Question: Can someone help me with this problem? Attached is an example to help 6.3a#3 3. Company ABC is required to pay their customers an amount

Can someone help me with this problem? Attached is an example to help

6.3a#3

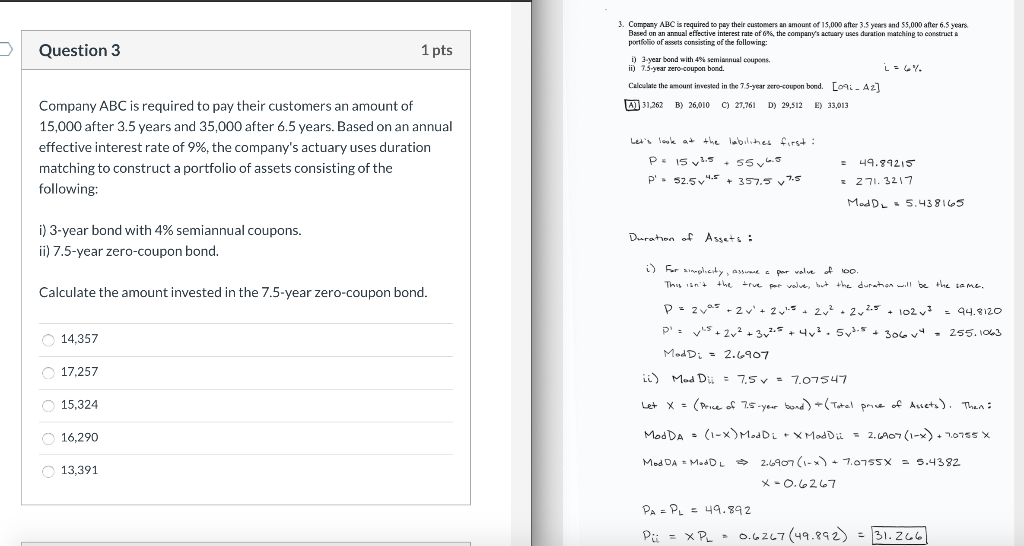

3. Company ABC is required to pay their customers an amount of 15,000 after 3.5 years and 55.000 after 6.5 years Based on an annual effective interest rate of the company's cury uses duration Watching to construct portfolio of assets consisting of the following: Question 3 1 pts i) 3-year bond with 4% semiannual coupons. ii) 7.5 year zero-coupon bood. Calculate the amount invested in the 75-year ro-coupon bond. [ L-A2) Al 31,262 B) 26,010 ) 27,761 D) 29,512 E) 33,013 Company ABC is required to pay their customers an amount of 15,000 after 3.5 years and 35,000 after 6.5 years. Based on an annual effective interest rate of 9%, the company's actuary uses duration matching to construct a portfolio of assets consisting of the following: first: Let's look at the liabilithes P = 15 v2.5 + 555 P' 52.5v4.5 + 357.5 7.5 = 49.89215 = 271.3217 Mad D2 = 5.438165 i) 3-year bond with 4% semiannual coupons. ii) 7.5-year zero-coupon bond. Duration of Assets : Calculate the amount invested in the 7.5-year zero-coupon bond. 14,357 17.257 15,324 i) for sineplaty, a k pour value of O. This isn't the true par valve, but the duration will be the same. P = zv~5 +2V'+2+ + 22.22.5 + 102v1 - 94.8120 Plov"5 + 2x2 + 3x2.5 +4v2.572-5 + 306 v4.255.1063 Mad Di = 2.6907 ii) Mod Du = 7.5v = 7.07547 Let x = (Price of 7.5-yeur bond) +(Total price of Assets). Then a Mod DA = (1-x) ModDi + X Mod Du = 2.6907(1-x)+70755 X Mod DA - MedOL > 2.4907(1-x) + 7.0755X = 5.4382 X-0.6267 PAPL = 49.892 PU = X PL - 0.6267 (49.892) = 31.206 16,290 13,391 3. Company ABC is required to pay their customers an amount of 15,000 after 3.5 years and 55.000 after 6.5 years Based on an annual effective interest rate of the company's cury uses duration Watching to construct portfolio of assets consisting of the following: Question 3 1 pts i) 3-year bond with 4% semiannual coupons. ii) 7.5 year zero-coupon bood. Calculate the amount invested in the 75-year ro-coupon bond. [ L-A2) Al 31,262 B) 26,010 ) 27,761 D) 29,512 E) 33,013 Company ABC is required to pay their customers an amount of 15,000 after 3.5 years and 35,000 after 6.5 years. Based on an annual effective interest rate of 9%, the company's actuary uses duration matching to construct a portfolio of assets consisting of the following: first: Let's look at the liabilithes P = 15 v2.5 + 555 P' 52.5v4.5 + 357.5 7.5 = 49.89215 = 271.3217 Mad D2 = 5.438165 i) 3-year bond with 4% semiannual coupons. ii) 7.5-year zero-coupon bond. Duration of Assets : Calculate the amount invested in the 7.5-year zero-coupon bond. 14,357 17.257 15,324 i) for sineplaty, a k pour value of O. This isn't the true par valve, but the duration will be the same. P = zv~5 +2V'+2+ + 22.22.5 + 102v1 - 94.8120 Plov"5 + 2x2 + 3x2.5 +4v2.572-5 + 306 v4.255.1063 Mad Di = 2.6907 ii) Mod Du = 7.5v = 7.07547 Let x = (Price of 7.5-yeur bond) +(Total price of Assets). Then a Mod DA = (1-x) ModDi + X Mod Du = 2.6907(1-x)+70755 X Mod DA - MedOL > 2.4907(1-x) + 7.0755X = 5.4382 X-0.6267 PAPL = 49.892 PU = X PL - 0.6267 (49.892) = 31.206 16,290 13,391

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts