Question: Can someone help me with problem 17.1 a and 17.1 b from Health Finance by Gapenski below. Thank you 12.8 Regardless of the specific line

Can someone help me with problem 17.1 a and 17.1 b from Health Finance by Gapenski below.

Thank you

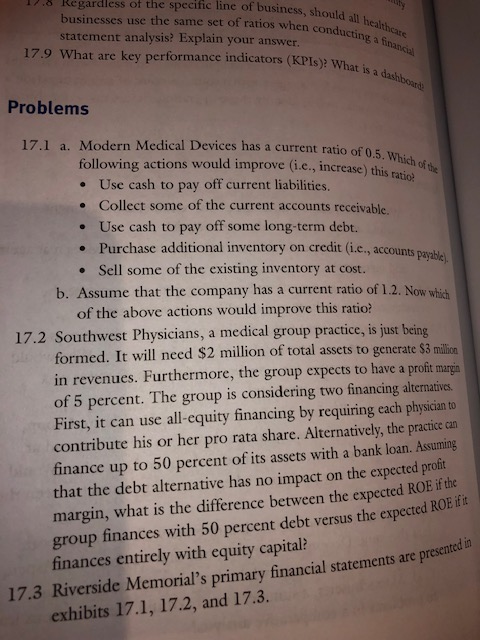

12.8 Regardless of the specific line of business, should businesses use the same set of ratios when cond statement analysis? Explain your answer. 17.9 What are key performance indicators (KPIs)? Wher ould all healthcare conducting a financial What is a dashboard Problems 0.5. Which of the 17.1 a. Modern Medical Devices has a current ratio of 0.5 W following actions would improve (1.e., increase) this Use cash to pay off current liabilities. Collect some of the current accounts receivable. Use cash to pay off some long-term debt. Purchase additional inventory on credit (i.e., accounts payah Sell some of the existing inventory at cost. b. Assume that the company has a current ratio of 1.2. Now which of the above actions would improve this ratio? 17.2 Southwest Physicians, a medical group practice, is just being formed. It will need $2 million of total assets to generate $3 million in revenues. Furthermore, the group expects to have a profit margin of 5 percent. The group is considering two financing alternatives. First, it can use all-equity financing by requiring each physician to contribute his or her pro rata share. Alternatively, the practice can finance up to 50 percent of its assets with a bank loan. Assuming that the debt alternative has no impact on the expected profit margin, what is the difference between the expected ROE if the group finances with 50 percent debt versus the expected finances entirely with equity capital? 17.3 Riverside Memorial's primary financial statements are pres exhibits 17.1, 17.2, and 17.3. nents are presented in

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts