Question: can someone help me with these problems 11.TRUE / FALSE: Stock price appreciation and dividend payments are two primary reasons that investors desire to invest

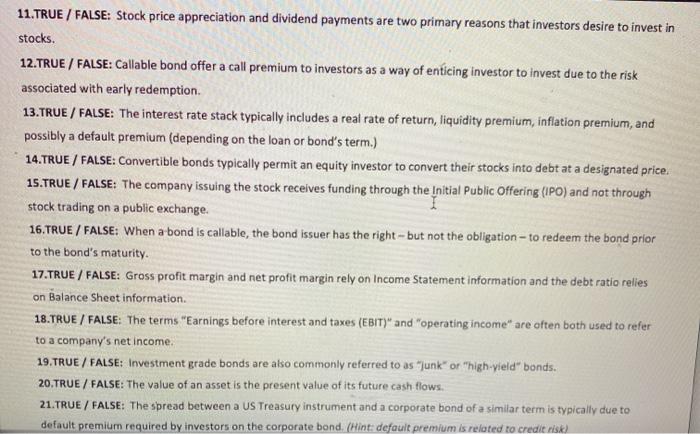

11.TRUE / FALSE: Stock price appreciation and dividend payments are two primary reasons that investors desire to invest in stocks. 12.TRUE / FALSE: Callable bond offer a call premium to investors as a way of enticing investor to invest due to the risk associated with early redemption 13.TRUE / FALSE: The interest rate stack typically includes a real rate of return, liquidity premium, inflation premium, and possibly a default premium (depending on the loan or bond's term.) 14.TRUE / FALSE: Convertible bonds typically permit an equity investor to convert their stocks into debt at a designated price. 15.TRUE / FALSE: The company issuing the stock receives funding through the Initial Public Offering (IPO) and not through stock trading on a public exchange. 16.TRUE / FALSE: When a bond is callable, the bond issuer has the right -- but not the obligation to redeem the bond prior to the bond's maturity. 17.TRUE / FALSE: Gross profit margin and net profit margin rely on Income Statement information and the debt ratio relies on Balance Sheet information 18.TRUE / FALSE: The terms "Earnings before interest and taxes (EBIT)" and "operating income" are often both used to refer to a company's net income. 19.TRUE / FALSE: Investment grade bonds are also commonly referred to as "junk" or "high-yield" bonds. 20. TRUE / FALSE: The value of an asset is the present value of its future cash flows. 21. TRUE / FALSE: The spread between a US Treasury instrument and a corporate bond of a similar term is typically due to default premium required by investors on the corporate bond. (Hint: default premium is related to credit risk)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts