Question: Can someone help me with this question please ? the solution answer for Case #2 answers are already posted but my question is why is

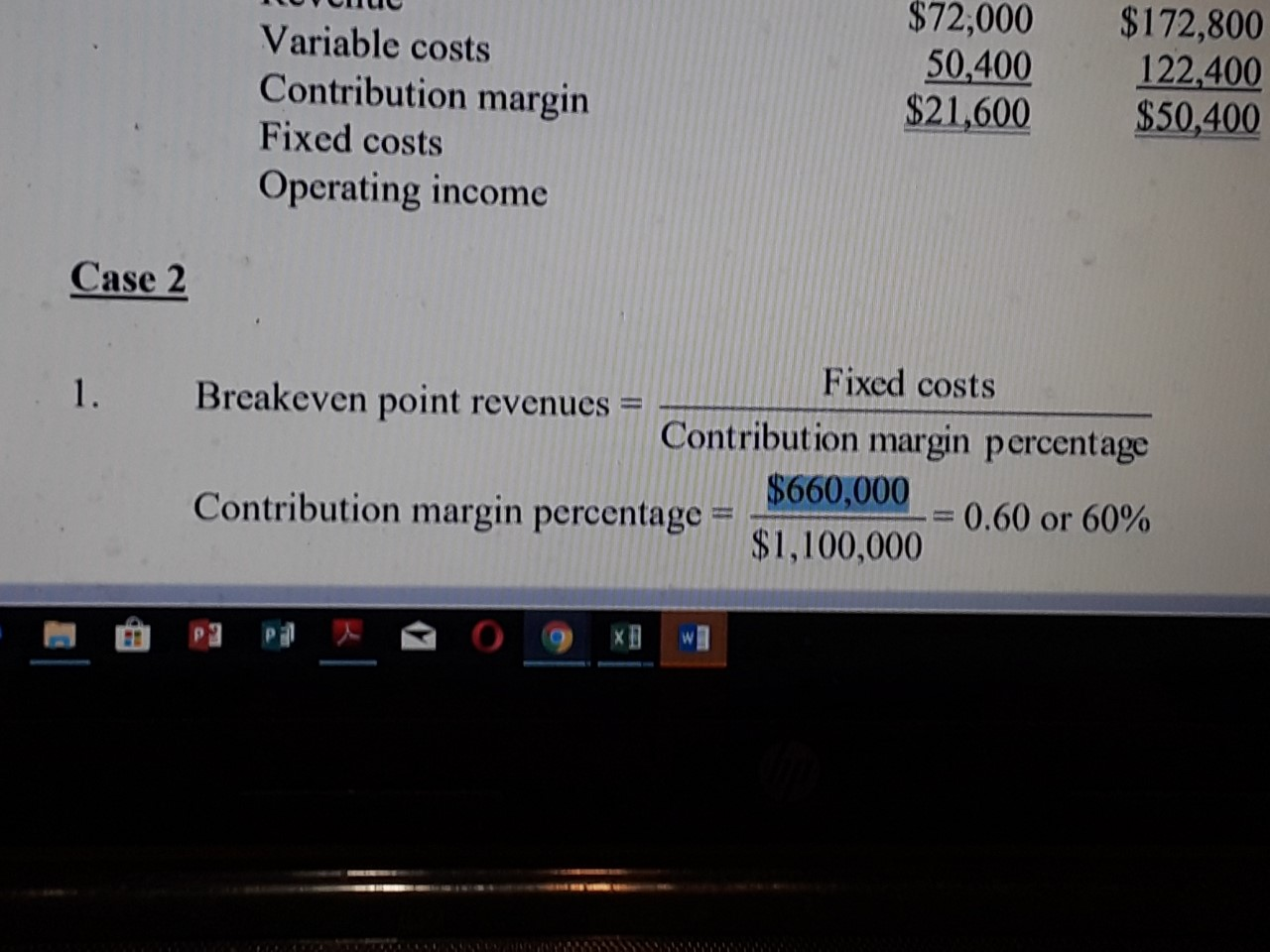

Can someone help me with this question please ? the solution answer for Case #2 answers are already posted but my question is why is it using fixed costs to calculate contribution margin percentage? here it says fixed contribution margin percentage is= fixed costs/Revenues but I thought the formula for contribution margin percentage was contribution margin percentage= Contribution margin/ revenues? Please help and thanks in advance

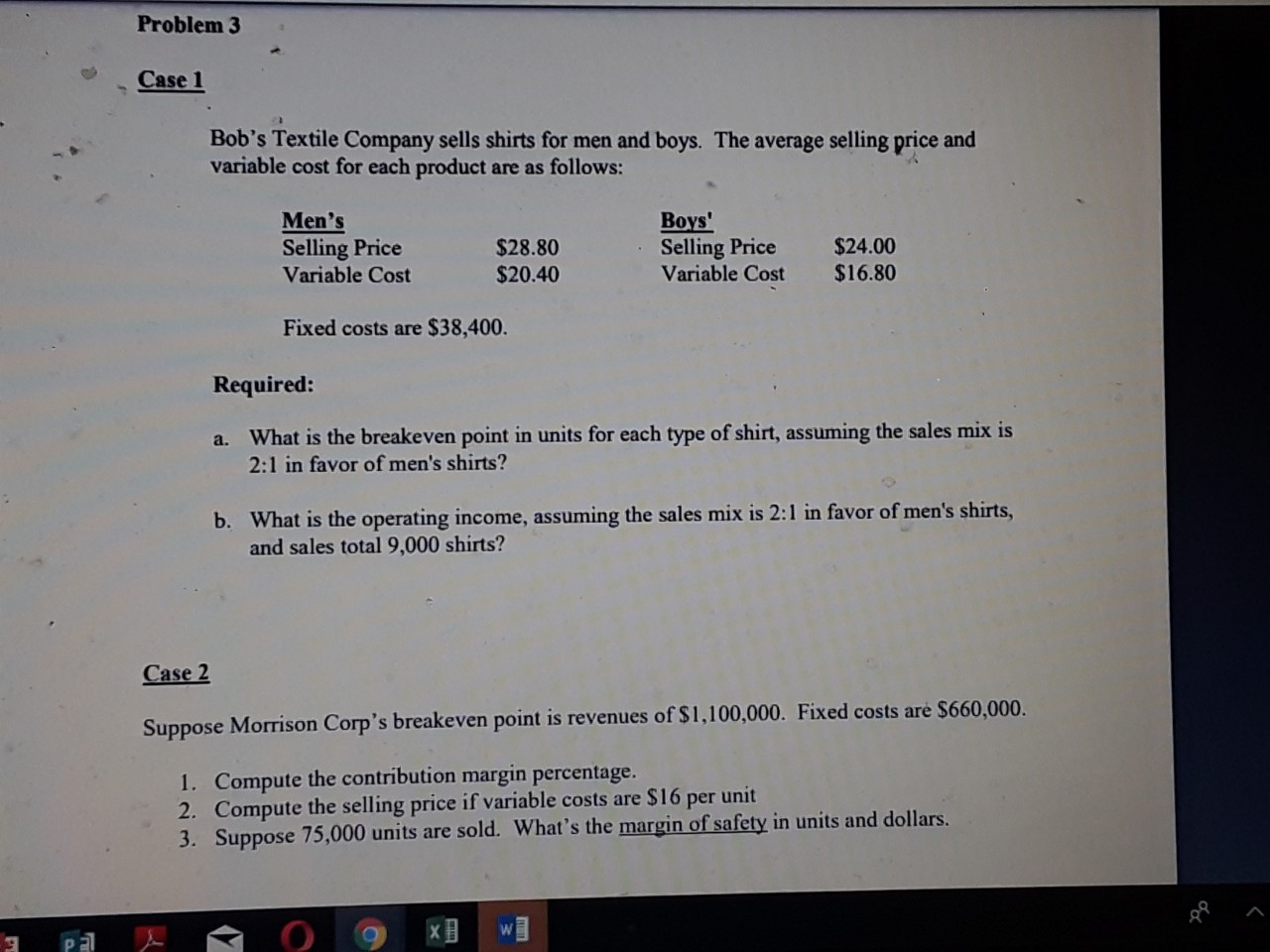

Problem 3 Case 1 Bob's Textile Company sells shirts for men and boys. The average selling price and variable cost for each product are as follows: Men's Selling Price Variable Cost $28.80 $20.40 Boys' Selling Price Variable Cost $24.00 $16.80 Fixed costs are $38,400. Required: a. What is the breakeven point in units for each type of shirt, assuming the sales mix is 2:1 in favor of men's shirts? b. What is the operating income, assuming the sales mix is 2:1 in favor of men's shirts, and sales total 9,000 shirts? Case 2 Suppose Morrison Corp's breakeven point is revenues of $1,100,000. Fixed costs are $660,000. 1. Compute the contribution margin percentage. 2. Compute the selling price if variable costs are $16 per unit 3. Suppose 75,000 units are sold. What's the margin of safety in units and dollars. OVUU Variable costs Contribution margin Fixed costs Operating income $72,000 50,400 $21,600 $172,800 122,400 $50,400 Case 2 1. Fixed costs Breakeven point revenues = Contribution margin percentage Contribution margin percentage = $660,000 = 0.60 or 60% $1,100,000 P9 W 353

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts