Question: can someone help me with this and with formulas please. thank you [14 points) ALC is considering offering catered meal services to seniors who live

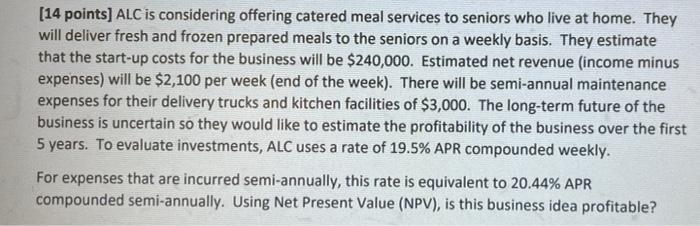

[14 points) ALC is considering offering catered meal services to seniors who live at home. They will deliver fresh and frozen prepared meals to the seniors on a weekly basis. They estimate that the start-up costs for the business will be $240,000. Estimated net revenue (income minus expenses) will be $2,100 per week (end of the week). There will be semi-annual maintenance expenses for their delivery trucks and kitchen facilities of $3,000. The long-term future of the business is uncertain so they would like to estimate the profitability of the business over the first 5 years. To evaluate investments, ALC uses a rate of 19.5% APR compounded weekly. For expenses that are incurred semi-annually, this rate is equivalent to 20.44% APR compounded semi-annually. Using Net Present Value (NPV), is this business idea profitable? [14 points) ALC is considering offering catered meal services to seniors who live at home. They will deliver fresh and frozen prepared meals to the seniors on a weekly basis. They estimate that the start-up costs for the business will be $240,000. Estimated net revenue (income minus expenses) will be $2,100 per week (end of the week). There will be semi-annual maintenance expenses for their delivery trucks and kitchen facilities of $3,000. The long-term future of the business is uncertain so they would like to estimate the profitability of the business over the first 5 years. To evaluate investments, ALC uses a rate of 19.5% APR compounded weekly. For expenses that are incurred semi-annually, this rate is equivalent to 20.44% APR compounded semi-annually. Using Net Present Value (NPV), is this business idea profitable

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts