Question: Can someone help me with sensitivity analysis? Please show the steps, thank you!!!! Universal Farm Supply's management has observed that it can sell as much

Can someone help me with sensitivity analysis? Please show the steps, thank you!!!!

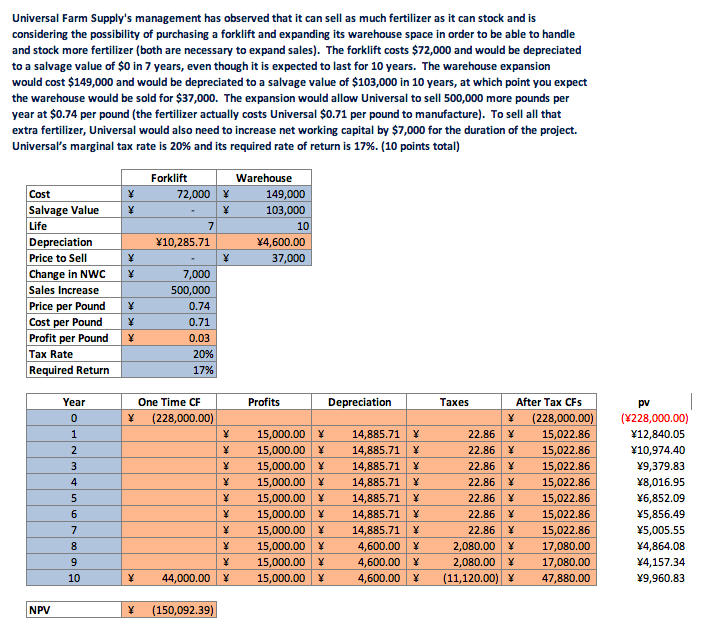

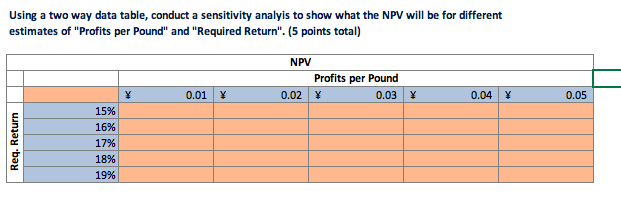

Universal Farm Supply's management has observed that it can sell as much fertilizer as it can stock and is considering the possibility of purchasing a forklift and expanding its warehouse space in order to be able to handle and stock more fertilizer (both are necessary to expand sales). The forklift costs $72,000 and would be depreciated to a salvage value of $0 in 7 years, even though it is expected to last for 10 years. The warehouse expansion would cost $149,000 and would be depreciated to a salvage value of $103,000 in 10 years, at which point you expect the warehouse would be sold for $37,000. The expansion would allow Universal to sell 500,000 more pounds per year at $0.74 per pound (the fertilizer actually costs Universal $0.71 per pound to manufacture). To sell all that extra fertilizer, Universal would also need to increase net working capital by $7,000 for the duration of the project. Universal's marginal tax rate is 20% and its required rate of return is 17%. (10 points total) Forklift 72,000 X Warehouse 149,000 X 103,000 10 4,600.00 37,000 7 10,285.71 Cost Salvage Value Life Depreciation Price to Sell Change in NWC Sales Increase Price per Pound Cost per Pound Profit per Pound Tax Rate Required Return 7,000 500,000 0.74 0.71 0.03 20% 17% Profits Depreciation One Time CF (228,000.00) Year 0 1 2 3 4 5 15,000.00 15,000.00 Y 15,000.00 15,000.00 15,000.00 15,000.00 x 15,000.00 Y 15,000.00 15,000.00 Y 15,000.00 Taxes After Tax CFS (228,000.00) 22.86 Y 15,022.86 22.86 Y 15,022.86 22.86 Y 15,022.86 22.86 Y 15,022.86 22.86 x 15,022.86 22.86 Y 15,022.86 22.86 x 15,022.86 2,080.00 Y 17,080.00 2,080.00 y 17,080.00 (11,120.00) 47,880.00 14,885.71 Y 14,885.71 14,885.71 14,885.71 14,885.71 14,885.71 14,885.71 4,600.00 Y 4,600.00 4,600.00 X pv (4228,000.00) 12,840.05 10,974.40 9,379.83 8,016.95 6,852.09 5,856.49 5,005,55 4,864.08 4,157.34 9,960.83 6 7 8 9 10 44,000.00 X NPV (150,092.39) Using a two way data table, conduct a sensitivity analyis to show what the NPV will be for different estimates of "Profits per Pound" and "Required Return". (5 points total) NPV Profits per Pound 0.02 X 0.03 0.01 0.04 0.05 Req. Return 15% 16% 17% 18% 19% Universal Farm Supply's management has observed that it can sell as much fertilizer as it can stock and is considering the possibility of purchasing a forklift and expanding its warehouse space in order to be able to handle and stock more fertilizer (both are necessary to expand sales). The forklift costs $72,000 and would be depreciated to a salvage value of $0 in 7 years, even though it is expected to last for 10 years. The warehouse expansion would cost $149,000 and would be depreciated to a salvage value of $103,000 in 10 years, at which point you expect the warehouse would be sold for $37,000. The expansion would allow Universal to sell 500,000 more pounds per year at $0.74 per pound (the fertilizer actually costs Universal $0.71 per pound to manufacture). To sell all that extra fertilizer, Universal would also need to increase net working capital by $7,000 for the duration of the project. Universal's marginal tax rate is 20% and its required rate of return is 17%. (10 points total) Forklift 72,000 X Warehouse 149,000 X 103,000 10 4,600.00 37,000 7 10,285.71 Cost Salvage Value Life Depreciation Price to Sell Change in NWC Sales Increase Price per Pound Cost per Pound Profit per Pound Tax Rate Required Return 7,000 500,000 0.74 0.71 0.03 20% 17% Profits Depreciation One Time CF (228,000.00) Year 0 1 2 3 4 5 15,000.00 15,000.00 Y 15,000.00 15,000.00 15,000.00 15,000.00 x 15,000.00 Y 15,000.00 15,000.00 Y 15,000.00 Taxes After Tax CFS (228,000.00) 22.86 Y 15,022.86 22.86 Y 15,022.86 22.86 Y 15,022.86 22.86 Y 15,022.86 22.86 x 15,022.86 22.86 Y 15,022.86 22.86 x 15,022.86 2,080.00 Y 17,080.00 2,080.00 y 17,080.00 (11,120.00) 47,880.00 14,885.71 Y 14,885.71 14,885.71 14,885.71 14,885.71 14,885.71 14,885.71 4,600.00 Y 4,600.00 4,600.00 X pv (4228,000.00) 12,840.05 10,974.40 9,379.83 8,016.95 6,852.09 5,856.49 5,005,55 4,864.08 4,157.34 9,960.83 6 7 8 9 10 44,000.00 X NPV (150,092.39) Using a two way data table, conduct a sensitivity analyis to show what the NPV will be for different estimates of "Profits per Pound" and "Required Return". (5 points total) NPV Profits per Pound 0.02 X 0.03 0.01 0.04 0.05 Req. Return 15% 16% 17% 18% 19%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts