Question: Can someone help me with question C ! ! ! In December 2 0 1 5 , General Electric ( GE ) had a book

Can someone help me with question C

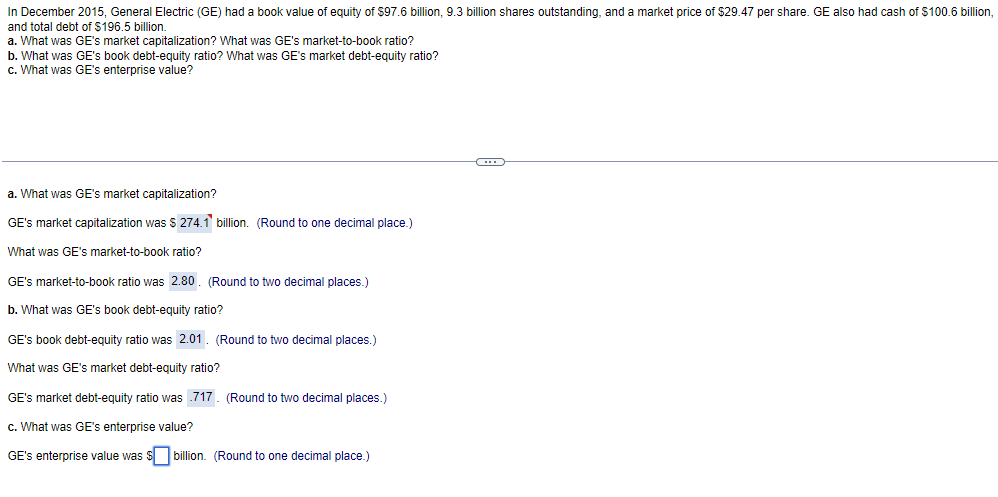

In December General Electric GE had a book value of equity of $ billion, billion shares outstanding, and a market price of $ per share. GE also had cash of $ billion,

and total debt of $ billion.

a What was GE's market capitalization? What was GE's markettobook ratio?

b What was GE's book debtequity ratio? What was GE's market debtequity ratio?

c What was GE's enterprise value?

a What was GE's market capitalization?

GE's market capitalization was $ billion. Round to one decimal place.

What was GE's markettobook ratio?

GE's markettobook ratio was Round to two decimal places.

b What was GE's book debtequity ratio?

GE's book debtequity ratio was Round to two decimal places.

What was GE's market debtequity ratio?

GE's market debtequity ratio was Round to two decimal places.

c What was GE's enterprise value?

GE's enterprise value was $ billion. Round to one decimal place.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock