Question: Can someone help me with this financial derivatives problem? I dont quite understand it. If someone could help me solve the whole question that would

Can someone help me with this financial derivatives problem? I dont quite understand it. If someone could help me solve the whole question that would be amazing. Could I request that you display the steps and formulas used so I have comprehensive understanding of how its done. It will help my learning. Thank you

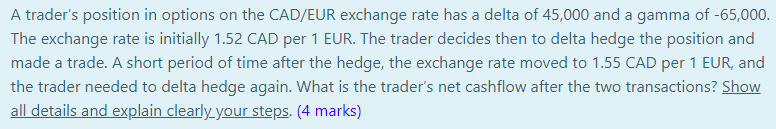

A trader's position in options on the CAD/EUR exchange rate has a delta of 45,000 and a gamma of -65,000. The exchange rate is initially 1.52 CAD per 1 EUR. The trader decides then to delta hedge the position and made a trade. A short period of time after the hedge, the exchange rate moved to 1.55 CAD per 1 EUR, and the trader needed to delta hedge again. What is the trader's net cashflow after the two transactions? Show all details and explain clearly_your steps. (4 marks) A trader's position in options on the CAD/EUR exchange rate has a delta of 45,000 and a gamma of -65,000. The exchange rate is initially 1.52 CAD per 1 EUR. The trader decides then to delta hedge the position and made a trade. A short period of time after the hedge, the exchange rate moved to 1.55 CAD per 1 EUR, and the trader needed to delta hedge again. What is the trader's net cashflow after the two transactions? Show all details and explain clearly_your steps. (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts