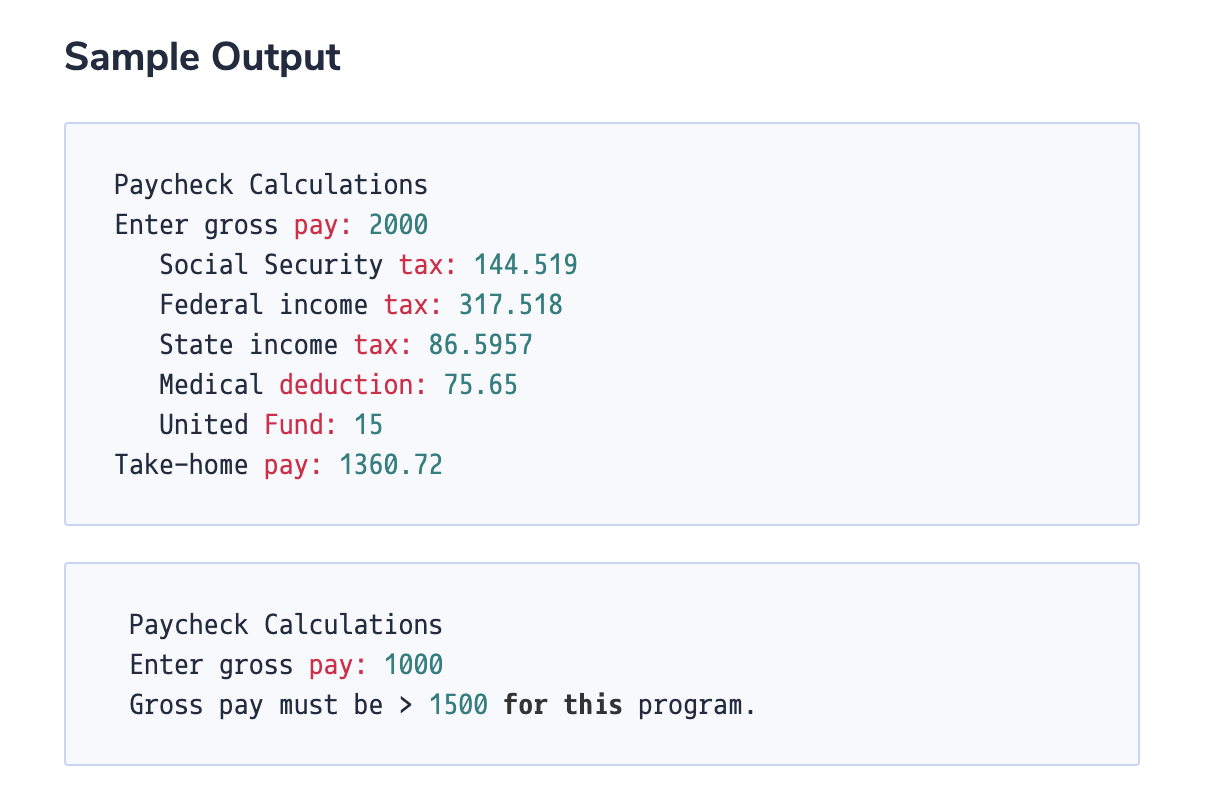

Take home pay Write a double => double function whose parameter is an employee's gross pay for one month. Compute and return the take- home pay, given the following constants: Medical plan deduction = $75.65 Social security tax rate = 7.51% Federal income tax rate = 16.5% State income tax rate = 4.5% United Fund deduction = $15.00 The medical deduction must be subtracted from the gross pay before the tax amounts are computer. Then the taxes should be computed and subtracted from the gross. As each one is computed, print the amount. Finally, subtract the United Fund contribution and return the remaining amount. Your main program should print the final pay amount. Formulas taxable = gross - medical ss = taxable * ssrate fed = taxable * fedrate state = taxable * staterate takehome = taxable - (ss + fed + state) - UnitedFund Note: These numbers are valid only for gross pay > $1500. Sample Output Paycheck Calculations Enter gross pay: 2000 Social Security tax: 144.519 Federal income tax: 317.518 State income tax: 86.5957 Medical deduction: 75.65 United Fund: 15 Take-home pay: 1360.72 Paycheck Calculations Enter gross pay: 1000 Gross pay must be > 1500 for this program

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts