Question: Can someone help me with the question below? I'm stuck. Suppose that the market portfolio has an expected return of 10%, and a standard deviation

Can someone help me with the question below? I'm stuck.

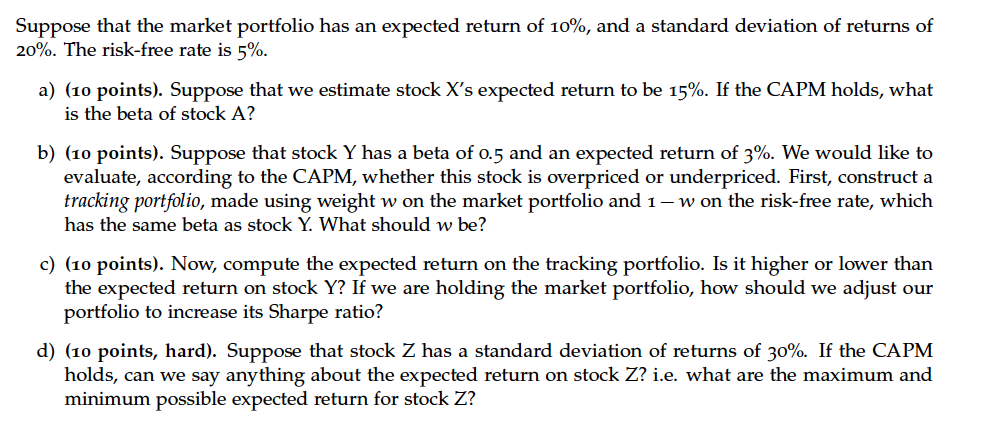

Suppose that the market portfolio has an expected return of 10%, and a standard deviation of returns of 20%. The risk-free rate is 5%. a) (10 points). Suppose that we estimate stock X's expected return to be 15%. If the CAPM holds, what is the beta of stock A? b) (10 points). Suppose that stock Y has a beta of 0.5 and an expected return of 3%. We would like to evaluate, according to the CAPM, whether this stock is overpriced or underpriced. First, construct a tracking portfolio, made using weight w on the market portfolio and 1- w on the risk-free rate, which has the same beta as stock Y. What should w be? c) (10 points). Now, compute the expected return on the tracking portfolio. Is it higher or lower than the expected return on stock Y? If we are holding the market portfolio, how should we adjust our portfolio to increase its Sharpe ratio? d) (10 points, hard). Suppose that stock Z has a standard deviation of returns of 30%. If the CAPM holds, can we say anything about the expected return on stock Z? i.e. what are the maximum and minimum possible expected return for stock Z? Suppose that the market portfolio has an expected return of 10%, and a standard deviation of returns of 20%. The risk-free rate is 5%. a) (10 points). Suppose that we estimate stock X's expected return to be 15%. If the CAPM holds, what is the beta of stock A? b) (10 points). Suppose that stock Y has a beta of 0.5 and an expected return of 3%. We would like to evaluate, according to the CAPM, whether this stock is overpriced or underpriced. First, construct a tracking portfolio, made using weight w on the market portfolio and 1- w on the risk-free rate, which has the same beta as stock Y. What should w be? c) (10 points). Now, compute the expected return on the tracking portfolio. Is it higher or lower than the expected return on stock Y? If we are holding the market portfolio, how should we adjust our portfolio to increase its Sharpe ratio? d) (10 points, hard). Suppose that stock Z has a standard deviation of returns of 30%. If the CAPM holds, can we say anything about the expected return on stock Z? i.e. what are the maximum and minimum possible expected return for stock Z

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts