Question: can someone help please also, those are the answer that are wrong. The Board of Directors of Teton Pearl, Inc, a private foundation, consists of

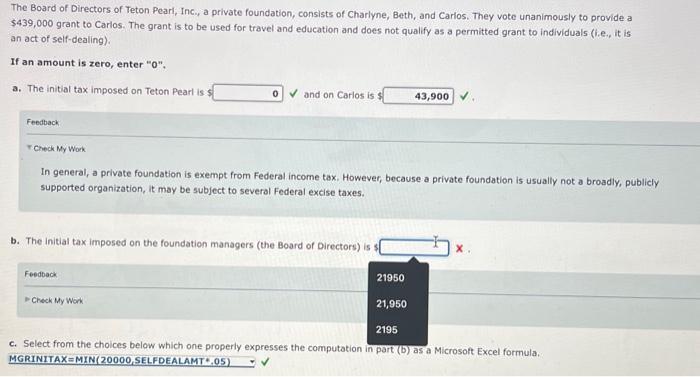

The Board of Directors of Teton Pearl, Inc, a private foundation, consists of Charlyne, Beth, and Carios. They vote unanimously to provide a $439,000 grant to Carlos. The grant is to be used for travel and education and does not qualify as a permitted grant to individuals (i.e., it is an act of self-dealing). If an amount is zero, enter " 0 ", a. The initial tax imposed on Teton Pearl is $ and on Carlos is ? Feedback F Check My Work In general, a private foundation is exempt from Federal income tax. However, because a private foundation is usually not a broadly, publicly supported organization, it may be subject to several Federal excise taxes. b. The initial tax imposed on the foundation managers (the Board of Directors) is $ x Feedback Creck My Work c. Select from the choices below which one Dronerly expresses the computation in part (b) as a Microsoft Excel formula

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts