Question: Can someone help me with this question + formula Rankine has been in business for a number of years as a greengrocer making up his

Can someone help me with this question + formula

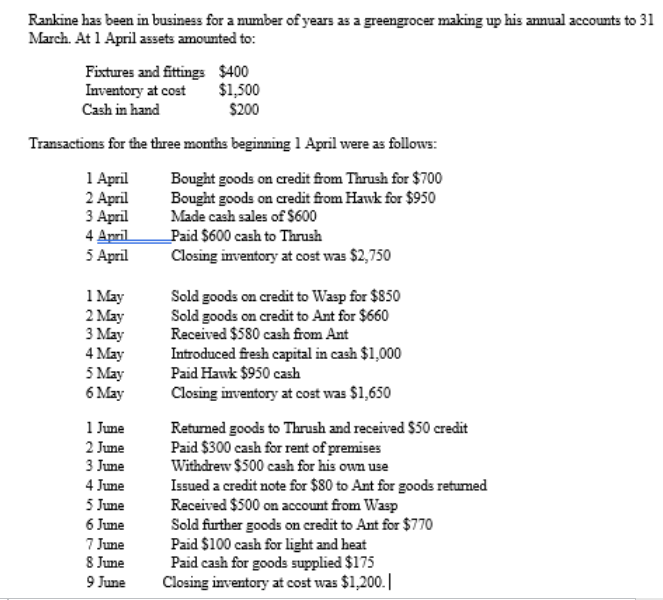

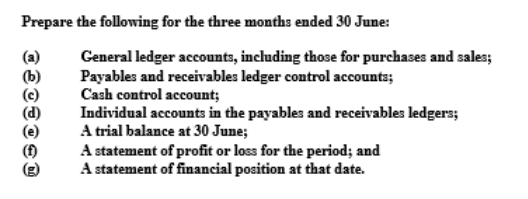

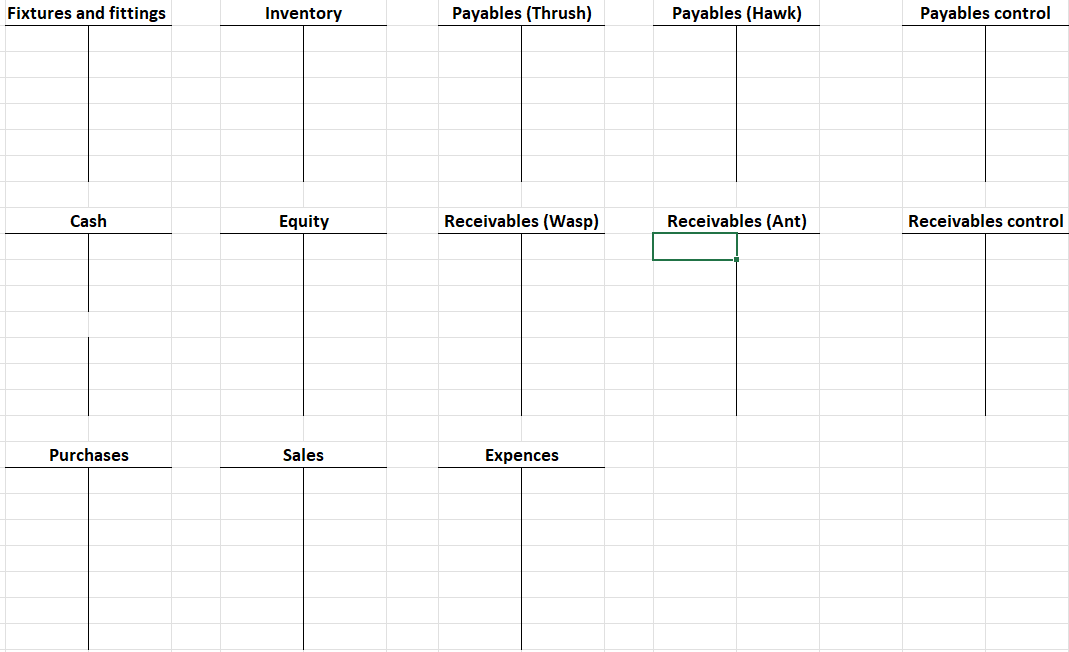

Rankine has been in business for a number of years as a greengrocer making up his annual accounts to 31 March. At 1 April assets amounted to: Fixtures and fittings $400 Inventory at cost $1,500 Cash in hand $200 Transactions for the three months beginning 1 April were as follows: 1 April Bought goods on credit from Thrush for $700 2 April Bought goods on credit from Hawk for $950 3 April Made cash sales of $600 4 April _Paid $600 cash to Thrush 5 April Closing inventory at cost was $2,750 1 May Sold goods on credit to Wasp for $850 2 May Sold goods on credit to Ant for $660 3 May Received $580 cash from Ant 4 May Introduced fresh capital in cash $1,000 5 May Paid Hawk $950 cash 6 May Closing inventory at cost was $1,650 1 June Returned goods to Thrush and received $50 credit 2 June Paid $300 cash for rent of premises 3 June Withdrew $500 cash for his own use 4 June Issued a credit note for $80 to Ant for goods retumed 5 June Received $500 on account from Wasp 6 June Sold further goods on credit to Ant for $770 7 June Paid $100 cash for light and heat 8 June Paid cash for goods supplied $175 9 June Closing inventory at cost was $1,200. Prepare the following for the three months ended 30 June: General ledger accounts, including those for purchases and sales; (b) Payables and receivables ledger control accounts; Cash control account; Individual accounts in the payables and receivables ledgers; A trial balance at 30 June; A statement of profit or loss for the period; and A statement of financial position at that date. Fixtures and fittings Inventory Payables (Thrush) Payables (Hawk) Payables control Cash Equity Receivables (Wasp) Receivables (Ant) Receivables control Purchases Sales Expences Rankine has been in business for a number of years as a greengrocer making up his annual accounts to 31 March. At 1 April assets amounted to: Fixtures and fittings $400 Inventory at cost $1,500 Cash in hand $200 Transactions for the three months beginning 1 April were as follows: 1 April Bought goods on credit from Thrush for $700 2 April Bought goods on credit from Hawk for $950 3 April Made cash sales of $600 4 April _Paid $600 cash to Thrush 5 April Closing inventory at cost was $2,750 1 May Sold goods on credit to Wasp for $850 2 May Sold goods on credit to Ant for $660 3 May Received $580 cash from Ant 4 May Introduced fresh capital in cash $1,000 5 May Paid Hawk $950 cash 6 May Closing inventory at cost was $1,650 1 June Returned goods to Thrush and received $50 credit 2 June Paid $300 cash for rent of premises 3 June Withdrew $500 cash for his own use 4 June Issued a credit note for $80 to Ant for goods retumed 5 June Received $500 on account from Wasp 6 June Sold further goods on credit to Ant for $770 7 June Paid $100 cash for light and heat 8 June Paid cash for goods supplied $175 9 June Closing inventory at cost was $1,200. Prepare the following for the three months ended 30 June: General ledger accounts, including those for purchases and sales; (b) Payables and receivables ledger control accounts; Cash control account; Individual accounts in the payables and receivables ledgers; A trial balance at 30 June; A statement of profit or loss for the period; and A statement of financial position at that date. Fixtures and fittings Inventory Payables (Thrush) Payables (Hawk) Payables control Cash Equity Receivables (Wasp) Receivables (Ant) Receivables control Purchases Sales Expences

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts