Question: Can someone help me with these True/False questions? Please provide justifications so I can learn. a) (10 points). Since investors are compensated for holding risk,

Can someone help me with these True/False questions? Please provide justifications so I can learn.

Can someone help me with these True/False questions? Please provide justifications so I can learn.

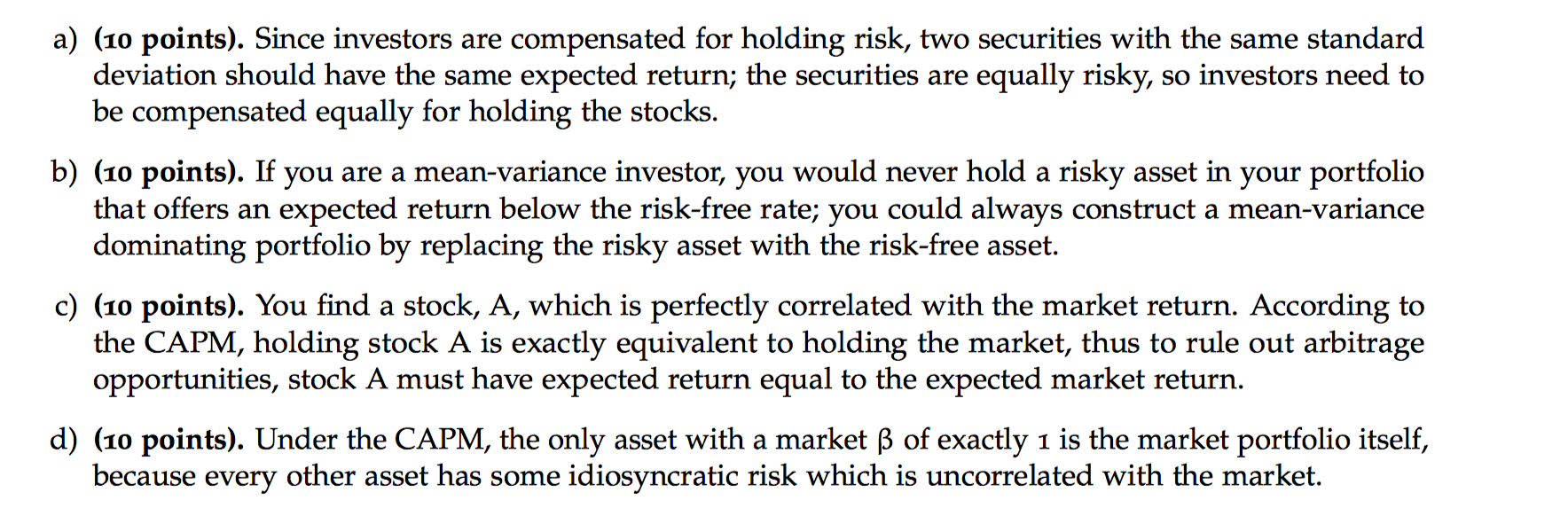

a) (10 points). Since investors are compensated for holding risk, two securities with the same standard deviation should have the same expected return; the securities are equally risky, so investors need to be compensated equally for holding the stocks. b) (10 points). If you are a mean-variance investor, you would never hold a risky asset in your portfolio that offers an expected return below the risk-free rate; you could always construct a mean-variance dominating portfolio by replacing the risky asset with the risk-free asset. c) (10 points). You find a stock, A, which is perfectly correlated with the market return. According to the CAPM, holding stock A is exactly equivalent to holding the market, thus to rule out arbitrage opportunities, stock A must have expected return equal to the expected market return. d) (10 points). Under the CAPM, the only asset with a market B of exactly 1 is the market portfolio itself, because every other asset has some idiosyncratic risk which is uncorrelated with the market

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts