Question: Can someone help please? show work if possible please Problem 3: (20 points) The current free cash flow to cquity, FCFE0, for ANP Inc. is

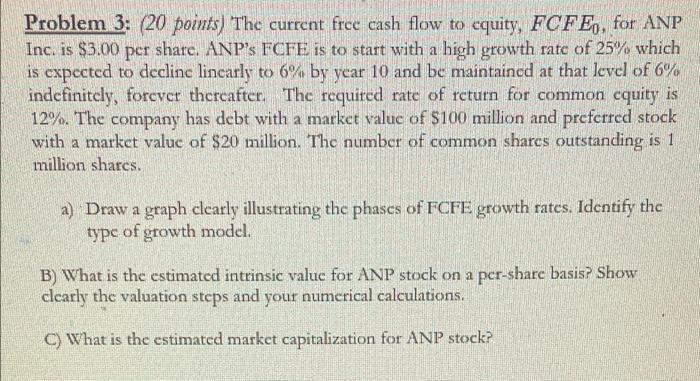

Problem 3: (20 points) The current free cash flow to cquity, FCFE0, for ANP Inc. is $3.00per share. ANP's FCFE is to start with a high growth rate of 25% which is expected to decline linearly to 6% by ycar 10 and be maintaincd at that level of 6% indefinitely, forever thereafter. The required rate of icturn for common equity is 12%. The company has debt with a market value of $100 million and preferred stock with a market value of $20 million. The number of common shares outstanding is 1 million sharcs. a) Draw a graph clearly illustrating the phases of FCFE growth rates. Identify the type of growth model. B) What is the estimated intrinsic valuc for ANP stock on a per-sharc basis? Show clearly the valuation steps and your numerical calculations. C) What is the estimated market capitalization for ANP stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts