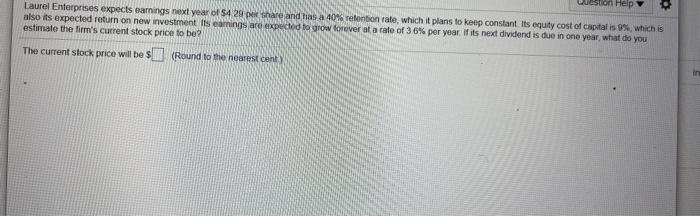

Question: can someone help me with this practice problem i do not understand Help Laurel Enterprises expects earnings next year of $4 29 per share and

Help Laurel Enterprises expects earnings next year of $4 29 per share and has a 40% retention rate, which it plans to keep constant its equity cost of capital is 9%, which is also its expected return on new investment its earings are expected to grow forever at a rate of 3.6% per year. If its next dividend is due in one year, what do you estimate the firm's current stock price to be The current stock price will be $ (Round to the nearest cent) in

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts