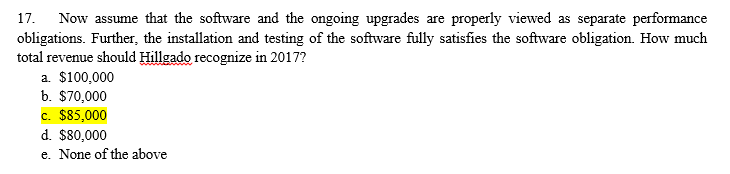

Question: Can someone help me with this question? I KNOW the answer is 85,000 but I wanna know how this would look in a journal entry?

Can someone help me with this question? I KNOW the answer is 85,000 but I wanna know how this would look in a journal entry? I tried to do it below but I don't know if I did it correctly or not.

my work:

jan 1, 2017 July 1, 2017 Dec 31,2017

Cash 70,000 Cash 30,000 Cash 30,000

Contract asset 10,000 Contract liability 30,000 Accounts receviable 10,000

Sales revenue 80,000 Service revenue 5000

contract liability 15,000

note: I got the 10,000 accounts receiveable from the 10,000 contract asset that I debited earlier on jan 1,2017.

the answer is 85,000, but I just wanted to see how it would look in journal entry to kind of visualize what's going on, so if my journal entry above looks wrong please correct me and show me how it's done.

Also, contract liability simply means unearned revenue here. Please help and thanks in advance!

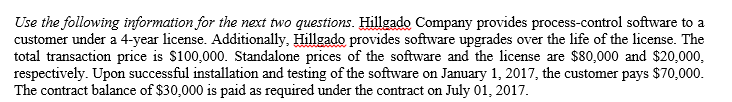

Use the following information for the next two questions. Hillgado Company provides process-control software to a customer under a 4-year license. Additionally, Hillgado provides software upgrades over the life of the license. The total transaction price is $100,000. Standalone prices of the software and the license are $80,000 and $20,000 respectively. Upon successful installation and testing of the software on January 1, 2017, the customer pays $70,000 The contract balance of $30,000 is paid as required under the contract on July 01, 2017 Now assume that the software and the ongoing upgrades are properly viewed as separate performance obligations. Further, the installation and testing of the software fully satisfies the software obligation. How much total revenue should Hillgado recognize in 2017? a. $100,000 17 b. $70,000 c. $85,000 d. $80,000 e. None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts