Question: can someone help me with this practice problem Suppose your firm receives a $5 14 million order on the last day of the year You

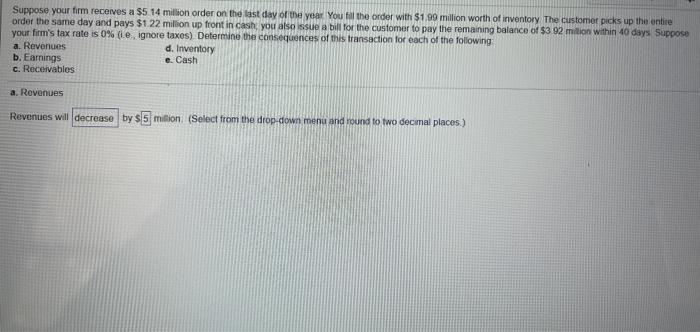

Suppose your firm receives a $5 14 million order on the last day of the year You fill the order with $1 99 million worth of inventory The customer picks up the entire order the same day and pays $122 million up front in cash, you also issue a bill for the customer to pay the remaining balance of $3 92 milion within 40 days Suppose your firm's tax rate is 0% (ie, ignore taxes) Determine the consequences of this transaction for each of the following a. Revenues d. Inventory b. Earnings e. Cash c. Receivables a. Revenues Revenues will decrease by $5 million (Select from the drop-down menu and round to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts