Question: Can someone help me with the second part, please? What is the difference between a capital gain and a capital loss? What are the definitions

Can someone help me with the second part, please?

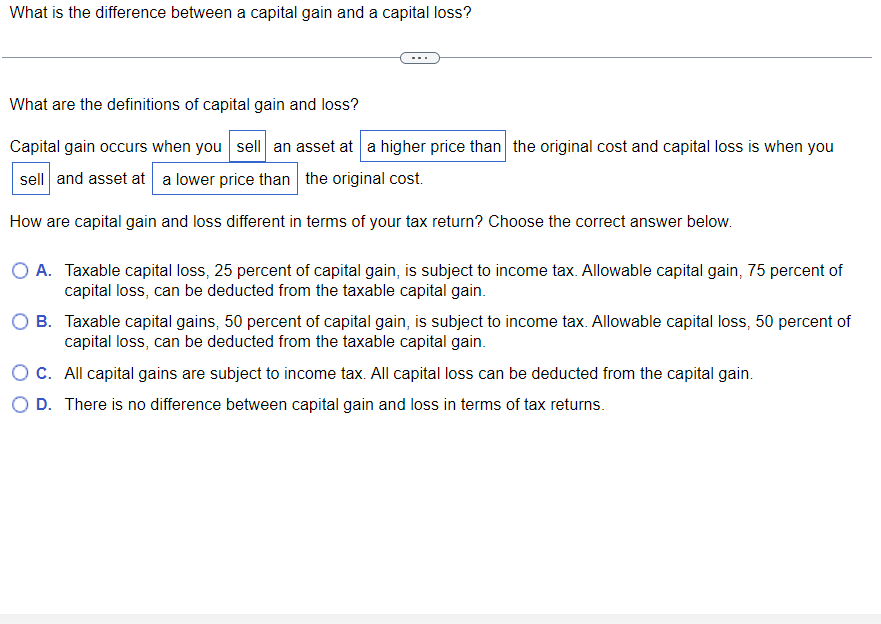

What is the difference between a capital gain and a capital loss? What are the definitions of capital gain and loss? Capital gain occurs when you an asset at and asset at the original cost. How are capital gain and loss different in terms of your tax return? Choose the correct answer below. A. Taxable capital loss, 25 percent of capital gain, is subject to income tax. Allowable capital gain, 75 percent of capital loss, can be deducted from the taxable capital gain. B. Taxable capital gains, 50 percent of capital gain, is subject to income tax. Allowable capital loss, 50 percent of capital loss, can be deducted from the taxable capital gain. C. All capital gains are subject to income tax. All capital loss can be deducted from the capital gain. D. There is no difference between capital gain and loss in terms of tax returns

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts