Question: can someone help me with this, its the same question just has three parts to it. Required information [The following information applies to the questions

![questions displayed below] Ramirez Company installs a computerized manufacturing machine in its](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66e8ac58d1434_50466e8ac585c9fd.jpg)

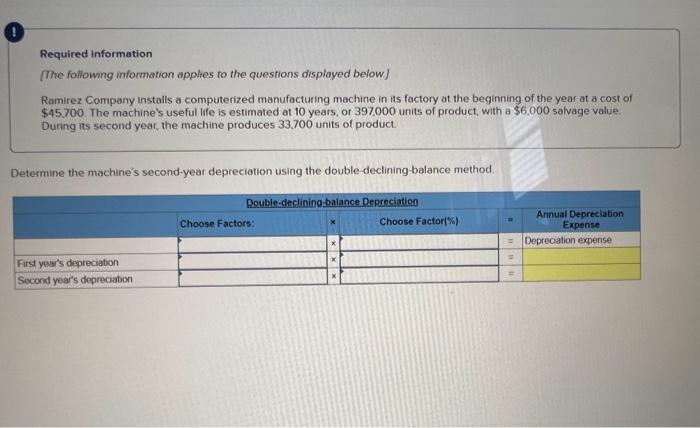

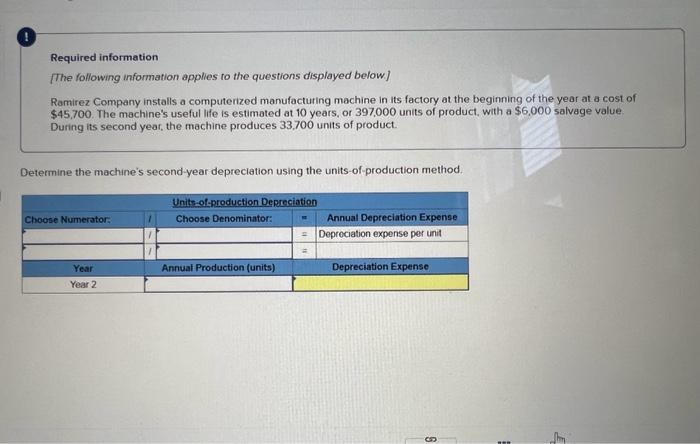

Required information [The following information applies to the questions displayed below] Ramirez Company installs a computerized manufacturing machine in its factory at the beginning of the year at a cost of $45,700. The machine's useful life is estimated at 10 years, or 397.000 units of product, with a $6,000 salvage value. During its second year, the machine produces 33.700 units of product. Determine the machine's second-year depreciation using the double-declining-balance method. Required information [The following information opplies to the questions displayed below] Ramirez Company installs a computerized manufacturing machine in its factory at the beginning of the year at a cost of $45,700. The machine's useful life is estimated at 10 years, or 397,000 units of product. with a $6,000 salvage value. During its second year, the machine produces 33,700 units of product. Determine the machine's second-year depreciation using the units-of-production method. Required information [The following information applies to the questions displayed below. Ramirez Company installs a computerized manufacturing machine in its factory at the beginning of the year at a cost of $45,700. The machine's useful life is estimated at 10 years, or 397,000 units of product, with a $6,000 salvage value During its second year, the machine produces 33.700 units of product. Determine the machine's second-year depreciation and year end book value under the straight-line method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts