Question: can someone help me with this question. please show work. Times New Roman - 10 = & Wrap Te i Merg TU AME C27 X

can someone help me with this question. please show work.

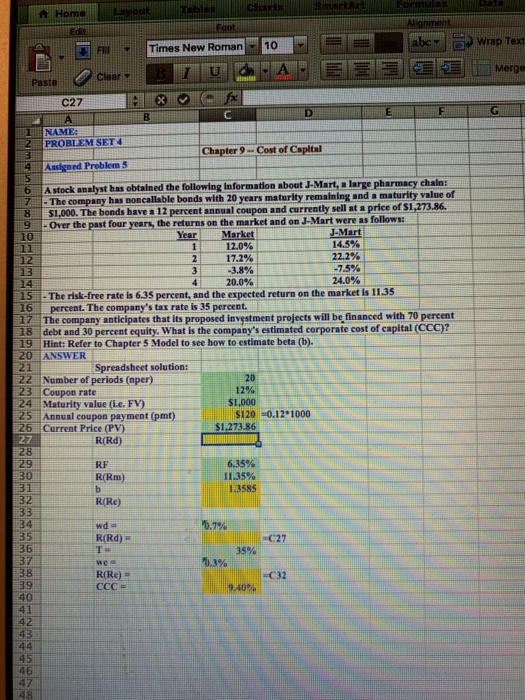

can someone help me with this question. please show work. Times New Roman - 10 = & Wrap Te i Merg TU AME C27 X NAME: PROBLEMSET 4 Chapter 9 Cost of Capital ed Problem 5 OSAGA A stock analyst has obtained the following information about J-Mart, a large pharmacy chain: - The company has noncallable bonds with 20 years maturity remaining and a maturity value of $1,000. The bonds have a 12 percent annual coupon and currently sell at a price of $1,273.86. - Over the past four years, the returns on the market and on J-Mart were as follows: Year Market J-Mart 1 12.0% 14.5% 17.2% 22.2% -3.8% -7.5% 20.0% 24.0% 15 The risk-free rate is 6.35 percent, and the expected return on the market is 11.35 percent. The company's tax rate is 35 percent. 17 The company anticipates that its proposed Investment projects will be financed with 70 percent 18 debt and 30 percent equity. What is the company's estimated corporate cost of capital (CCC)? 19 Hint: Refer to Chapter 5 Model to see how to estimate beta (b). 20 ANSWERS 21 Spreadsheet solution: 22 Number of periods (nper) 20 Coupon rate 12% Maturity value (i.e. FV) $1,000 Annual coupon payment (pet) 120 -0.12.1000 26 Current Price (PV) $1.27386 R(Rd) RF R(Rm) 6.35% 1.3585 R(Re) wa RRd) - R(Re) CEC=

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts