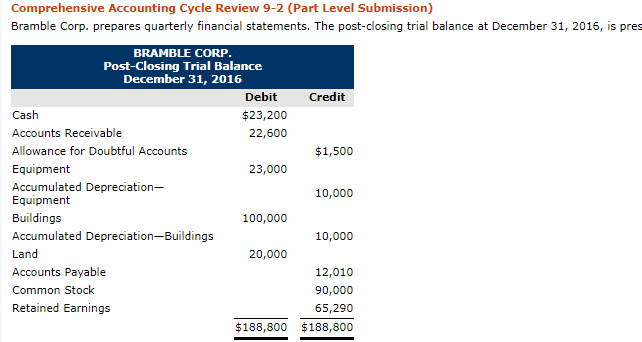

Question: CAN SOMEONE HELP ME WITH THE MISSING NUMBERS PLEASE I need journal entries to the ledger accounts LAND,BUILDINGS,ACCOUNTS PAYABLE, RETaINED EARNINGS, SERVICE REVENUE During the

CAN SOMEONE HELP ME WITH THE MISSING NUMBERS PLEASE

I need journal entries to the ledger accounts

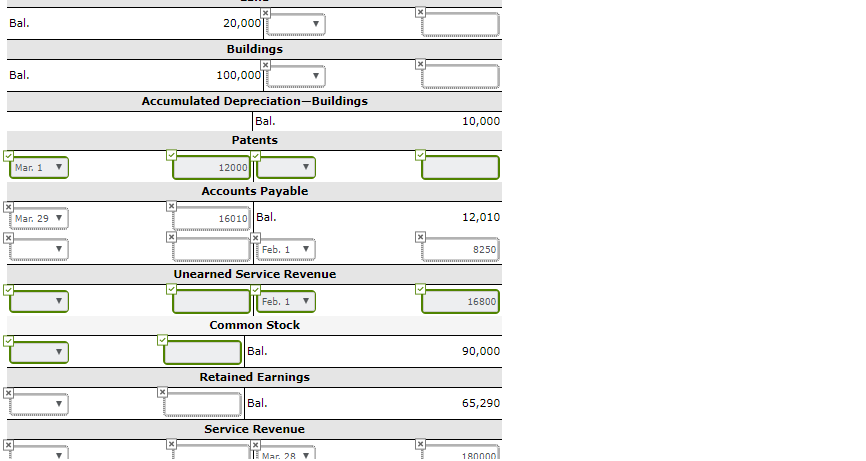

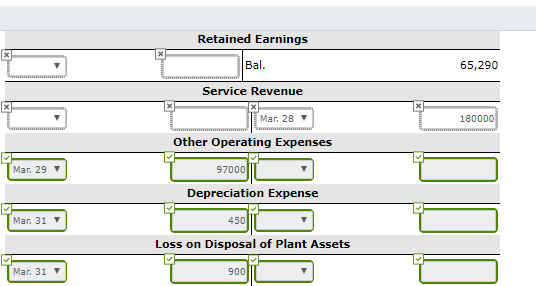

LAND,BUILDINGS,ACCOUNTS PAYABLE, RETaINED EARNINGS, SERVICE REVENUE

During the first quarter of 2017, the following transactions occurred:

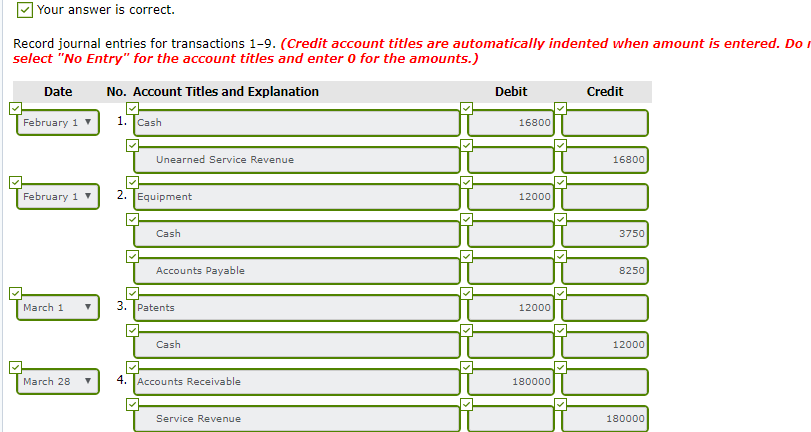

| 1. | On February 1, Bramble collected fees of $16,800 in advance. The company will perform $1,400 of services each month from February 1, 2017, to January 31, 2018. | |

| 2. | On February 1, Bramble purchased computer equipment for $11,250 plus sales taxes of $750. $3,750 cash was paid with the rest on account. Check #455 was used. | |

| 3. | On March 1, Bramble acquired a patent with a 10-year life for $12,000 cash. Check #456 was used. | |

| 4. | On March 28, Bramble recorded the quarters sales in a single entry. During this period, Bramble had total sales of $180,000 (not including the sales referred to in item 1 above). All of the sales were on account. | |

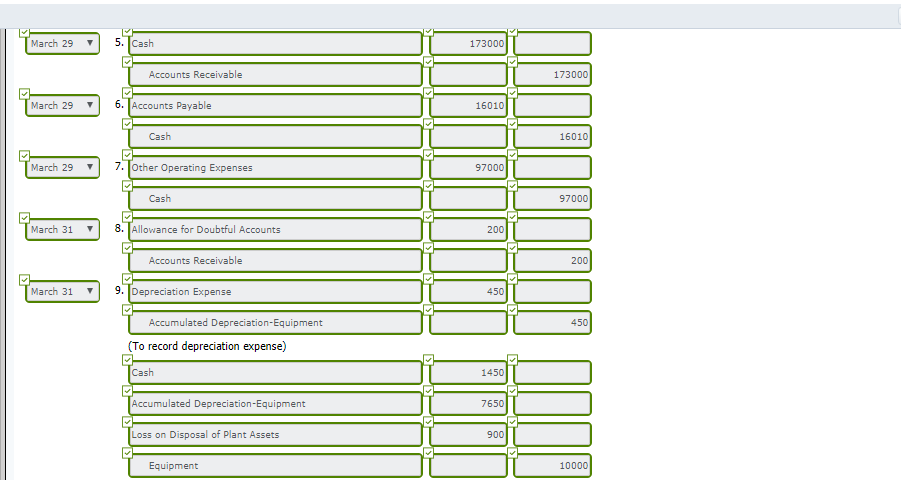

| 5. | On March 29, Bramble collected $173,000 from customers on account. | |

| 6. | On March 29, Bramble paid $16,010 on accounts payable. Check #457 was used. | |

| 7. | On March 29, Bramble paid other operating expenses of $97,000. Check #458 was used. | |

| 8. | On March 31, Bramble wrote off a receivable of $200 for a customer who declared bankruptcy. | |

| 9. | On March 31, Bramble sold for $1,450 equipment that originally cost $10,000. It had an estimated life of 5 years and salvage of $1,000. Accumulated depreciation as of December 31, 2016, was $7,200 using the straight line method. (Hint: Record depreciation on the equipment sold, then record the sale.) |

Bank reconciliation data and adjustment data:

| 1. | The company reconciles its bank statement every quarter. Information from the December 31, 2016, bank reconciliation is:

| |||||||||||||||||||||||||||||||||||||||||

| 2. | Record revenue earned from item 1 above. | |||||||||||||||||||||||||||||||||||||||||

| 3. | $24,000 of accounts receivable at March 31, 2017, are not past due yet. The bad debt percentage for these is 4%. The balance of accounts receivable are past due. The bad debt percentage for these is 24%. Record bad debt expense. (Hint: You will need to compute the balance in accounts receivable before calculating this.) | |||||||||||||||||||||||||||||||||||||||||

| 4. | Depreciation is recorded on the equipment still owned at March 31, 2017. The new equipment purchased in February is being depreciated on a straight-line basis over 5 years and salvage value was estimated at $1,200. The old equipment still owned is being depreciated over a 10-year life using straight-line with no salvage value. | |||||||||||||||||||||||||||||||||||||||||

| 5. | Depreciation is recorded on the building on a straight-line basis based on a 30-year life and a salvage value of $10,000. | |||||||||||||||||||||||||||||||||||||||||

| 6. | Amortization is recorded on the patent. | |||||||||||||||||||||||||||||||||||||||||

| 7. | The income tax rate is 30%. This amount will be paid when the tax return is due in April. (Hint: Prepare the income statement up to income before taxes and multiply by 30% to compute the amount.) |

Your answer is correct. Record journal entries for transactions 1-9. (Credit account titles are automatically indented when amount is entered. Do select "No Entry" for the account titles and enter 0 for the amounts.) Date No. Account Titles and Explanation Debit Credit February 1 1, Cash 16800 Unearned Service Revenue 16800 February 1 | 2.TEquipment 12000 Cash 3750 Accounts Payable 8250 March 1 3. Patents 12000 Cash 12000 March 28 4, Accounts Receivable 180000 Service Revenue 180000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts