Question: can someone help me with question 4.32 . needs to be completed on excel . inte CORE I3 for Nederland and compare Analyzing Financial Statements

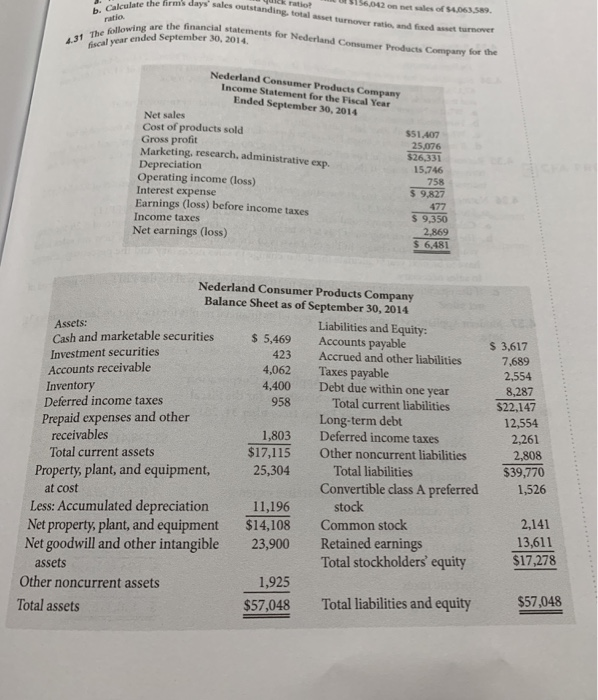

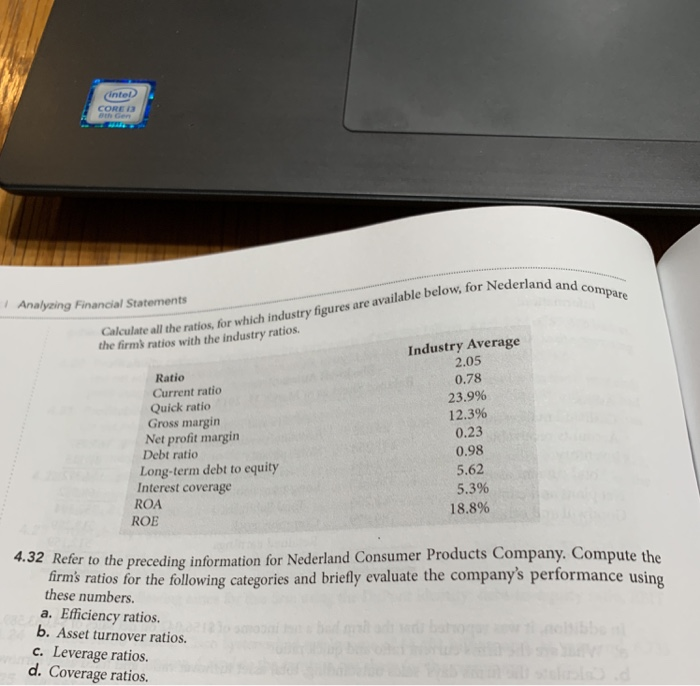

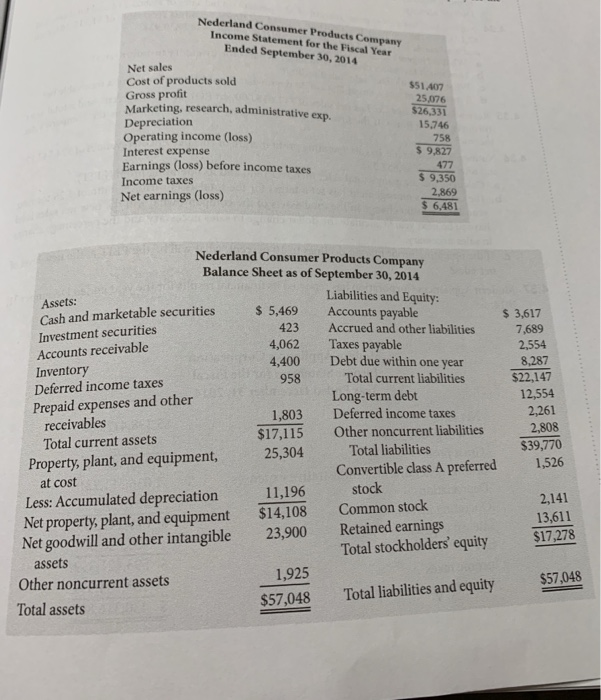

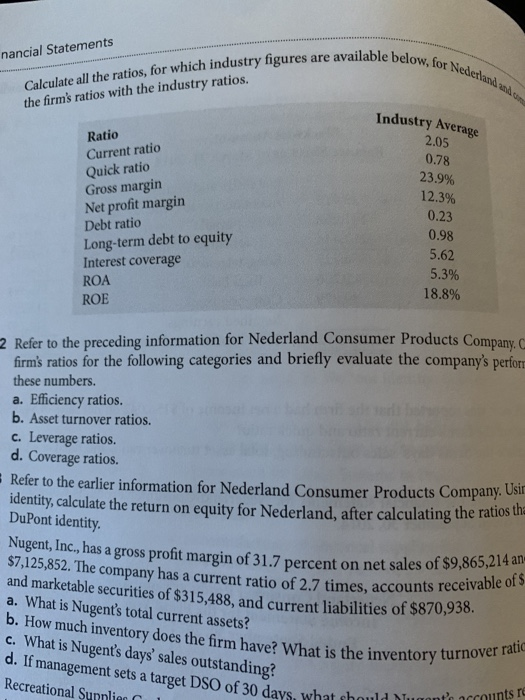

inte CORE I3 for Nederland and compare Analyzing Financial Statements Calculate all the ratios,for which industry figures are avat the firms ratios with the industry ratios Industry Average 2.05 0.78 23.9% 12.3% 0.23 0.98 5.62 5.3% 18.8% Ratio Current ratio Quick ratio Gross margin Net profit margin Debt ratio Long-term debt to equity Interest coverage ROA ROE 4.32 Refer to the preceding information for Nederland Consumer Products Company. Compute the firms ratios for the following categories and briefly evaluate the company's performance using these numbers. a. Efficiency ratios b. Asset turnover ratios c. Leverage ratios. d. Coverage ratios. Calculate all the ratios, for which industry figures are available bel the firm's ratios with the industry ratios. below, for Nedetang nancial Statements Industry Average Ratio Current ratio Quick ratio Gross margin Net profit margin Debt ratio Long-term debt to equity Interest coverage ROA ROE 2.05 0.78 23.9% 12.3% 0.23 0.98 5.62 5.3% 18.8% 2 Refer to the preceding information for Nederland Consumer Products Company, C firm's ratios for the following categories and briefly evaluate the company's perfor these numbers a. Eficiency ratios. b. Asset turnover ratios. c. Leverage ratios d. Coverage ratios. Refer to the earlier information for Nederland Consumer Products Company identity, calculate the return on equity for Nederland, after calculating the ra DuPont identity ratios th Nugent, Inc, has a $7,125,852. The company has a current ratio of 2.7 times, accoun and marketable securities of $315,488, and current liabilities of a. What is Nugent's total current assets? b. How much inventory does the firm have? What is the inventoryturnov c. What is Nugent's days' sales outstanding? d. If management sets a target DSO of 30 days, what thould Recreational Sunnlio gross profit margin of 31.7 percent on net sales of $9,865,214 an ts receiva e ccounts r inte CORE I3 for Nederland and compare Analyzing Financial Statements Calculate all the ratios,for which industry figures are avat the firms ratios with the industry ratios Industry Average 2.05 0.78 23.9% 12.3% 0.23 0.98 5.62 5.3% 18.8% Ratio Current ratio Quick ratio Gross margin Net profit margin Debt ratio Long-term debt to equity Interest coverage ROA ROE 4.32 Refer to the preceding information for Nederland Consumer Products Company. Compute the firms ratios for the following categories and briefly evaluate the company's performance using these numbers. a. Efficiency ratios b. Asset turnover ratios c. Leverage ratios. d. Coverage ratios. Calculate all the ratios, for which industry figures are available bel the firm's ratios with the industry ratios. below, for Nedetang nancial Statements Industry Average Ratio Current ratio Quick ratio Gross margin Net profit margin Debt ratio Long-term debt to equity Interest coverage ROA ROE 2.05 0.78 23.9% 12.3% 0.23 0.98 5.62 5.3% 18.8% 2 Refer to the preceding information for Nederland Consumer Products Company, C firm's ratios for the following categories and briefly evaluate the company's perfor these numbers a. Eficiency ratios. b. Asset turnover ratios. c. Leverage ratios d. Coverage ratios. Refer to the earlier information for Nederland Consumer Products Company identity, calculate the return on equity for Nederland, after calculating the ra DuPont identity ratios th Nugent, Inc, has a $7,125,852. The company has a current ratio of 2.7 times, accoun and marketable securities of $315,488, and current liabilities of a. What is Nugent's total current assets? b. How much inventory does the firm have? What is the inventoryturnov c. What is Nugent's days' sales outstanding? d. If management sets a target DSO of 30 days, what thould Recreational Sunnlio gross profit margin of 31.7 percent on net sales of $9,865,214 an ts receiva e ccounts r

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts