Question: Can someone help me with this question, please? I know the answer is C)21,600 but I don't know how it got that number? I want

Can someone help me with this question, please? I know the answer is C)21,600 but I don't know how it got that number? I want a good explanation of why the answer is C)21,600. Please help and thanks in advance!

Can someone help me with this question, please? I know the answer is C)21,600 but I don't know how it got that number? I want a good explanation of why the answer is C)21,600. Please help and thanks in advance!

Given Answer: C) 21,600

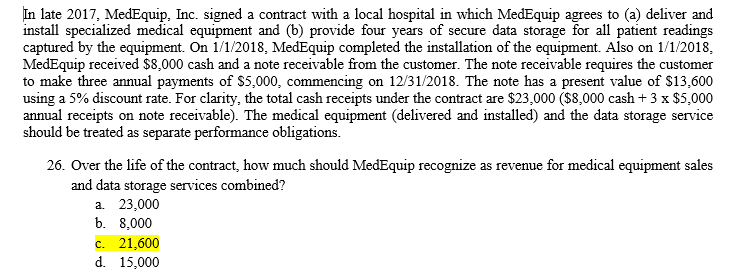

In late 2017, MedEquip, Inc. signed a contract with a local hospital in which MedEquip agrees to (a) deliver and install specialized medical equipment and (b) provide four years of secure data storage for all patient readings captured by the equipment. On 1/1/2018, MedEquip completed the installation of the equipment. Also on 1/1/2018, MedEquip received $8,000 cash and a note receivable from the customer. The note receivable requires the customer to make three annual payments of $5,000, commencing on 12/31/2018. The note has a present value of $13,600 using a 5% discount rate. For clarity, the total cash receipts under the contract are $23,000 ($8,000 cash + 3 x $5,000 annual receipts on note receivable). The medical equipment (delivered and installed) and the data storage service should be treated as separate performance obligations. 26. Over the life of the contract, how much should MedEquip recognize as revenue for medical equipment sales and data storage services combined? a. 23,000 b. 8,000 C. 21,600 d. 15,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts