Question: Can someone help me with this please? Problem 6 Intro Go to Yahoo Finance and download weekly stock price data for Target and Walmart for

Can someone help me with this please?

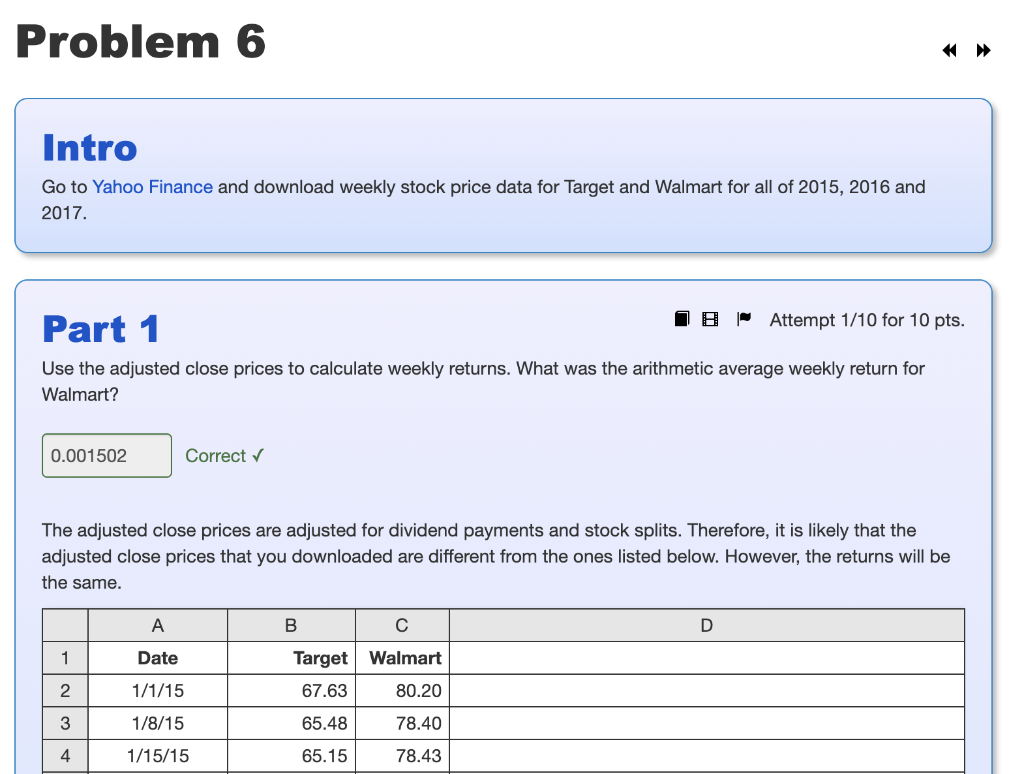

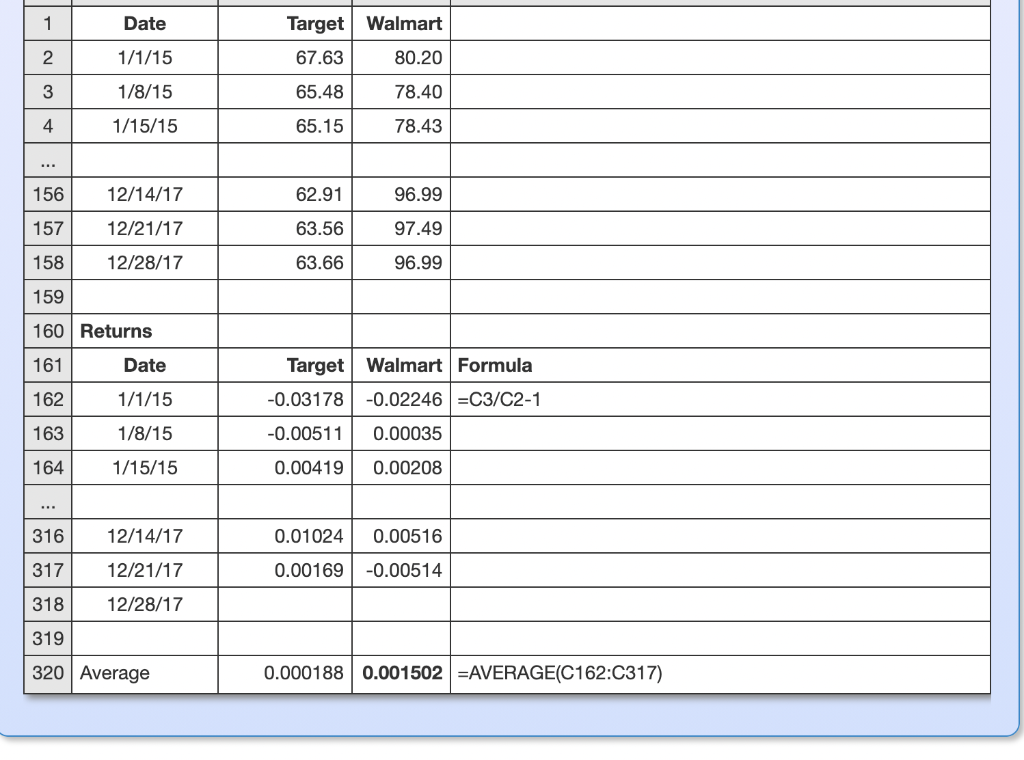

Problem 6 Intro Go to Yahoo Finance and download weekly stock price data for Target and Walmart for all of 2015, 2016 and 2017. 18 Attempt 1/10 for 10 pts. Part 1 Use the adjusted close prices to calculate weekly returns. What was the arithmetic average weekly return for Walmart? 0.001502 Correct The adjusted close prices are adjusted for dividend payments and stock splits. Therefore, it is likely that the adjusted close prices that you downloaded are different from the ones listed below. However, the returns will be the same. A B D 1 Date Target Walmart 2 1/1/15 67.63 80.20 3 1/8/15 65.48 78.40 4 1/15/15 65.15 78.43 1 Date Target Walmart 2 1/1/15 67.63 80.20 3 1/8/15 65.48 78.40 4 1/15/15 65.15 78.43 156 12/14/17 62.91 96.99 157 12/21/17 63.56 97.49 158 12/28/17 63.66 96.99 159 160 Returns 161 Date Target Walmart Formula 162 1/1/15 -0.03178 -0.02246 =C3/C2-1 163 1/8/15 -0.00511 0.00035 164 1/15/15 0.00419 0.00208 316 12/14/17 0.01024 0.00516 317 12/21/17 0.00169 -0.00514 318 12/28/17 319 320 Average 0.000188 0.001502 =AVERAGE(C162:C317) Part 2 Attempt 4/10 for 10 pts. What was the arithmetic average weekly return for a portfolio 90% invested in Target and the remainder in Walmart (assuming weekly rebalancing)? 6+ decimals Submit Attempt 2/10 for 10 pts. Part 3 What was the standard deviation of the portfolio? 4+ decimals Submit Problem 6 Intro Go to Yahoo Finance and download weekly stock price data for Target and Walmart for all of 2015, 2016 and 2017. 18 Attempt 1/10 for 10 pts. Part 1 Use the adjusted close prices to calculate weekly returns. What was the arithmetic average weekly return for Walmart? 0.001502 Correct The adjusted close prices are adjusted for dividend payments and stock splits. Therefore, it is likely that the adjusted close prices that you downloaded are different from the ones listed below. However, the returns will be the same. A B D 1 Date Target Walmart 2 1/1/15 67.63 80.20 3 1/8/15 65.48 78.40 4 1/15/15 65.15 78.43 1 Date Target Walmart 2 1/1/15 67.63 80.20 3 1/8/15 65.48 78.40 4 1/15/15 65.15 78.43 156 12/14/17 62.91 96.99 157 12/21/17 63.56 97.49 158 12/28/17 63.66 96.99 159 160 Returns 161 Date Target Walmart Formula 162 1/1/15 -0.03178 -0.02246 =C3/C2-1 163 1/8/15 -0.00511 0.00035 164 1/15/15 0.00419 0.00208 316 12/14/17 0.01024 0.00516 317 12/21/17 0.00169 -0.00514 318 12/28/17 319 320 Average 0.000188 0.001502 =AVERAGE(C162:C317) Part 2 Attempt 4/10 for 10 pts. What was the arithmetic average weekly return for a portfolio 90% invested in Target and the remainder in Walmart (assuming weekly rebalancing)? 6+ decimals Submit Attempt 2/10 for 10 pts. Part 3 What was the standard deviation of the portfolio? 4+ decimals Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts