Question: Can someone help me with this and also explain please. For Option II, initial installation of hardware and software requires $300,000. A further $100,000 marketing

Can someone help me with this and also explain please.

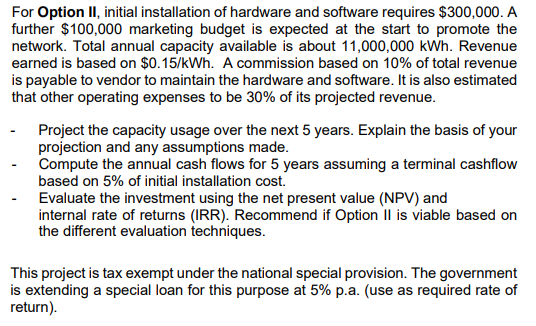

For Option II, initial installation of hardware and software requires $300,000. A further $100,000 marketing budget is expected at the start to promote the network. Total annual capacity available is about 11,000,000kWh. Revenue earned is based on $0.15/kWh. A commission based on 10% of total revenue is payable to vendor to maintain the hardware and software. It is also estimated that other operating expenses to be 30% of its projected revenue. - Project the capacity usage over the next 5 years. Explain the basis of your projection and any assumptions made. - Compute the annual cash flows for 5 years assuming a terminal cashflow based on 5% of initial installation cost. - Evaluate the investment using the net present value (NPV) and internal rate of returns (IRR). Recommend if Option II is viable based on the different evaluation techniques. This project is tax exempt under the national special provision. The government is extending a special loan for this purpose at 5% p.a. (use as required rate of return). For Option II, initial installation of hardware and software requires $300,000. A further $100,000 marketing budget is expected at the start to promote the network. Total annual capacity available is about 11,000,000kWh. Revenue earned is based on $0.15/kWh. A commission based on 10% of total revenue is payable to vendor to maintain the hardware and software. It is also estimated that other operating expenses to be 30% of its projected revenue. - Project the capacity usage over the next 5 years. Explain the basis of your projection and any assumptions made. - Compute the annual cash flows for 5 years assuming a terminal cashflow based on 5% of initial installation cost. - Evaluate the investment using the net present value (NPV) and internal rate of returns (IRR). Recommend if Option II is viable based on the different evaluation techniques. This project is tax exempt under the national special provision. The government is extending a special loan for this purpose at 5% p.a. (use as required rate of return)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts