Question: can someone help me with this quick 8. Nominal bond yield (CHOOSE ALL CORRECT ANSWERS): a) represents the ratio of all possible income from investing

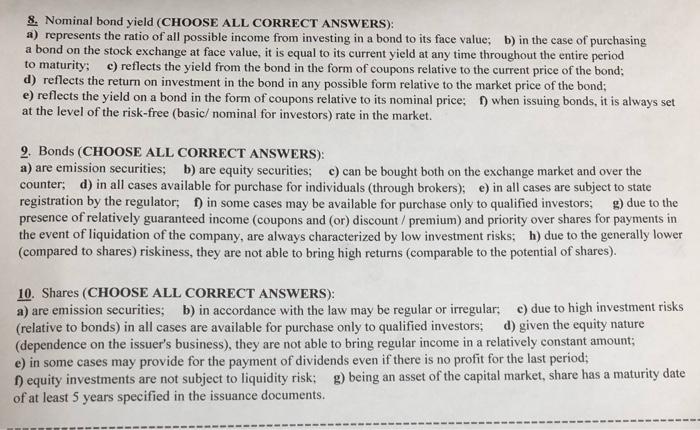

8. Nominal bond yield (CHOOSE ALL CORRECT ANSWERS): a) represents the ratio of all possible income from investing in a bond to its face value; b) in the case of purchasing a bond on the stock exchange at face value, it is equal to its current yield at any time throughout the entire period to maturity; c) reflects the yield from the bond in the form of coupons relative to the current price of the bond; d) reflects the return on investment in the bond in any possible form relative to the market price of the bond; e) reflects the yield on a bond in the form of coupons relative to its nominal price; f ) when issuing bonds, it is always set at the level of the risk-free (basicominal for investors) rate in the market. 9. Bonds (CHOOSE ALL CORRECT ANSWERS): a) are emission securities; b) are equity securities; c) can be bought both on the exchange market and over the counter; d) in all cases available for purchase for individuals (through brokers); e) in all cases are subject to state registration by the regulator; f ) in some cases may be available for purchase only to qualified investors; g ) due to the presence of relatively guaranteed income (coupons and (or) discount / premium) and priority over shares for payments in the event of liquidation of the company, are always characterized by low investment risks; h ) due to the generally lower (compared to shares) riskiness, they are not able to bring high returns (comparable to the potential of shares). 10. Shares (CHOOSE ALL CORRECT ANSWERS): a) are emission securities; b) in accordance with the law may be regular or irregular; c) due to high investment risks (relative to bonds) in all cases are available for purchase only to qualified investors; d) given the equity nature (dependence on the issuer's business), they are not able to bring regular income in a relatively constant amount; e) in some cases may provide for the payment of dividends even if there is no profit for the last period; f) equity investments are not subject to liquidity risk; g) being an asset of the capital market, share has a maturity date of at least 5 years specified in the issuance documents

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts