Question: can someone help me with this question + calculations Test 3 In Bryn's accounts for the year ended 31 December 2019 there is a gain

can someone help me with this question + calculations

can someone help me with this question + calculations

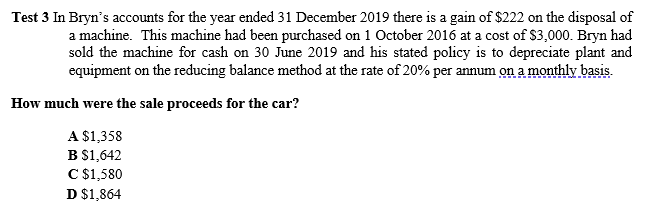

Test 3 In Bryn's accounts for the year ended 31 December 2019 there is a gain of $222 on the disposal of a machine. This machine had been purchased on 1 October 2016 at a cost of $3,000. Bryn had sold the machine for cash on 30 June 2019 and his stated policy is to depreciate plant and equipment on the reducing balance method at the rate of 20% per annum on a monthly basis. How much were the sale proceeds for the car? A $1,358 B $1,642 C $1,580 D $1,864

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts